Neodymium. Dysprosium. Lanthanum. Europium. Yttrium.

Do you recognise any of these names?

Well, chances are, you don’t.

They look strange. They’re almost unpronounceable. And if you’re not a geologist or a chemist, you wouldn’t be familiar with these metals.

But here’s the thing. They are absolutely critical to your life:

- You will find them in your smartphone. In your television. In your car. In your batteries. In your light bulbs.

- That’s right. These days, most of our modern gizmos require these rare-earth elements. Our need for them is universal.

For this reason, rare earths have received a lot of attention in the press lately:

- But here’s a surprising fact. Rare earths are actually not that rare. In fact, if you tried to search for these elements in your backyard, there’s a good chance you could actually find some tiny deposits there. No kidding.

- However, here’s the problem: harvesting rare earths on a large scale is resource-intensive. Worse still, some people believe that processing these metals is too dirty and pollutive.

- Yes, this has become a point of ideological contention. Unfortunately, such feelings have given rise to nanny-state environmentalism. And this has crippled the West’s ability to explore and extract rare earths.

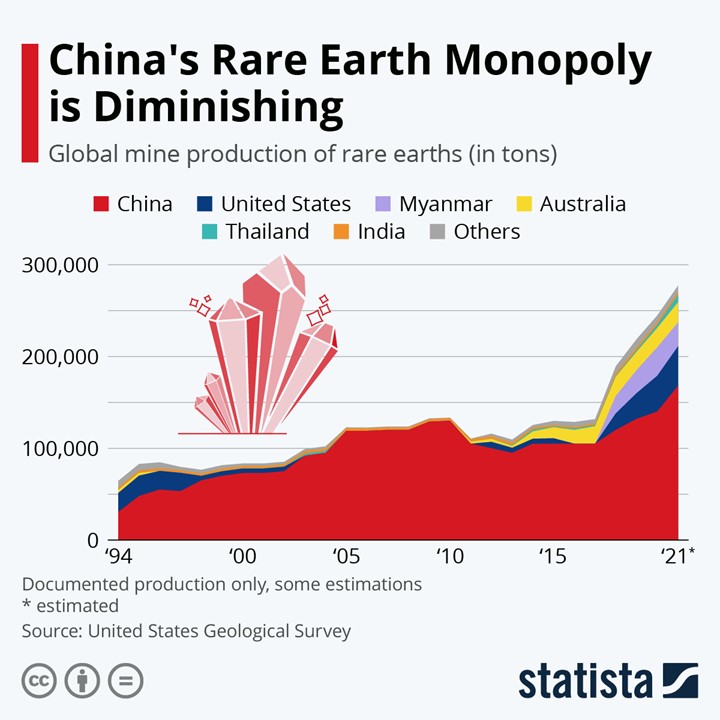

- This means that the industry has been largely outsourced to China. And this has given the Chinese a monopoly in rare earths. In 2010, the country came to dominate 95% of global production. Astonishing, isn’t it?

Source: Statista

However, the commodity cycle is starting to turn now. There’s a growing scepticism about the role that China has been playing in our global supply chains. Is it actually healthy?

- Well, unlike his friendlier predecessors Hu Jintao and Jiang Zemin, the current Chinese president Xi Jinping is more aggressively nationalist. He’s more willing to play hardball. And this has put him on a collision course with the West.

- Therefore, decoupling from China has become a priority. America and its allies are now looking to ‘friendshore’ the production and processing of rare earths where possible. This is about national security. This is about economic leverage. This is about common sense.

- Right now, as supply chains start to diversify, China’s dominance of rare earths is starting to slip, dropping towards the 60% mark.

- So, is this creating a potential opening for commodity-minded investors? What are the risks and opportunities here? Let’s take a deeper look at the global strategic picture…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.