Dream big and be prepared mentally and financially to act fast when opportunities present themselves.

Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.—Warren Buffett

The tortoise and the hare. The dog and the wolf.

These are stories from childhood that remind you of what life is about. Often read on a wet Taranaki day from a Ladybird book.

Well, Ladybird books have been updated for our generation:

Source: Penguin Books NZ

But some things remain the same.

In this age of freedom under threat, Aesop’s The Dog and the Wolf is pertinent.

I’m sure you know the tale. A hungry wolf meets a well-fed dog. The dog waxes lyrical about his great life. His master leaves all the food he could want in a bowl, morning and night. He gets taken on walks to the park. Or the beach. And he has the run of the family’s quarter-acre section.

‘You should come and join me,’ the dog proclaims.

Then the wolf notices the dog’s neck is chaffed.

‘Oh, that’s from the collar I have to wear,’ the dog replies.

You know the ending. The wolf runs back into the woods, realising an eternal truth.

Comfort is a poor price to pay for freedom.

When wolves win

There are two types of people. Their patterns are evident in the worlds of investing and politics. There are those who want to be looked after and seek security. And those who want to make their own way and have freedom.

Of course, it is a spectrum. From the pampered dog…to the wild wolf…with most of us either dog-leaning or wolf-leaning.

The trouble is that society today is focused on obedient dogs. Get a steady job, follow the rules, contribute to KiwiSaver, and you’ll have a comfortable life.

But let me apply this to two people I know who are about 50 years old (not their real names):

Jeffery has only once had full-time employment, when he drove a forklift as a uni student. While he enjoyed the camaraderie of working with others, Jeffery is a wolf.

When opportunities arose in the wilds, he started businesses, invested in property, and the financial markets. Today, he receives profitable income from many different sources. From more than 50 customers in his business. From his property. And from his shares. But he continues to hunt, as that is his nature.

Andy also went to university, then worked in Britain for his OE. Back in New Zealand, he has a good job with a corporate employer.

He has a home with a mortgage and a rental property that doesn’t pay its way. Andy really only has one source of income that is profitable, and that is from his single employer. He is afraid of losing this job. In the current market, it might be hard to replace it.

Jeffrey has probably had a much tougher life. He almost lost everything at one point. But at the midpoint of life, I would far rather be walking on Jeffrey’s paws.

Simply, he has an advantage that Andy doesn’t. The many challenges of making it without the security of an employer have made Jeffrey resilient. He experiences post-traumatic growth, rather than post-traumatic stress.

Do wolves make better leaders?

In New Zealand, most of our leaders have been dogs. Or even puppies. They come from corporate careers. Or, worse, are political lifers.

They are yes-men or yes-women who are looking to maintain the status quo of the food bowl. Depending on their stripes, this may be by allowing ‘freer’ roaming on the right, or securing hefty fences on the left.

Negative publicity from the baying hounds of the media flummoxes them.

One reason why Donald Trump has so much popularity in the US is that — love or hate the orange man — he is a wolf. He has no history of answering to a single employer or board and ‘toeing the line’. He is free to make brave choices.

This is why, despite his well-publicised shortcomings, he has a 20-point lead over Biden on ‘who would better handle the economy’. It is also why, despite his equally well-publicised trial, the exposure only increases his support.

Investing with wolves

Making money in the markets requires the ability to manage risk in a wild environment. Markets swing to and fro on sentiment. These swings can be severe.

A dog will see this threatening their safety. They may want to pull their money out at the wrong time. Then think investing in financial markets is not for them.

A wolf will see opportunity. Dark clouds of volatility give them the chance to act fast and buy the best assets. They will position themselves for long-run freedom with many growth and income sources.

