As an investor, you are a mental athlete. You build portfolios and prosperity by thinking critically. Good thinking leads to sound decisions. It is difficult.

I do some thinking when reading. In the evening, when the house is quiet, I will put on Classic FM (a UK radio station that plays classical music). I’ll relax with my latest book in front of the fire. My notebook alongside.

The Basic Laws of Human Stupidity

I’m reading a very short but very entertaining book. It’s called The Basic Laws of Human Stupidity. It’s written by Carlo Cipolla, and it was an underground hit in Italy.

It reminds me that the more you learn, the more you realise how little you know.

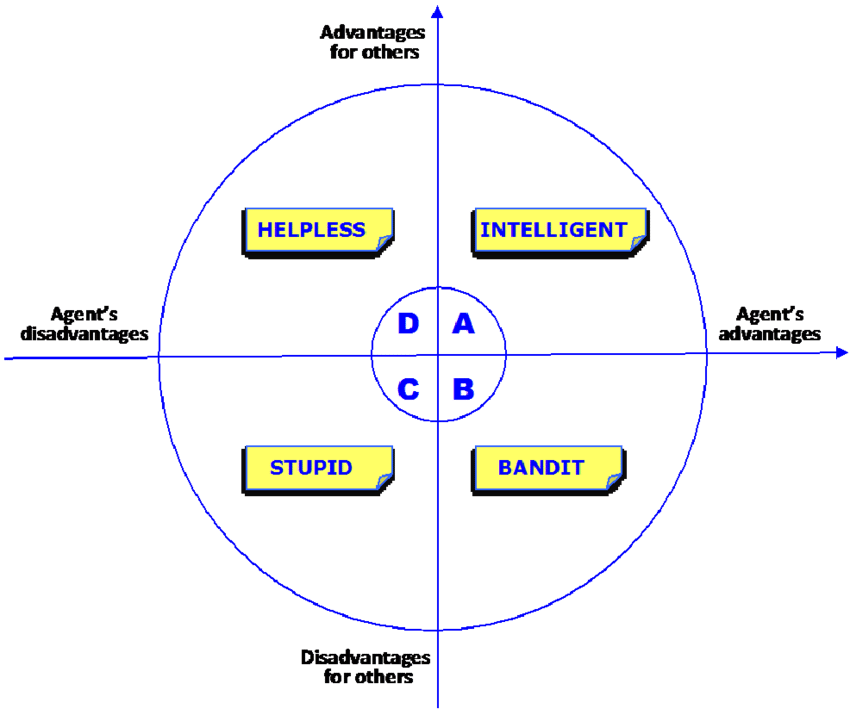

Cipolla puts human beings into four quadrants. He is interested in the dangers of stupid people (quadrant C):

Source: Scientific Research, Piero Mella, Pavia University, Italy

- A) Intelligent people act to benefit themselves, and when they do so, benefit others as well. The more they gain for themselves, the more others gain. Example: when the intelligent person generates $100 of value for themselves, they also produce $100 (or more) for another. Society is $200+ better off.

- B) Bandits are thieves. They benefit themselves by causing loss to others. Eventually, this catches up on them and reduces their benefits. Their enterprise may get shut down or they wind up in jail. However, the economic outcome is roughly neutral. When the bandit takes $100 from another, there is still $100.

- C) Now, ‘A stupid person is a person who causes losses to another person or to a group of persons while himself deriving no gain and even possibly incurring losses.’ (Cipolla). Example: when the stupid person spends $100 for no gain to himself, another loses $100 (or more). Society is $200+ worse off.

- D) Helpless or naïve people willingly sacrifice themselves to provide benefits to others. Again, the economics is neutral. The helpless person loses $100 to another.

Of course, if you have a society of many stupid people, it turns to hell.

The probability of a person being stupid is independent of any other characteristic.

Stupid people are found in all strata of society, including the highly-educated and well-paid.

Stupid people tend not to last very long in any private business. When they keep causing loss, either the business folds or they are let go.

Unfortunately, the same does not go for the public sector. They may cause losses for themselves and for others unabated. They may continue to be employed, or they may be elected by a constituency of other stupid people every few years.

Of course, stupid people do not reveal their irrationality in plain sight. These days, many disguise their stupidity under the appearance of being a paragon of virtue. This is called ‘virtue signalling’.

So, when you hear a person excuse their loss-causing behaviour to some virtuous reason (for example: equity, inclusion, the climate, and so forth), be cautious.

In investing, stupid people are generally those who fail to keep their emotions in check. They do not realise that the flipside of a crisis is opportunity. And that most decent opportunities can take some years to play out.

So when a market storm comes, they fret over losses and sell their portfolios. In doing so, they cause loss for themselves and further contribute to drawdown in the market (loss to others).

Artificial Intelligence (AI)

This brings us to AI. It can cause both benefit and harm. Hence the way in which it gets used defines its value.

When it can benefit its owner and its users, then it is intelligent. Otherwise, it is either a bandit, helpless, or stupid.

Example: booking a trip on Airbnb

View from Airbnb, Florence. Source: Brian Koprowski / Flickr

Last year, Airbnb [NASDAQ:ABNB] made its first acquisition. A $200 million AI company called Gameplanner.AI. Nobody seems to know what this company does.

According to Airbnb, Gameplanner.AI will accelerate Airbnb’s AI projects.

Airbnb CEO Brian Chesky has said that generative AI will radically change the platform. It will learn about users over time and enhance their travel matches.

Well, at the moment. my wife and I are booking a family trip to Italy. The AI model on Airbnb appears to be offering us both benefit and loss. First, it matches us with desirable options. Yet as we show more interest in one area — for example, Venice — the prices of favoured options jump.

This app feels like a bandit!

Then, as I hesitate, it produces a new option in Venice that seems even better, but back at a desirable price!

So, smartly applied AI clearly has the ability to revolutionise business profits. And be intelligent by providing benefit to users and society.

It is no wonder that some are picking AI to lift global GDP by 7% over the next decade.

But this will depend on how AI is used. Whether it causes gains to all parties involved and is genuinely intelligent. Or it is, in fact, used as a bandit. Or worse, in the wrong hands, it becomes ‘artificial stupidity’, where losses are caused to all.

It strikes me that when used to improve the functions of a good-quality business, it can be genuinely intelligent.

Are you looking for someone to protect you from stupid people?

Here at Wealth Morning, we run a night-trading desk focused on global markets. We aim to build up defensive and income-rich portfolios for our Eligible and Wholesale Clients.

Have you previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Past performance does not indicate the future and dividend income is not guaranteed. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.