Are you under 30…or even 40?

Did you miss out on that moment when asset prices (property and stocks) became completely out of sync with wage growth?

Well, this explains why more and more young people are embracing cryptocurrency assets as a way to get ahead.

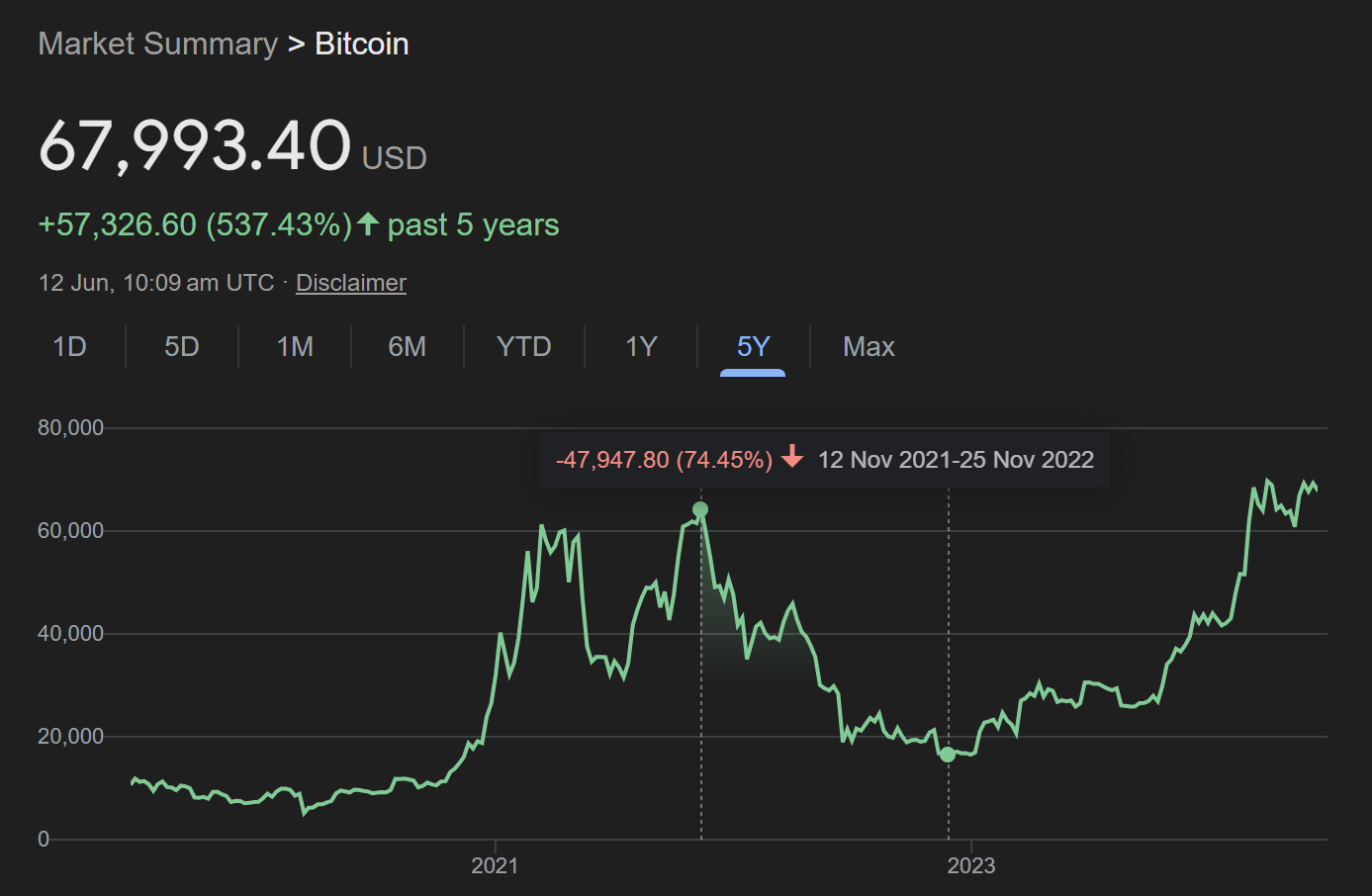

Over the past year, the price of Bitcoin is up around 160%. You’d have to get your speculative stock-picking spot on to get anything like that.

