Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

A couple of days ago, Warren Buffett and Charlie Munger’s Japan trade was revealed.

Berkshire Hathaway borrowed money at 0.5% in Japan. Then invested in low-risk stocks paying a 5% yield there.

Munger described it this way:

‘It was like having God just opening a chest and just pouring money into it.’

The trade appears to involve stakes worth around $6 billion across five Japanese trading houses, stemming back to 2020.

Money from heaven indeed.

It would have helped make up for potential losses over the past few months as financial markets wore a bond run.

Well, few people get the chance to borrow money at 0.5%. But this does show the value of the ‘carry trade’. Where you can find relatively reliable dividends that well exceed the cost of money.

To some extent, dividends are carrying our portfolios through this year.

We now have property positions in Europe on track to pay as much as 15%.

Yet the hard story for all market participants in October has been around the ‘higher for longer’ interest rate story.

There is nowhere to hide in stocks when the bonds run

You can only ease the losses with income yield.

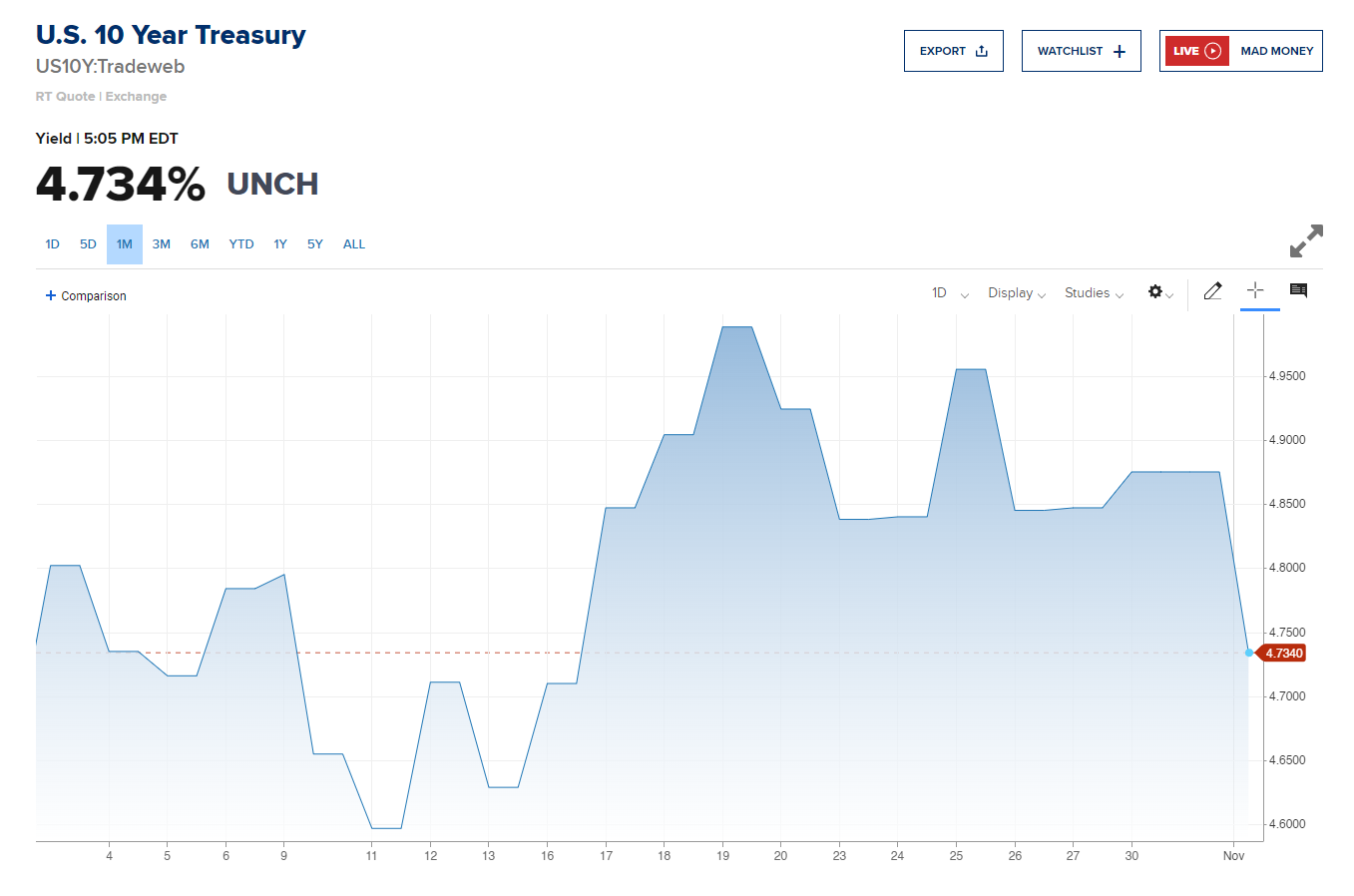

In October, interest rates did boil over, with the US 10 Year Treasury touching 5% on the 23rd of October. A milestone last reached in July 2007 during the GFC.

Source: CNBC

This was more than we expected. The fear no doubt exacerbated by Israel and the risk of spiking oil prices. A risk that has not yet come to pass.

But I did warn you last month that October can be a volatile month. If you look back through history, a month most prone to crashes.

Now the story is changing again. Those who deployed in September and October will no doubt be very well-positioned, just as Warren did when he pushed the button on Japan some time back.

EU inflation is now down to 2.9%. Finally, a fall more than expected.

Of course, central banks in the US and Europe have a sub-2% target for inflation. Not the 0%–3% we allow in New Zealand. So there is still some work to do.

There remains an open window to deploy. A window that could soon reveal some great value once the fog clears.

Managed Account performance*

For the month of October 2023, we were down 3.75% across the composite portfolio (total aggregate return across all portfolios following the strategy).

Our MSCI EAFE benchmark was down 1.46%.

This brings our return for the 10 months of this year to date (1 January to 31 October, 2023) to 4.40%.

Our average annualised return since inception is 13.95% p.a.

Please see our performance chart for more details.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.