I was listening to a talk the other day on mortgage pain.

‘Inflation is the excuse to keep lifting mortgage rates,’ the speaker claimed.

Then rising bank profits were mentioned. At a time when ordinary people experience their personal wealth diminishing. How dare they!

The finger was pointed at net interest margin: ‘When interest rates are higher, the bank can make a higher profit margin.’

The discussion went on…

‘How could the Reserve Bank gift the banks this opportunity?’

‘Oh, this is why banks are a leech on society.’

‘The Reserve Bank is not here to help you.’

Pain and truth

Banks — an integral part of society?

Source: Impression generated by AI (Canva)

The average two-year mortgage rate in New Zealand doubled between 2020 and 2023.

Fortnightly payments on a $500,000 mortgage have gone up around $300 per week.

That’s another grocery bill for many. On your home, the only way to defray that is to increase income, ideally from the property itself.

Yet, in this pain situation, blaming bank profits and the Reserve Bank is mistaken. Banking is a business. We live in a free market, mainly.

The Reserve Bank targets price stability. Inflation between 1% and 3%. Ideally at about 2%.

They are charged with dousing inflation when it alights. Though, in the case of Covid-19, it does seem they allowed monetary policy to flounder.

In fairness, they were also responding to a government that applied a fire hose of cash to the economy. While a lockdown to deal with the initial emergency may have been necessary, the wholesale throttling by a socialist government is now being questioned.

So, are banks profiting?

We follow one of Australasia’s leading lenders: Westpac Banking Corporation [ASX:WBC].

They have been leading the pack, with net profit last financial year up 26% to A$7.195 billion. Return on Equity (capital invested) increased 2% to 10.1%. Net interest margin (NIM) lifted slightly to 1.95%.

Interim results announced in May saw these numbers soften. Though the strong cash position still enabled bumper returns to shareholders. A special dividend and increased share buyback were announced.

Over the past six months, this stock has generated capital gain of over 25% for investors. That’s on top of the near-6% dividend projected.

Generally, yes, banks are profiting. Many shareholders have been doing well over the past year. In fact, this is consistent across banking groups in Europe as well. There, one of our targets was up over 90% over the same period. It is currently projecting a return on its capital of almost 15%.

Banks need to be profitable…

A loss-making bank is actually a danger to the wider economy.

Fractional lending means banks can lend up to 90% of their deposits.

When you deposit $100,000 into your bank, they might lend out $90,000 to someone else.

The person who ultimately receives that $90,000 will deposit it into their bank. Their bank can then lend out $81,000. And so on…

An unprofitable bank could become unable to meet its commitments. It then becomes a contagion risk to the rest of the economy where it is embedded.

As reported recently, we are already concerned about the potential onslaught of CBDCs on the banking business.

Here in New Zealand, banks source around 70% of their lending from domestic deposits. Around 20% of their non-equity funding comes from overseas. This supplements the small pool of domestic savings.

Our weak savings rate means New Zealand’s rate of offshore bank funding is high. The country is vulnerable to disruptions in global financial markets. And compared to currencies such as the US dollar or euro, the NZ dollar is seen by investors as a riskier currency.

So long as this persists, we may see higher interest rates in New Zealand compared to some other developed countries.

Banks have been profitable through history

Lucrezia Tornabuoni — House of Medici.

Source: Impression generated by AI (Canva)

The first bank, as we may think of banks today, goes back more than 700 years to the city-state of Venice. When the Republic was at war and running short of funds, it had recourse to forcing a loan. The contributors were allowed an annual interest rate of 4% from what became the Chamber of Loans.

As respect for the Chamber grew, merchants began placing their money with it for safekeeping. So the second function of banks came about — deposit takers.

By the 15th century, the Medici Bank had set up branches in every significant European market. Today, Medici is credited as the founder of the double-entry accounting system for tracking debits and credits.

