Democrat. Republican.

Liberal. Conservative.

Progressive. Reactionary.

Which side are you on?

Well, clearly, it’s the silly season again. The 2024 presidential race is heating up, and so is the rhetoric:

- On December 15, 2023, President Joe Biden released a campaign video, poking fun at his opponent, President Donald Trump.

- The video is a sly one. It begins with footage of Trump from 2020, giving a dramatic speech, making this statement: ‘If Biden wins, you’re gonna have a stock market collapse the likes of which you’ve never had.’

- Then the video transitions to a cunning montage. We are shown clips of Joe Biden grinning, looking triumphant. Why? Well, the Dow Jones Industrial Average has hit an an-all time high in December 2023, setting a fresh record. It has gone above 37,000 points.

- The suggestion is clear: Biden has defied Trump’s doomsday prediction, steering the market to greater heights.

Uh-huh. This is great advertising. But here’s the thing — both Biden and Trump are totally wrong. They are misrepresenting how the market works:

- The market is actually a dynamic environment of push and pull; supply and demand; production and consumption.

- In fact, the market is the sum total of millions of entrepreneurs, workers, and consumers. And within this competitive space, businesses are striving to solve problems. Create products and services. Generate value and income.

Source: City Index

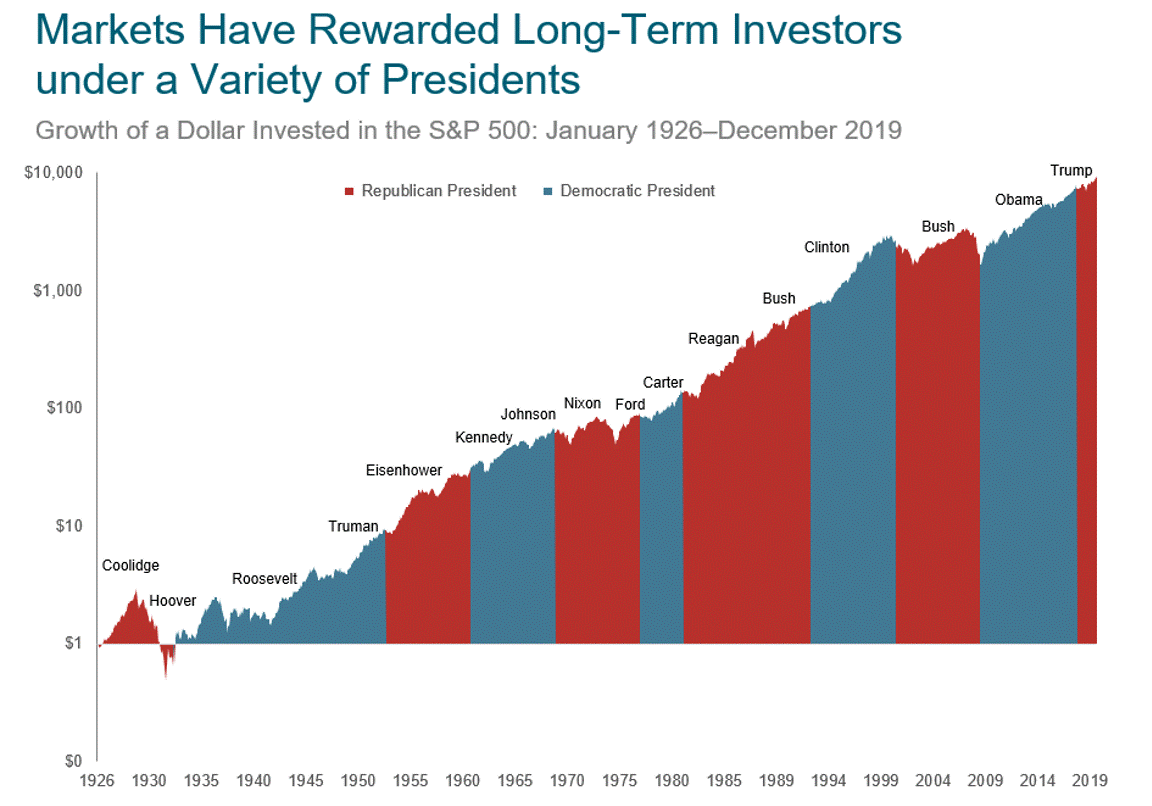

- So, as much as Democrats and Republicans may try to hijack the storyline for their respective campaigns, the historical trend is pretty clear. The market is neither conservative nor liberal. In fact, it’s politically agnostic. The market’s sole desire is to create compounded growth.

Still, are you feeling anxious right now? Are you feeling jittery about what will happen during this election cycle? Well, you might like to think of the big picture:

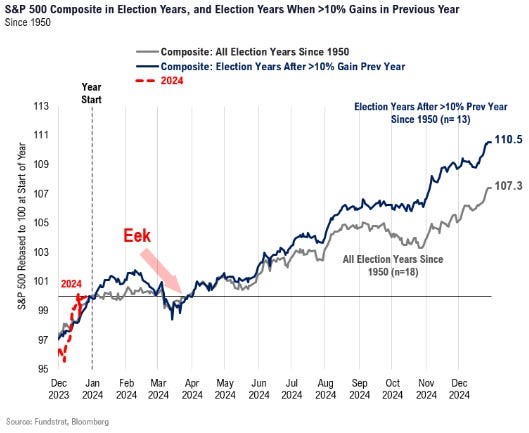

- Despite the drama, this cycle is usually positive for the stock market. In fact, an analysis of all election years dating back to 1928 reveals that the stock market has been positive 83% of the time. These historical patterns may represent an opportunity hiding in plain sight.