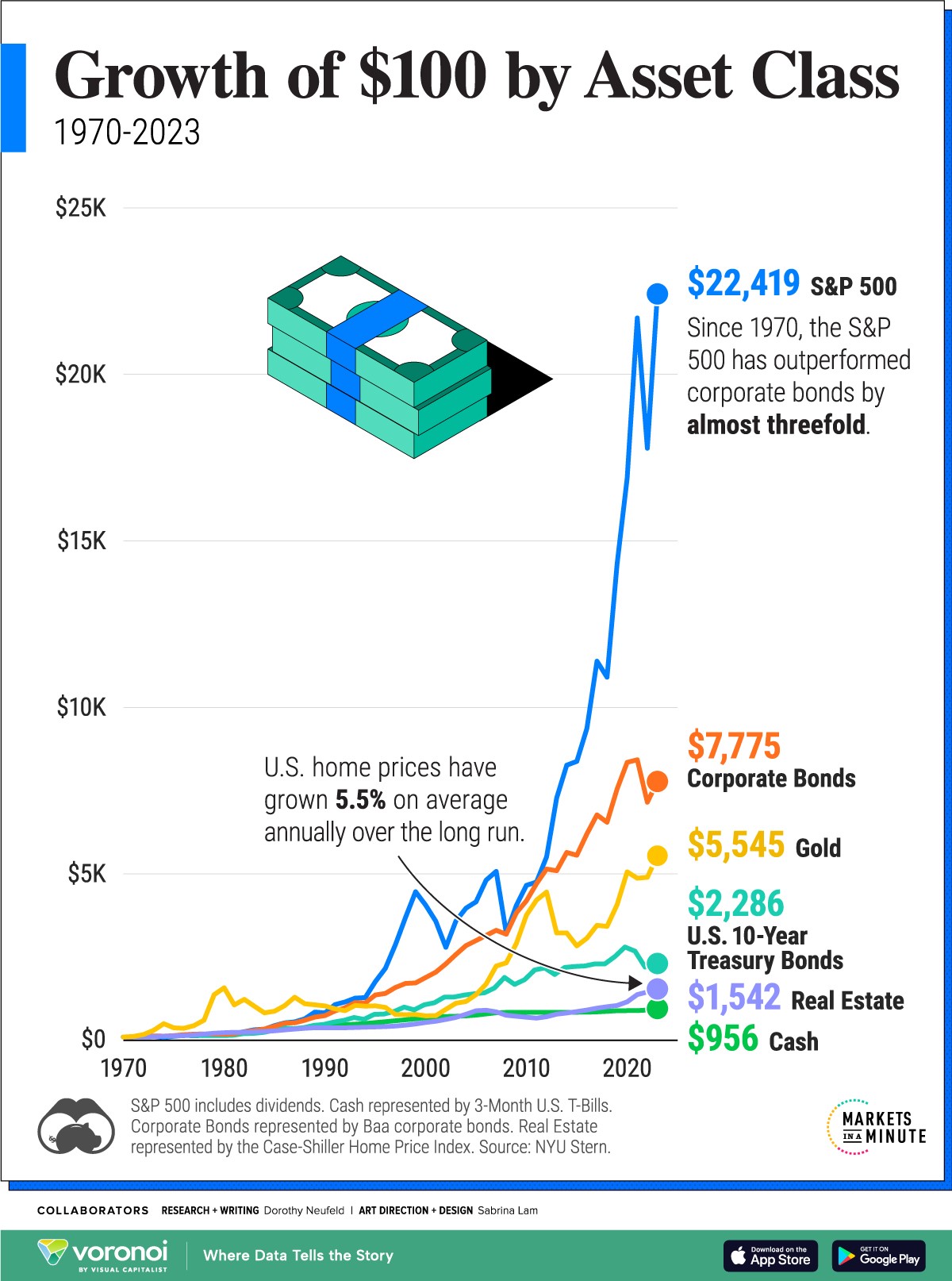

In my generation, wolves have done very well hunting in global stock markets, especially in the US. Here are some of their top performing assets:

Source: Visual Capitalist

If you are looking for more writing on how wolves prevail in matters financial, I encourage you to support Wealth Morning with a premium subscription.

Our weekly Quantum Wealth Report provides a more in-depth focus on the direction of global markets. And the opportunities those trends could present beyond the radar.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.