It surprises me how many people I come across willing to throw the dice on cryptocurrency. But will complain bitterly when equity markets and real assets drop 15%.

The argument is that Bitcoin might be uncorrelated to other markets, and hence could provide some form of protection. Or even serious upside.

That, in time of crisis, Bitcoin could act like digital gold and increase its value. And that its truly golden years are still ahead as its limited supply but durable fundamentals have become elevated.

It’s true. Over the past year, Bitcoin is up over 150%. But Nvidia [NASDAQ:NVDA] is up over 230%. Even Uber [NYSE:UBER] (with risk spread across a large user base) has seen over 140%.

Of course, the prospect of speculative fortunes on crypto does tend to capture the imagination.

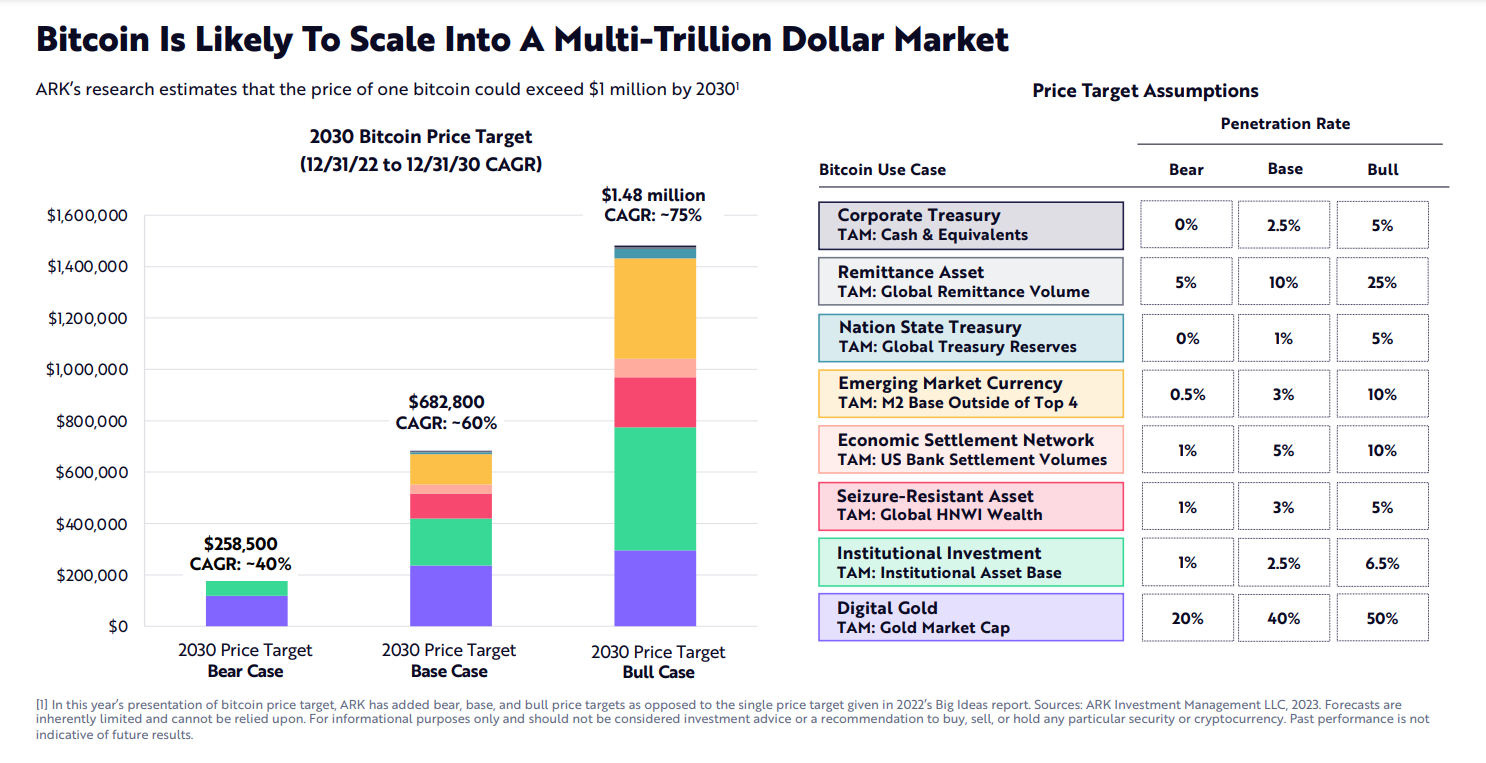

According to Cathie Wood’s ARK Invest, the bull case for Bitcoin could see it reach USD $1.48 million by 2030.