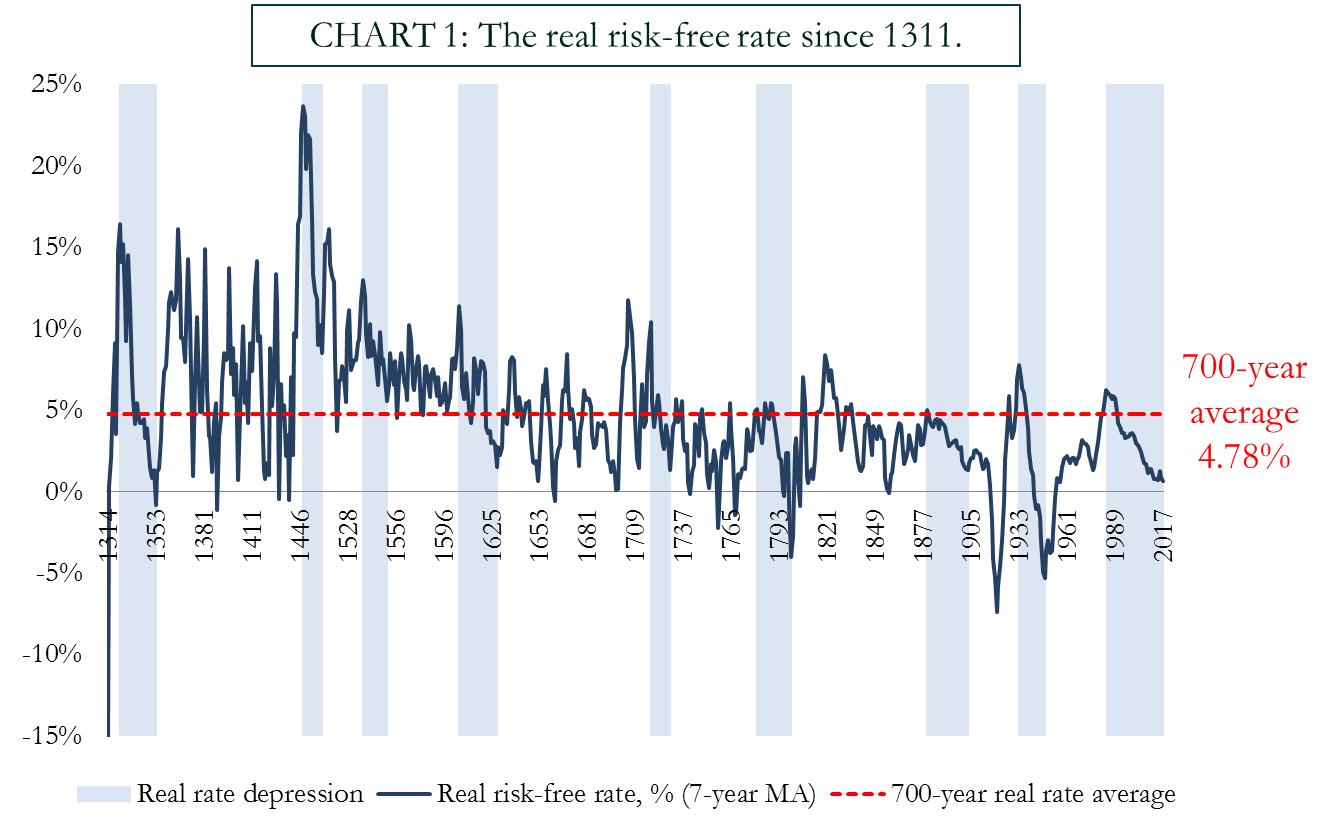

If we look back to the advent of banking, we find the average interest rate charged across history is just a bit over 4%. The average inflation rate is a little over 1%.

Source: Paul Schmelzing, Bank Underground

Banking operations have generally averaged returns just over 3.5% ahead of inflation. But they’re also vulnerable to economic shocks.

An inflationary downturn with higher interest rates may give them a higher interest rate margin. It may also slow lending as the economy sours.

Banks are embedded in the economy

In New Zealand, where the housing market is expensive and integral, home lending should remain a profitable business.

‘Follow the banks,’ a successful commercial property investor once told me. He meant that he sought his properties near where the banks were.

The question to ask is not whether banks are making too much profit — but whether you are positioning yourself for profits too?

Borrowing for a profitable return can make good financial sense. For example, when you buy a business, quality shares, or a cash-flow positive rental property.

I notice that many of our high-net-worth clients don’t keep much cash sitting around. They have it out working in productive assets in the market. Earning their share of the available profits. These assets then offer a line of credit that could be used to capture more opportunities.

Is home ownership an opportunity? It has been over the past few decades in New Zealand. Yet your home is not really an ‘asset’ in financial terms unless it generates a profit.

Of course, everyone needs somewhere to live. A well-structured loan on an affordable property could leave you better off than renting.

But the real question to ask is not, ‘Are banks making too much profit?’

Well, banks have been doing so at various levels for 700 years.

Instead, it’s better to ask, ‘How can I get on the right side of that profit?’

As in most things financial, that comes down to optimising your situation and investing.

It’s one reason why we may invest in value banking stocks when the cycle is ripe. With the goal of helping our Wholesale Clients position for profit.

Are you looking for someone to stand up for you?

Here at Wealth Morning, we run a night-trading desk. We focus on building up robust and profitable portfolios for our Eligible and Wholesale Clients.

We seek to stay ahead of the curve and position our clients for income and growth for the next stage of the cycle.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.