Do you like to play games that stimulate your imagination?

I certainly do.

So, for today, let’s play a game, shall we?

It’s a thought experiment. An experiment of the mind.

Right now, I’m going to give you two imaginary news headlines. And all you have to do choose the one that stimulates your mind the most. It’s easy enough. Are you ready? Well, here we go:

- Headline #1: ‘Man returns home to his family after a day at work.’

- Headline #2: ‘Woman brutally murders husband after discovering shocking affair.’

Okay. Beep, beep. Time’s up:

- So, did you choose Headline #1? Or…did you choose Headline #2?

- Well, if you’re like most people, chances are, you will find yourself drawn to Headline #2.

- Yes, it’s scandalous. Yes, it’s vulgar. But it appeals directly to your negativity bias.

- In fact, psychological research has shown that negative headlines can increase the clickthrough rate up to 63%. Astounding.

So…it’s no wonder that the media loves to peddle negativity so much.

- Conflict. Crime. Disaster.

- As the old saying goes: ‘If it bleeds, it leads.’

Yes, we are subconsciously drawn to drama. The Decision Lab explains why our minds work this way:

The negativity bias is a cognitive bias that results in adverse events having a more significant impact on our psychological state than positive events. Negativity bias occurs even when adverse events and positive events are of the same magnitude, meaning we feel negative events more intensely.

Now, here’s the remarkable thing:

- Headline #1 — man returning home to his family from work — is something that happens 95% of the time.

- Headline #2 — woman murdering husband over affair — is something that happens 0.13% of the time.

- And yet…it’s fascinating that how much of our daily news is made up of statistically improbable events. It dramatises them. It exaggerates them. Often to the exclusion of everything else.

Just think about it:

- No one notices the people who don’t die of murder.

- No one notices the people who don’t die of cancer.

- No one notices the people who don’t die in infancy.

- No one notices the buses, trains, and planes that don’t crash.

- No one notices the white swans that aren’t black swans.

It’s curious, isn’t it?

- To this day, I can still recall what my lecturer at university told me: ‘The news is something that almost never happens. That’s why it’s the news.’

- So…be careful with what you absorb and perceive. Cognitive bias may be playing tricks on your mind. Much more than you realise.

Watch out for the fat tail

Now, if you’re an investor, risk is something that you always have to account for:

- It boils down to this: how much risk are you willing to endure in order to achieve the return on investment that you’re looking for?

- It should be a simple enough thing to figure out. But, unfortunately, recent events have shown me that people are generally not very good with measuring risk at all.

- They tend to misread the signs completely. Because of cognitive bias. Because of exaggerated emotion. Because they only see what they want to see.

For example, here are two real-world quotes that I have heard from people that I know, born out of extreme bearishness:

- ‘The economy is going to collapse. I’m going to change all my assets into gold.’

- ‘Paper money is worthless. It’s not even worth the paper it’s printed on.’

I find these statements intriguing:

- These pessimists are so steadfast — so stubborn — that they have assigned a 100% probability to their conclusions being correct.

- But what they have failed to realise is that their opinions actually have a 0.13% probability — far less than they think.

Meanwhile, on the opposite side of the spectrum, here are two other quotes that I have heard, born out of extreme bullishness:

- ‘Auckland house prices will never come down. Never!’

- ‘Bitcoin will only go up. To the moon!’

- Uh-huh. These optimists are claiming 100% probability. But, in truth, their statements only have a 0.13% probability. It’s much, much less than they assume.

That’s the problem with extreme greed and extreme fear:

- They are so outsized — so disproportionate — that they tend to dwarf any attempt at reasonable thinking.

- And in the process, you misjudge risk. By an outrageously wide margin.

- So, what’s the truth here? Well, for me, personally, I want clarity. I want the big picture.

