Guess what? We’ve reached the tail-end of June now.

This means that we’ve gone past the midway point for the year.

Gosh, time does fly, doesn’t it? We’re already halfway through 2024.

But one thing doesn’t change, though. The human tendency of marching to the drumbeat of fear is still with us. Here are a range of controversial comments that I’ve seen in the media lately:

- ‘I’m pretty sure that World War III is going to break out soon.’

- ‘I’m pretty sure there’s a 90% chance that the stock market is going to crash.’

- ‘I’m pretty sure that our civilisation is finished if the wrong man gets into the White House.’

Are things really that bad? Well, one thing’s for sure. The fear about World War III may be totally inaccurate:

- You see, World War III has already happened. It was the Cold War.

- World War IV has also already happened. It was the War on Terror.

- We survived those conflicts just fine. We just never realised it because the media has been feeding us with an unhealthy diet of angertainment.

But…what about the chances of the stock market crashing? Is it a foregone conclusion? Especially at this time of the year?

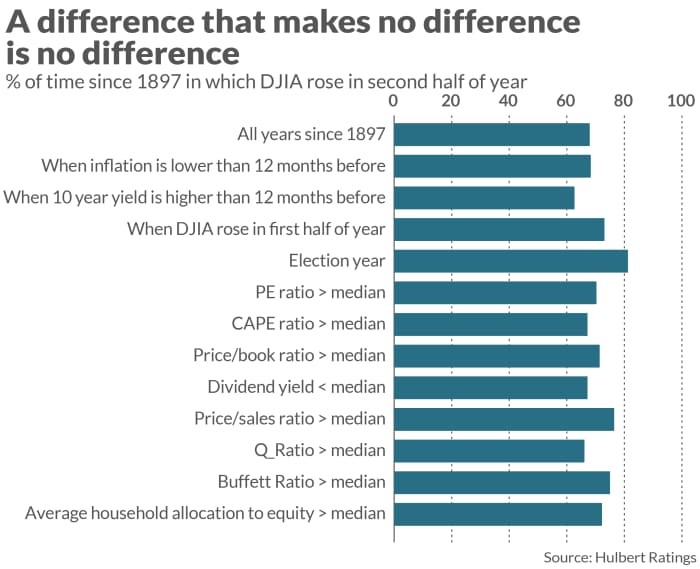

- Well, analyst Mark Hulbert has taken a close look at 128 calendar years for the Dow Jones Industrial Average. He’s gone all the way to 1897. He’s taken every economic indicator available to him — both good and bad — applying them to his research model.

- So, what did Hulbert discover? Well, something truly extraordinary. You see, while human beings tend to march to the drumbeat of fear, the stock market tends to march to the drumbeat of a different kind: progress and optimism.

- Now, regardless of the indicator that’s used, Hulbert has noticed that the pattern always appears to be the same. Generally speaking, there is a 68% probability that stocks will rise during the second half of this year.

- Furthermore, the probability actually gets better when stocks have already risen during the first half of the year (which has been the case for 2024). The odds here increase to 73%.

Source: MarketWatch

So, what about the fear that civilisation will end if the wrong man gets into the White House?

- The short answer? Well, nope. Not likely.

- In fact, Hulbert’s model reveals that the chances of the stock market rising during an election year is actually much higher than normal. It actually goes beyond 80%. The odds are pretty good.

So, there’s a two-out-of-three chance that the market will continue to rise in 2024:

- Of course, past performance is never a promise of the future.

- But here’s the thing: the market is a wild animal. Untamed. Unchained. A primal force of nature. Its hunger is ravenous. It wants growth. It wants yield.

- Indeed, the market will power forward because it must power forward. This feral instinct is hardwired into its DNA. Which makes it a lot more resilient than people are willing to give it credit for.

- So, frankly, I’ve learned not to underestimate the momentum of the market — and neither should you.

We’d love to hear from you…

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.