Source: Business Insider

- According to Tom Lee from research firm Fundstrat, a distinct softening in early 2024 is to be expected. This is especially true since we’ve had an exceptionally strong November and December 2023.

- So, this consolidation is not to be feared, but it may actually provide a brief opening for attentive investors. Indeed, it’s a chance to buy before the market marches higher.

- Like many observers, I am watching the presidential race play out with morbid fascination. The sound and the fury this cycle generates is second to none. It’s the greatest show on Earth.

- However, I won’t lose sight of this fact — when the dust clears, regardless of who’s in the White House, the market will likely digest the news and move on. It will be business as usual.

- We shouldn’t forget: the market is like a finely tuned symphony orchestra. It comes together create its own pitch and rhythm. Always has. Always will be.

Our Quantum Income Strategy

So, what are smart investors looking for in 2024?

- Better prospects for capital growth.

- A stronger stream of passive income.

- Diversified wealth protection.

You could achieve all this when you choose to buy into global assets on the stock market:

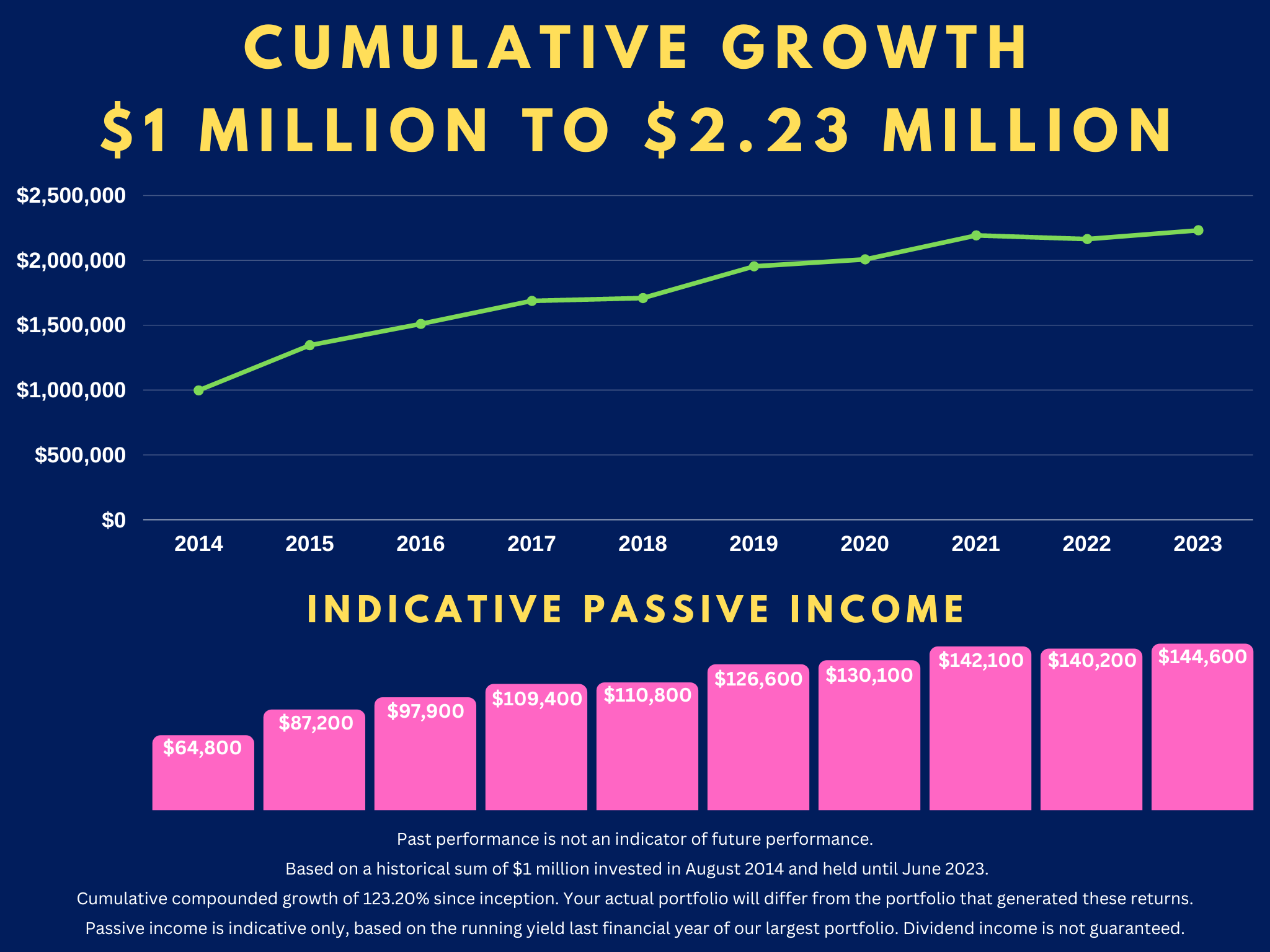

- This is what we’re focused on with our Quantum Income Strategy.

- If you qualify as a Wholesale or Eligible Investor, we can help you set up and manage a global brokerage account.

- We have our eye on investment targets in Australasia, Europe, and North America. We are especially keen on resilient sectors like property, infrastructure, and energy.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions):

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2024 and beyond.

Regards,

John Ling

Analyst, Wealth Morning

(Past performance is not an indicator of future performance. This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.