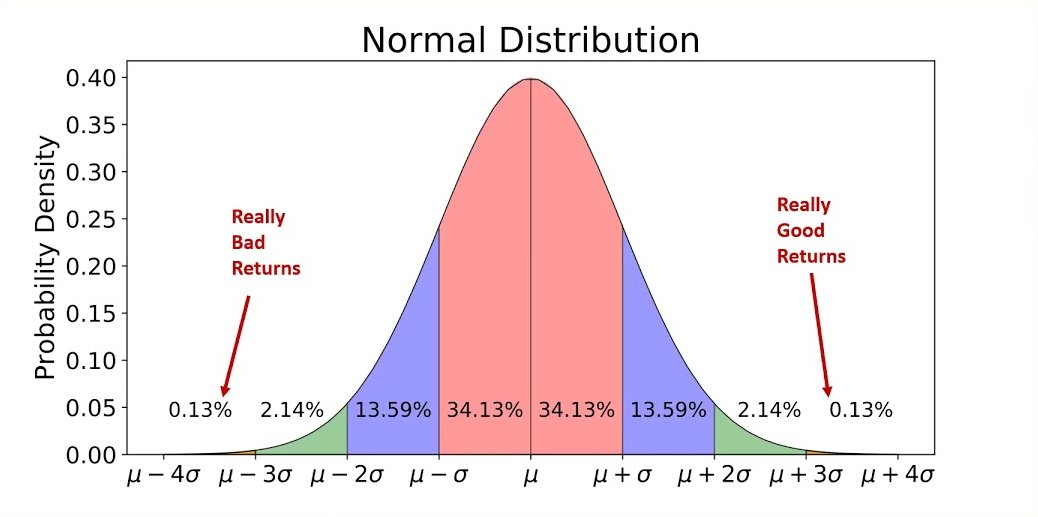

So I always turn to the Gaussian distribution — also known as the normal distribution. Here’s what it looks like:

Source: Investment Management Lab

The graph looks like a fat tail, doesn’t it? Well, there’s a very good reason for this:

- The bulging middle of the graph represents 95% probability. This where most investments usually lie.

- Now, on the extreme right of the graph, you have really good returns. And on the extreme left of the graph, you have really bad returns.

- Interesting enough, both outcomes are mirror images of each other — 0.13%. Both exist as outliers; way outside the norm. Indeed, they are statistically improbable.

So, my question to you is this: if you’re an investor, should you base your decision-making on statistically improbable events?

- Extreme greed? Extreme fear? Is this wise? Is this sustainable? Well, what if you’re wrong?

- Well, here’s the truth: taking too much risk can be damaging for your long-term wealth — but taking too little risk can be just as catastrophic.

You need to consider the big picture. Always. Here’s a statistic that will get you thinking:

- If you had invested $100,000 into gold on January 1985, it would be worth over $620,000 by January 2023.

- However, if you had invested $100,000 into the S&P 500 index on January 1985, it would be worth over $5.4 million by January 2023.

- So, if you had chosen gold instead of stocks, you would have missed out on over 775% in growth. What a huge difference.

- Yes, there’s such a thing as being too pessimistic for your own good!

Is this the moment for you to look beyond fear?

Now, here’s what I’ve noticed: the best value investors in the world are very good at measuring risk, then hedging against them accordingly:

- When they choose to make a commitment, they do it with both their head and their heart. They are rational — but they are also courageous.

- Their wise philosophy can be summed up like this: don’t be too greedy when times are good, and don’t be too fearful when times are bad.

- Not too hot. Not too cold. Just right. It’s the Goldilocks equation.

So, right now, here’s what you need to think about:

- Is it time for you to scale up?

- It is time for you to go global?

- Is it time for you to take a closer look at quality assets on the stock market?

These are big questions. Critical questions. And if they are important to you, you need to act now. Please accept my exclusive invitation:

- To date, we have investigated and exposed over 100 hidden ideas.

- From property to energy; from artificial intelligence to cryptocurrency; we are doing a deep dive into the latest quantum trends.

- If you are still hesitating, don’t forget the legendary words of Wayne Gretzky: ‘You miss 100% of the shots you don’t take.’

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

✅ EXCLUSIVE BONUS: You’ll also receive these additional eBook reports,

covering 13 NZX stocks, plus 2 global opportunities:

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.