‘The American dollar is worthless.’

‘The American economy is going to collapse any day now.’

‘The American century is over.’

Uh-huh. Okay. Well, barely a day goes by when I don’t hear about the impending doom of the Land of the Free and the Home of the Brave:

- For many conservatives, their pessimism seemed to hit overdrive when Barack Obama and his so-called brand of socialism arrived in the White House.

- Meanwhile, for many liberals, their pessimism seemed to get feverish when Donald Trump and his so-called brand of fascism arrived in the White House.

- Unfortunately, I find that when emotions come into play, it can be very hard to have a rational discussion. About anything. At all.

Still, I’m determined to try. And here’s what I’ve noticed. Regardless of whether the prophets of doom belong to the Left or the Right, one prickly issue always seems to come up. It goes like this:

- America’s national debt currently stands at around $34 trillion.

- America’s GDP currently stands at around $27 trillion.

- That’s a shortfall of around $7 trillion.

- Therefore — gasp — America is bankrupt.

- This is your cue to panic.

- (Screaming and rioting breaks out…)

Yeah, well, pretty dramatic. Except for one thing. All the above is complete hogwash:

- Please note that America is not bankrupt. Far from it.

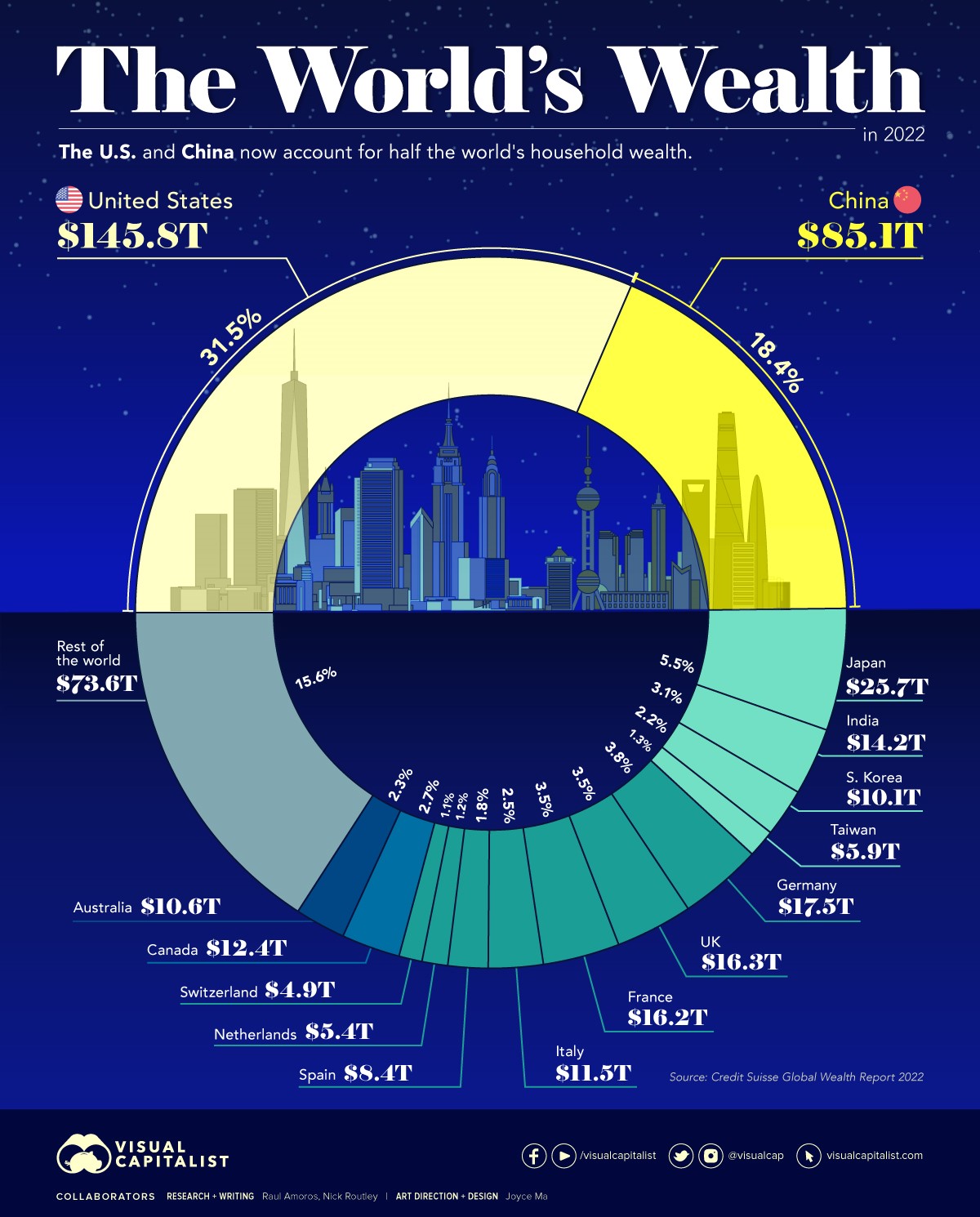

- America actually has over $145 trillion in total wealth.