Source: Image generated by AI courtesy of Canva

Though, interestingly enough, stakes in Rolls-Royce [LON:RR] or Nvidia [NASDAQ:NVDA] have done over 200%.

But to warn you — Bitcoin has been more volatile than even the most speculative of large-cap stocks. Between November 2021 and November 2022, it collapsed by over 70%.

Source: Google Finance

As you get on in life, there’s one component that can protect you from some volatility and pay you to hold your assets for long-term growth. (The real wealth is built over the longer term. Even Bitcoin has seen 500% over five years).

That component is income yield

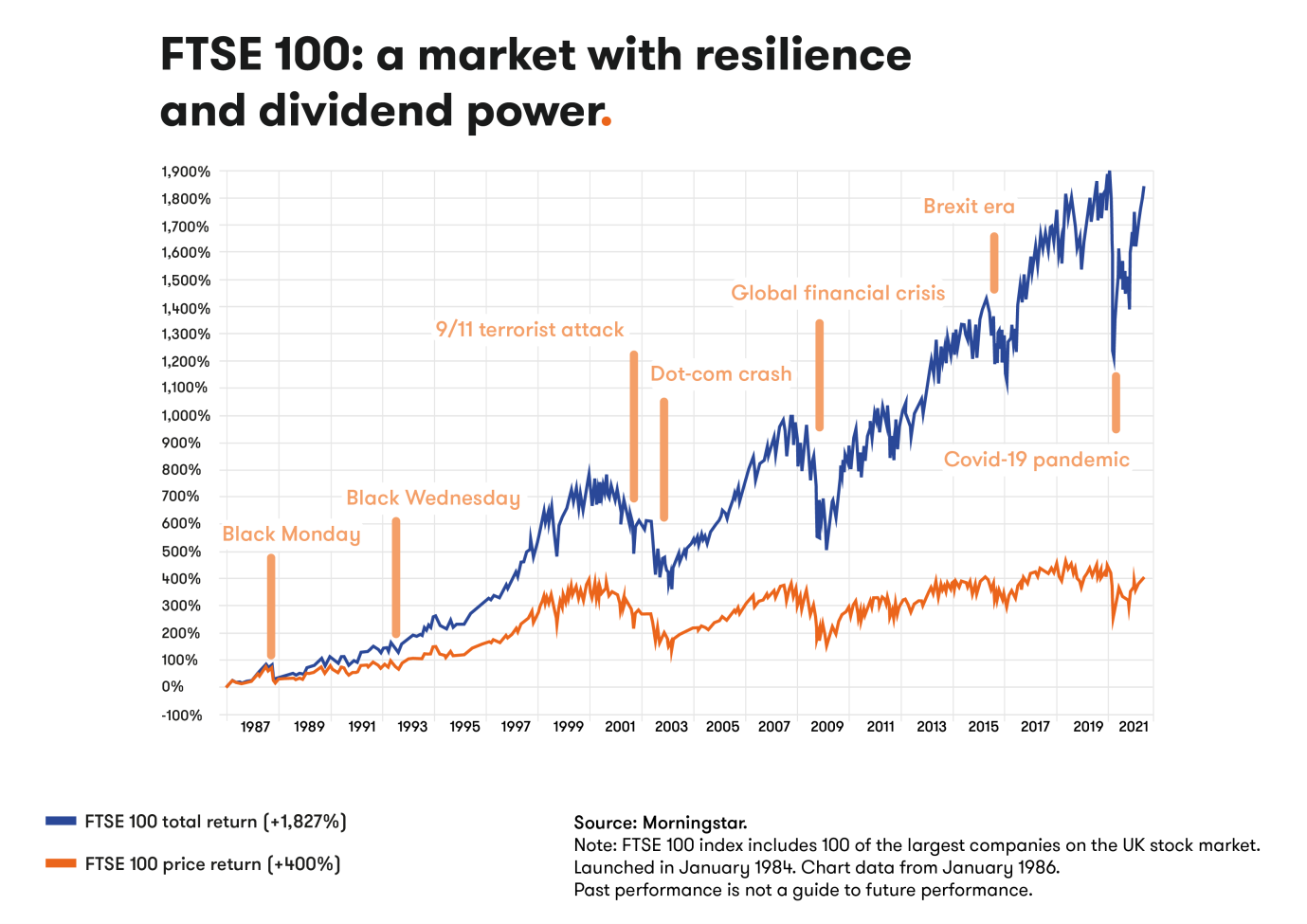

The secret sauce of income yield is that it can allow you to compound. In fact, over time, if you don’t need to withdraw income, it can comprise much of your return. This has certainly been the case with British stocks since 1987:

Source: Interactive Investor and Morningstar

Source: Interactive Investor and Morningstar

It’s simple to build wealth with dividend-paying stocks. Dividends from quality businesses tend to increase ahead of inflation. And while you may start with an entry yield of 4% or 5%, over the years, that yield can increase a lot (on the initial price) as things grow.

Mostly, though, I just like the security of knowing that there’s decent passive income available should I not wish to work all the hours of the day.

Some people believe in gold…

Yes, it has way less volatility. And it’s true, gold has held its value since biblical times.

But it’s very hard to get yield on gold. Like Bitcoin, you hold it for value escalation.

As for property, unless you’re buying large-scale commercial, yield tends to need a lot of time and work in managing tenancies.

So, is it possible to get an income yield from Bitcoin?

Some cryptocurrency holders seek income via ‘staking’.

Staking is where you lock up your coins for a certain time so they can be used to validate transactions on the blockchain.

Unfortunately, staking is not available on Bitcoin. That’s because the Bitcoin blockchain uses a Proof-of-Work consensus, not a Proof-of-Stake.

So, if you do see staking of Bitcoin, it’s probably more akin to you lending your coins rather than true blockchain staking.

Already, this suggests that garnering income from crypto involves quite a bit of risk.

Beyond Bitcoin, many of the smaller cryptocurrencies carry more risk and volatility.

Providing your Bitcoin for lending — or to take advantage of yield opportunity — inevitably means handing your assets over to a third party. This adds custody risk.

What about Bitcoin ETFs offering yield?

There are now exchange-traded funds in Bitcoin that offer yield. These are readily available. I can buy them on our brokerage platform in the same way as I would buy a line of stock.

One example is the Purpose Bitcoin Yield ETF [TSE:BTCY].

At the time of writing, it offers a yield of around 9%, with management fees of 1.1%.

So how does it work?

It is actually an options strategy. The yield is generated by selling covered call options on underlying Bitcoin assets and collecting the associated premium:

- A call option is a financial contract whereby a buyer has the right to buy an asset at a predetermined price (‘strike price’) on a predetermined date.

- It makes sense to exercise that if the asset price is above the strike price.

- The buyer of the option will pay a premium to the seller, and the seller will keep that whether the option is exercised or not.

- A ‘covered call’ simply means the seller of the call option owns an equal amount of the underlying asset. They sell the right for someone else to buy it, typically at a higher price.

The main risk with covered calls is that you miss out on the price appreciation of the asset if it goes above the strike price. For example, if the fund writes a covered call on Bitcoin for $75,000 but it goes to $100,000, it only receives the gain to $75,000 (and the premium paid).

Clearly, the premium can be used to pay a nice yield to holders of the fund. But should Bitcoin shoot for the stars (as many believe it will), there may be a heavy sacrifice between income and capital growth.

In fact, over the past five years, the value of this fund has fallen:

Source: Google Finance

So, it would seem that holders wanting exposure to Bitcoin have potentially given up over 500% in return to achieve the income yield.

No doubt, in the world of ETFs, there will be more exotic methods developed to find ways to generate yield from crypto.

It strikes me one of the simpler ways would be to run an active fund trading Bitcoin, and pay out part of those profits as yield.

As for dividend-paying stocks, some analysts will argue you also give up capital growth to gain a decent yield. Typically, this is because dividend-paying companies are more mature companies that do not have so many options to reinvest in their growth.

But I would argue a savvy investor finds an optimal intersection between growth and yield. A company that can both grow and pay decent income. These two objectives are often complementary.

Are you looking for someone to stand up for you?

Here at Wealth Morning, we run a night-trading desk focused on global markets. We aim to build up defensive and income-rich portfolios for our Eligible and Wholesale Clients.

Have you previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity. I encourage you to reach out at this pivotal time.

You’ll always miss 100% of the shots you don’t take.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Past performance does not indicate the future and dividend income is not guaranteed. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.