John Romulus Brinkley was known as the ‘goat-gland doctor’.

At his clinic, he performed operations he claimed would ‘restore male virility and fertility’.

The procedure involved implanting the testicular glands of goats in his male patients at a cost of $750 per operation (around USD $11,000 today).

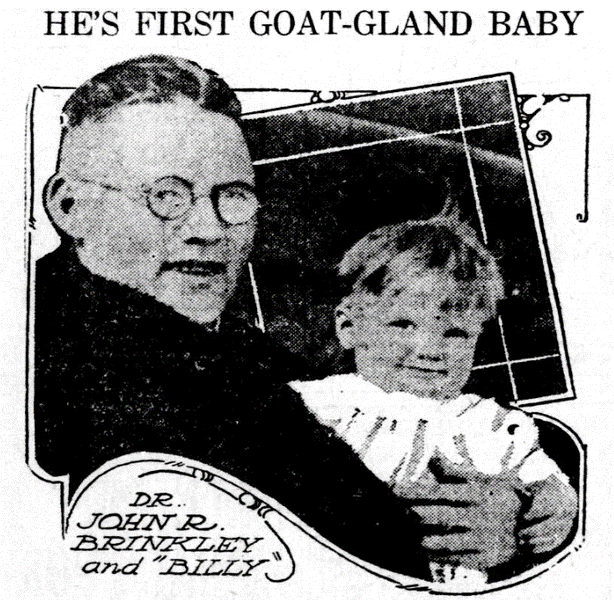

A newspaper advertisement from 1920. John Brinkley holds ‘Billy’, one of his famous goat-gland babies.

The parents of Billy had wanted a child for 18 years. Source: Wikimedia Commons

Despite his questionable medical training, Brinkley promoted his treatment with an advertising blitz. An advertising agent came up with the slogan of turning hapless men into ‘the ram that am with every lamb’.

At the height of Brinkley’s career, he amassed millions of dollars and almost won the Kansas governorship. Yet, apparently, he died nearly penniless due to malpractice, wrongful death, and fraud suits brought against him.

I reflected on Brinkley the other day, because he demonstrates how easily people’s opinions can be led astray. Clearly, his operations had limited to no efficacy, and very high risk.

When it comes to investing, opinions and thoughts lead to actions. Those actions make money, or lose it.

All this reminds me of the Enron scandal

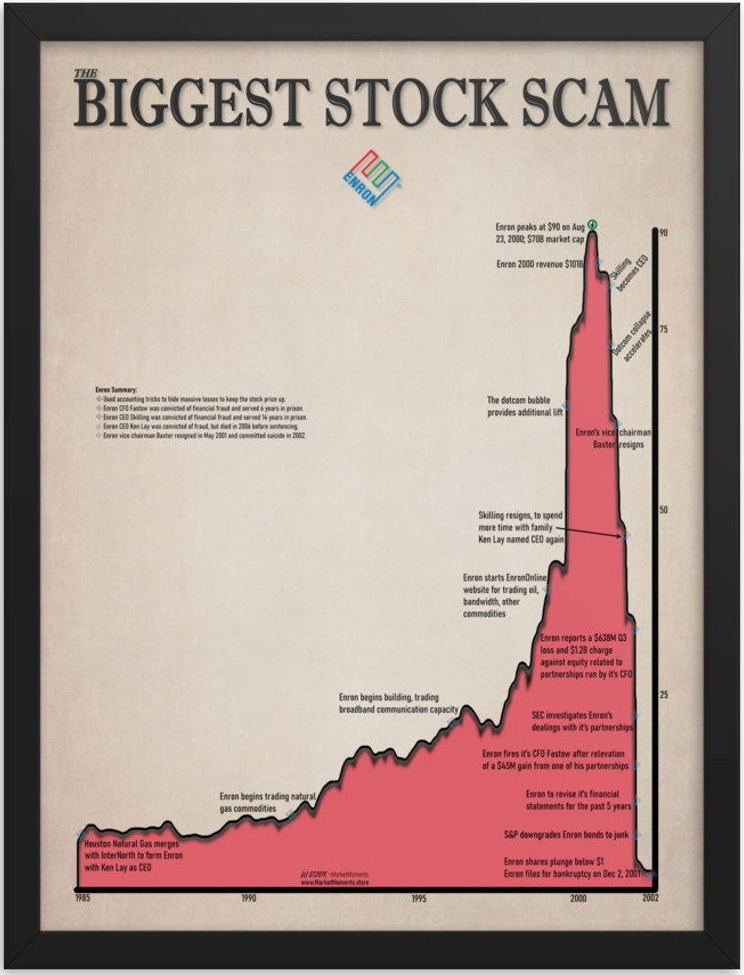

The rise and fall of Enron. Source: Art Print, Etsy

Let this picture be a warning.

Before its bankruptcy in December 2001, Enron employed 20,600 staff. It was a major electricity, gas, communications, and pulp and paper company. It claimed it had revenues of over $100 billion. Fortune magazine named Enron ‘America’s Most Innovative Company’ for six years running.

The Company was also behind one of the worst accounting frauds for a listed company in recent memory. It used special-purpose entities to mask liabilities and make Enron seem more profitable than it actually was, boosting the stock price. Insiders who knew about the offshore accounts traded millions worth of stock. Public investors were left in the dark.

Like the goat-testicle implants, the story with Enron was stimulating. The reality was very different. Enron shareholders lost north of $74 billion. Some of Brinkley’s implant patients met with very unfortunate results.

This brings me to the most important skill an investor can develop and possess…

Critical thinking

This involves assembling all the information you can on a subject, particularly before making a judgment or decision. It uses an analytical approach and questions all material aspects.

I find the most powerful component of it is elimination.

Good critical thinking could have avoided a goat-gland implant down below — or a stake in Enron.

Most simply, I apply it at restaurants. Given a large menu with a plethora of delectable choices, I begin by eliminating what I don’t want. Chicken? No, why have that at a restaurant? Lamb fries? Not after today’s article.

Deductive reasoning is also very applicable to good investing. As history shows, you can do well simply by not making mistakes and compounding good positions.

A company with a large, straightforward business, good profits, margin of safety, and growth tailwinds at a value price can be helpful.

Let’s explore an example.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.