- This is national net worth — which *excludes* any debt liabilities.

Source: Visual Capitalist

Oh, I can imagine you blinking in confusion now. ‘What? How can it be? Why wasn’t I told about this?’

- Well, do I have news for you. The mainstream media loves crisis and conflict. I mean, they really, really love it.

- Even when there is no drama, they will seek to create one. Just so they can grab your eyeballs. Make some ad revenue off you.

- A negative headline will get 60% more clicks. And astonishingly enough, each additional scary word will increase the click-through rate by 2.3%.

Uh-huh. I’m afraid you’ve been misinformed. You’ve been misinformed for a long, long time. So, from this point on, here’s what you need to keep in mind:

- GDP is short for ‘gross domestic product’. It’s the total monetary value of all the goods and services produced within America in one year.

- GDP’s focus is very narrow. It doesn’t take into account things like human resources, natural resources, and technological advancements.

- In other words, GDP does not take into account the total national wealth that America has.

Enlightening, isn’t it?

- Of course, when the media places national debt alongside GDP, that figure will look really big and scary. But guess what? It’s also extremely misleading.

- Sure, it makes for a catchy headline, but that doesn’t necessarily make it accurate.

- In fact, once you understand the theatrical nature of both the left-wing and right-wing media — you will start to see issues like the debt ceiling in an entirely new light.

Indeed, this is not quite the Armageddon — or the End of Days — that we’ve been led to believe:

- Yes, the United States has a national debt of $34 trillion.

- Yes, the United States has a GDP of $27 trillion.

- But here’s the twist: America’s debt servicing cost is only around $880 billion annually.

- Claudia Sahm, a former Federal Reserve economist, says that even though that number may feel big, it actually makes up a smaller percentage of GDP compared to previous decades.

- At the moment, America’s debt servicing cost is just over 3% of GDP. This is well below the 4.3% mark in the late 1990s.

- So, in this regard, America’s books are actually healthier than they were 20 years ago.

- Now, to put things into perspective, just imagine this: you’re currently paying off a mortgage for your home. Your debt repayments only make up 3% of your annual income. Are you in trouble? Well, no. You’re actually in the sweet spot. Your financial health is great.