Source: ARK Invest ‘Big Ideas’ Presentation 2030 — January 31, 2023

(Note: all cases rely on considerable growth in penetration rate.)

Cathie Wood’s career in investing in innovation has not been a smooth run.

Wood begins each morning reading the Bible. She has seen many testing moments during four decades of market upheavals. ‘Each of those times was a time of deepening my faith,’ she has said.

Observing Bitcoin does suggest it has seen a sort of biblical Joseph Effect. This tale of seven years of famine, followed by seven years of bountiful harvest, has been corroborated by mathematician Benoit Mandelbrot as occurring in other cyclical areas such as financial markets.

Further studies tend to show that the machinations of monetary policy also take about seven years to work through.

When I first became involved with Bitcoin in 2016, working for the world’s first regulated Bitcoin fund, it sat around USD $500.

It had really experienced almost seven years of ‘famine’ since its creation in 2009.

However, from 2016 until now, it has seen a high of $68,000 (in November 2021). And solid escalation this year back to around $40,000 after some serious drawdown.

Is Cathie Wood right? Could Bitcoin see a double feast, with seven more bountiful years ahead?

If it is a truly cyclical instrument, perhaps not.

Wood and others see several areas of price impetus:

- Institutions adopting it as an investment instrument and the approval of Bitcoin ETFs.

- A hedge against inflation in a time of Quantitative Easing and currency devaluations.

- Increasing utility as a remittance instrument in the face of continued hyperinflation and currency devaluations.

- Existing supply constraints could be further intensified as the next halving is less than six months out now.

Yet the currency devaluation force is actually coming to an end. Tight monetary policies have seen strengthening of currencies in developed markets. Traders now think rate cuts could occur as early as next year.

As for institutional adoption, it still feels somewhat precarious to invest in Bitcoin — or for that matter, most cryptocurrencies.

There is no discernible underlying value, apart from what the next person is prepared to pay.

While ‘the greater fool theory’ does point the way to powerful escalation in value without intrinsic value, there is the wider problem of securing the asset.

Bitcoin works like gold. If someone takes your gold (or your keys), they take your asset.

If you rely on an exchange to hold your Bitcoin, that’s only as good as the veracity of that exchange (the custodian). If you rely on non-custodial cold storage, then that’s up to you to protect the keys. There are countless stories of people losing them — or even the ink in which they are written bleeding unreadable inside a safe!

Bitcoin seems riskier than ever because its potential for gain is flipped by even greater potential for loss.

Though a highly volatile instrument does always present the opportunity for trading profits.

In 2016, Bitcoin operated like any breakthrough piece of technology. It was available at low cost but considerable long-run potential. Back then, you could buy following the famine.

For my own bids, I’d rather be looking into other areas of potential breakthrough that have a lower entry price. That may have feasting ahead of them.

Important, ARK Invest not only appears bullish on Bitcoin.

Their interests are diversified across a range of disruptive areas in equities:

Source: ARK Invest ‘Big Ideas’ Presentation 2030 — January 31, 2023

Of course, disruptive technology by definition carries high risk. It may not disrupt. It may stop disrupting. Something may stop it disrupting altogether.

And that remains a risk with Bitcoin. Regulators may make life difficult. A cheaper, more usable coin could come along (will Elon Musk push anything with X?).

Call me old-fashioned, but I’d rather find something more concrete with intrinsic value I can see.

This all comes back to calculating the investor’s nemesis: risk.

While it may appear markets can sometimes operate like a casino, with real assets (stocks, property) it may be possible to ‘beat the house’ and get some upside when you do your homework.

With crypto, it seems the house is the market.

Am I perhaps too contrarian on Bitcoin right now given its recent run?

Could Ethereum — or other coins available at a lower entry price — offer more potential?

I welcome your feedback.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary. It is general information only and should not be construed as any financial or investment advice or any recommendation. Past performance does not indicate the future. You should consult a licensed Financial Advice Provider to discuss your own situation.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.