Source: Talk Markets

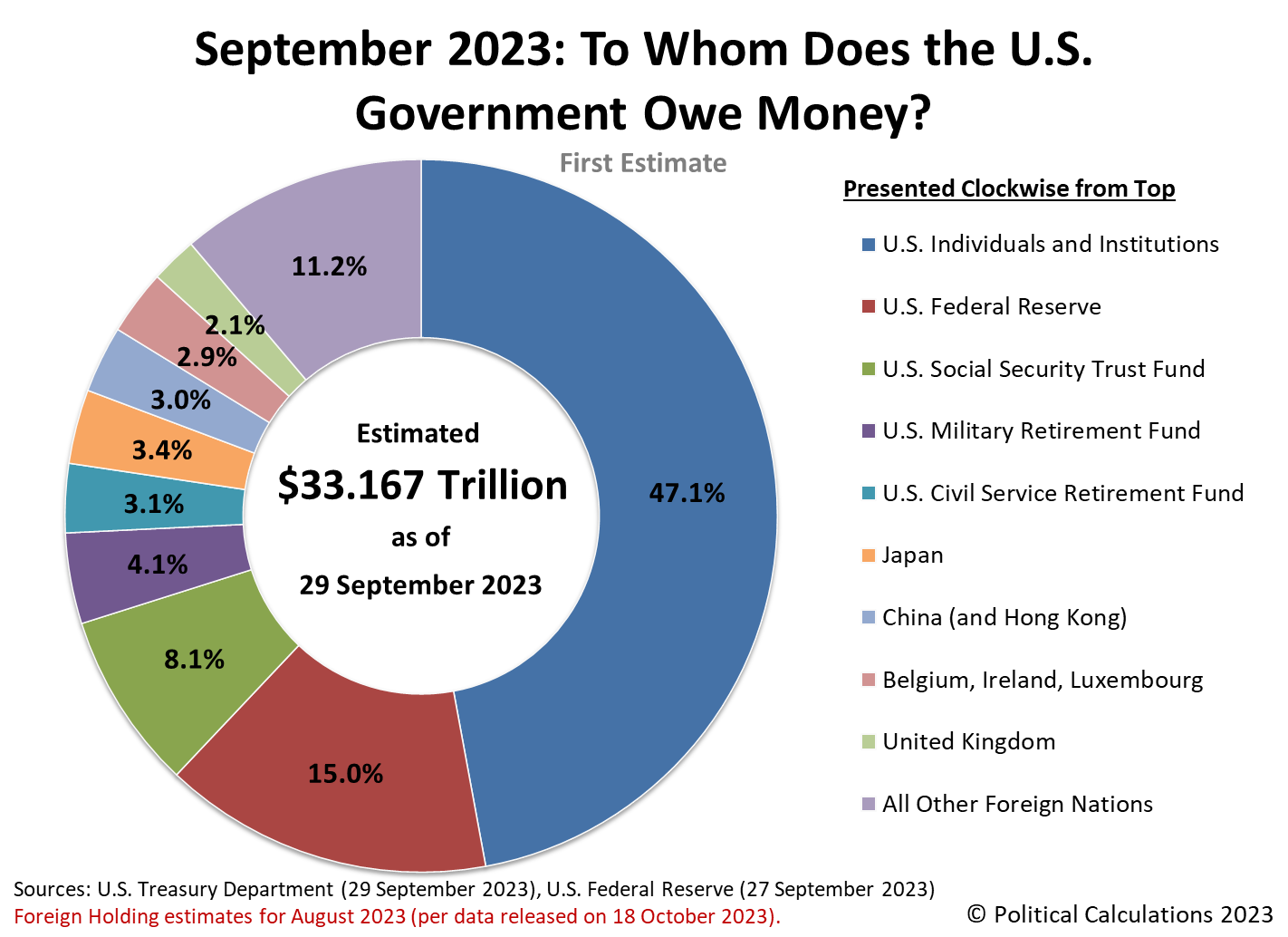

So, who actually owns the US national debt?

- Well, American individuals and companies actually control the biggest slice of it: almost 50%.

- Meanwhile, another 30% is controlled by the Federal Reserve and US pension funds.

- China only holds 3% of American debt.

- The remainder is largely held by American allies.

Never bet against America

Source: Canva

Legendary investor Warren Buffett continues to have faith in America. He explains why:

‘In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.’

What was true in the 20th century remains true in the 21st. The nation’s competitive advantage is impossible to deny:

- America has strong business institutions. Its system provides a stable and predictable environment to operate in.

- America has a highly skilled workforce. It has a large and well-educated population, which is a key factor in attracting and retaining businesses.

- America has a leading technology sector. It is home to many of the world’s top companies, making it a hub for cutting-edge innovation.

- America has access to capital. It has a deep and liquid market, which provides businesses with access to the funding they need to grow and succeed.

- America has a strategic location. It sits between Europe and Asia, which makes it an attractive place for businesses looking to access both continents.

Of course, this is not to say that America is perfect. It’s not all sunshine and rainbows. There are real problems that must be solved:

- Race. Religion. Social class. Social values. These are hot-button issues. Indeed, they are being fought over, even as we speak.

- However, don’t let the news headlines mislead you. The political brinkmanship may seem loud and rowdy, but that’s only because the issues are being debated openly. Americans love a fiery discourse. And the spirit of competition is a good thing. Because this is where the best ideas emerge. For entrepreneurship. For innovation. For progress.

- Make no mistake about it: America as a whole is greater than the sum of its parts. Its traditional motto still holds true. E pluribus unum. Out of many, one. This is why two-thirds of the companies on Silicon Valley today were founded by first or second-generation immigrants.

- The American Dream remains alive. And American entrepreneurs are the world’s best problem-solvers — even if the path forward may not always look like a straight line. Indeed, as the American Constitution declares, the soul of the nation itself is on an eternal journey ‘to form a more perfect Union.’

- Finally, let me put it to you plainly: I have not met a single Chinese or Russian person who would willingly choose to hold the bulk of their assets in the yuan and the ruble.

- In fact, when given a choice, they want to diversify into American assets and hold the US dollar. No ifs. No buts.

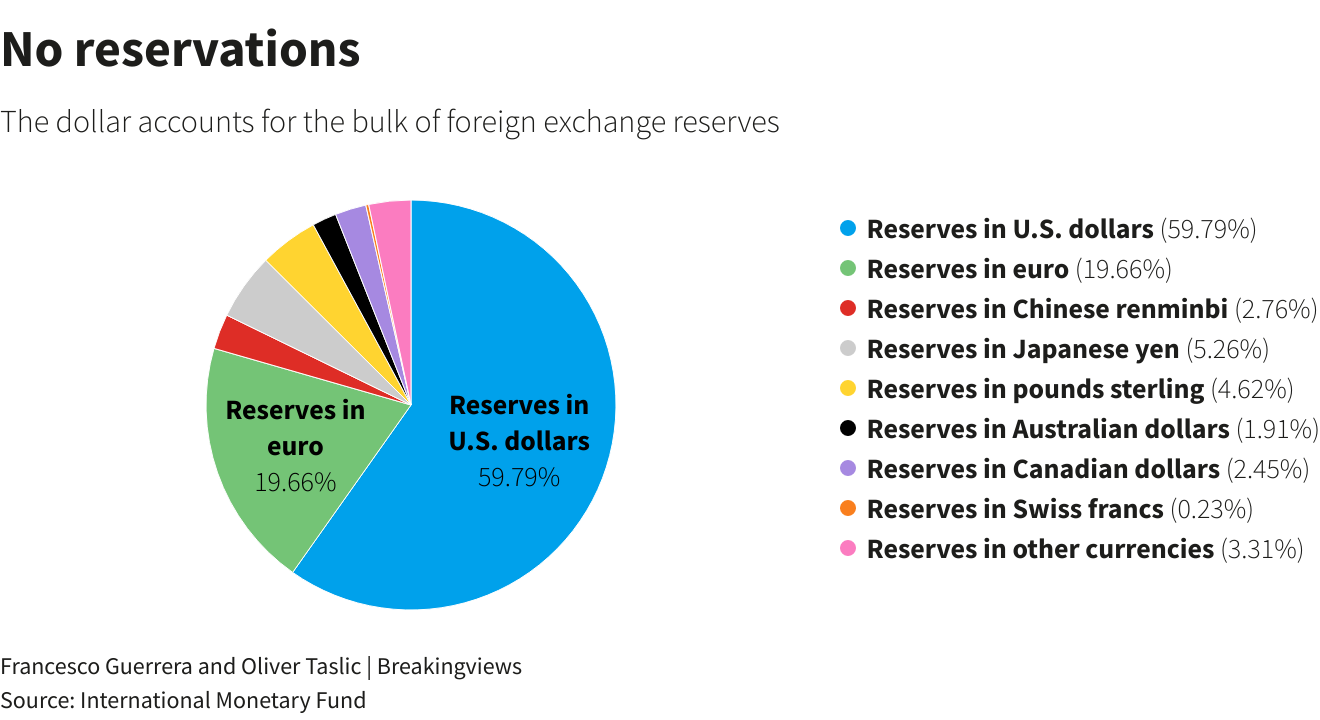

Source: Reuters

Look at the big picture. The numbers don’t lie:

- The US dollar makes up almost 60% of foreign-exchange reserves worldwide.

- For comparison, the Chinese yuan renminbi only makes up under 3%.

- What about the Russian ruble? Well, it’s such a non-entity, it doesn’t even appear on the list.

So, are you feeling optimistic about America? Or…are you feeling pessimistic?

- Certainly, there are many political opinions out there. But most of them are warped by a negativity bias about America that’s entirely unfounded.

- In the apocryphal words of Mark Twain: ‘The reports of my death are greatly exaggerated.’

- So let’s put emotion aside. My rational conclusion is this: America is a dynamic nation. Sometimes messy. Sometimes baffling. Sometimes frustrating. But always, always courageous, with an untameable spirit. Which is why America remains ideally placed to do what it does best — act as the global nerve centre of commerce and innovation.

- Madeleine Albright once called America ‘the indispensable nation’. And this is no idle boast. Ask yourself honestly: what other nation could have pioneered the development of an astonishing AI like ChatGPT? Well, the answer is clear: this could only happen in America.

- For all its faults, for all its frailties, America still stands taller and sees further into the future than other countries. That won’t change just yet.

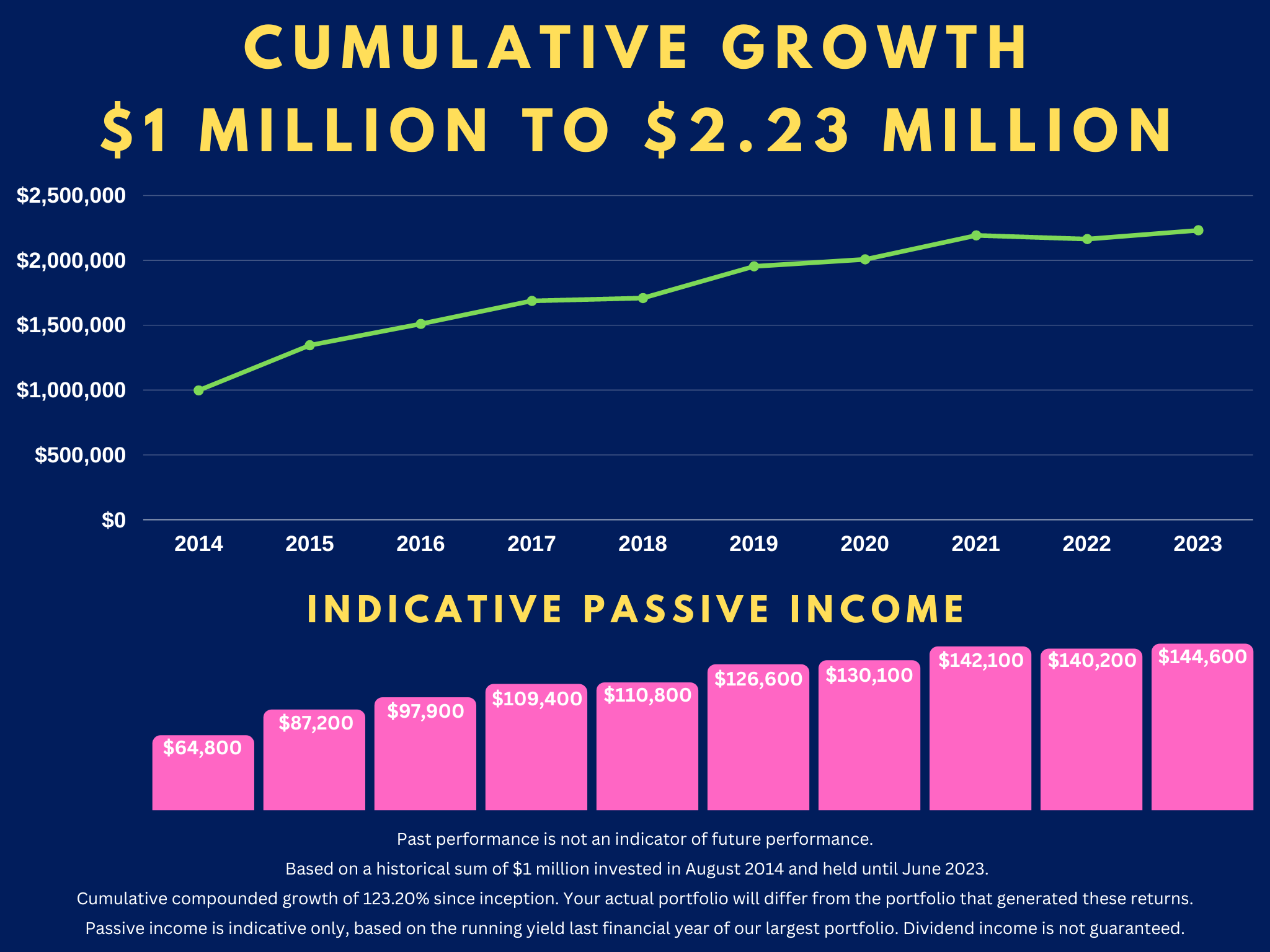

Our Quantum Income Strategy

So, what are smart investors looking for in 2024?

- Better prospects for capital growth.

- A stronger stream of passive income.

- Diversified wealth protection.

You could achieve all this when you choose to buy into global assets on the stock market:

- This is what we’re focused on with our Quantum Income Strategy.

- If you qualify as a Wholesale or Eligible Investor, we can help you set up and manage a global brokerage account.

- We have our eye on investment targets in Australasia, Europe, and North America. We are especially keen on resilient sectors like property, infrastructure, and energy.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions):

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2024 and beyond.

Regards,

John Ling

Analyst, Wealth Morning

(Past performance is not an indicator of future performance. This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.