What’s the best time to invest in the market?

What’s the worst time to invest in the market?

Or…does it really matter at all?

Well, these are the difficult questions that have bedevilled investors since forever.

If you’re reading this, chances are, you’ve already seen your fair share of YouTube videos, statistical graphs, and opinion pieces.

It’s so easy to get confused, isn’t it? There’s so much commentary out there. So many conflicting viewpoints.

So, what do you do?

Well, for the sake of cutting through all the noise, I actually find that simplicity is the best way forward.

Source: IDFC First Bank

In Ben Carlson’s book, A Wealth of Common Sense, he tells a parable. It’s a mythical story. About an American investor named Bob. Here’s how it plays out:

- Bob had a timid personality. For him, the glass was always half-empty. Never half-full. This meant that he was more of a follower than a leader. He never took the initiative on anything.

- Of course, Bob liked the idea of investing in the S&P 500 index. This made sense as a way to grow his wealth in the long-term. But here’s the thing: because of Bob’s personality, he was always filled with self-doubt. He always procrastinated.

- Because of this, Bob only ever dipped his toes in the market once it had already experienced a long and sustained bull run. In other words, Bob was a latecomer. He only started buying stocks once he was absolutely convinced that other investors had done well in it.

- As a result, Bob found himself investing at the peak of the market in 1972 — and tragically, the market would suffer a frightful crash of 48% soon after.

- Well, good grief. This experience left Bob emotionally shattered. He felt physically sick. He would swear off ever investing in the market ever again. This was like a casino! What a scam!

- But, of course, the market recovered eventually. It started climbing again. And pretty soon, it exploded into another bull run. But Bob watched it happen with a sceptical eye. He didn’t quite believe this was true. He found reasons to procrastinate. He remained sceptical until the market had boomed for years and years. Then, finally, Bob gave in. He found the courage to invest again.

- Uh-oh. You guessed it. Once more, Bob bought into the market at its highest point in 1987 — and once more, there was a horrific crash. This time, the decline was 34%. Déjà vu!

- Greatly traumatised, Bob promised himself that this would be the last time. He would avoid the market forever. This was a sure way to lose money!

- But, of course, it wasn’t the last time. The market cycle would turn once more. The bears would go into hibernation. The bulls would come stampeding back. And in 1999, Bob felt brave enough to venture into the market once more…

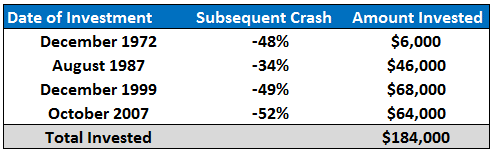

Well, yes. Lather, rinse, repeat. Here’s how Bob’s experience looked like over the years:

Source: A Wealth of Common Sense

- This is an absolute disaster, isn’t it? Totally catastrophic.

- Just by looking at this graph, you can get a sense of just how unlucky Bob has been. It’s uncanny, really. The man has a remarkable talent for blundering into danger!

- Each time, Bob invested at the market’s peak — and each time, the cycle turned shortly after. Punishing him with a devastating crash. Like clockwork.

- Poor Bob! You really feel for him. He’s a true underdog.

But watch out. Here’s the twist in the tale. Despite suffering heavy losses, Bob had another unusual talent. You see, whenever he put money into the market, he never took it out. He always stayed invested:

- This would prove to be his ultimate salvation.

- As a result — drum roll, please — Bob enjoyed a cumulative return of over 504%.

- From 1972 to 2013 — a 41-year period — he grew a humble sum of $184,000 into $1.1 million.

- So, by the time Bob retired, he was a millionaire. Even despite the missteps along the way.

Now, as I said previously, this story is a parable:

- Bob is a fictional character. Because, so far as we can tell, there has never been an investor as unlucky as Bob.

- You could say that Bob’s story is mythical in the same way that Robert Kiyosaki’s Rich Dad Poor Dad is mythical. Or it’s mythical in the same way that Aesop’s The Hare & the Tortoise is mythical.

- Bob’s story exists to demonstrate a larger moral point. It speaks to a deeper truth. Indeed, the dates and numbers in this story are all accurate and backtested.

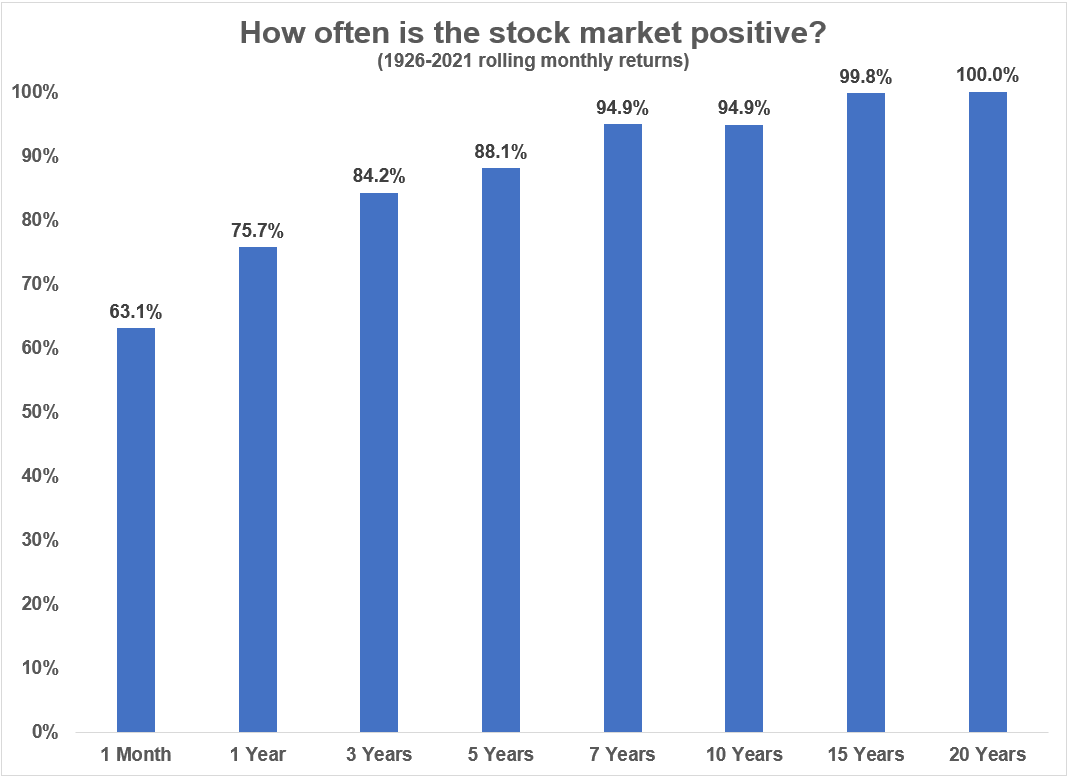

- This is where the genius of the market lies. It creates new products and services. It finds new customers. It solves existential problems. And as long as the market keeps doing that, the long-run potential will be positive.

Source: A Wealth of Common Sense

- Yes, in theory, Bob could have been richer if he had the courage to buy at the beginning of every cycle. And, yes, Bob might have done better if he had invested by dollar-cost-averaging during every downturn.

- Indeed, like a complex game of chess, there are any number of smarter financial moves Bob could have played. What if? What if? What if?

- But here’s what matters most. Even despite Bob’s fearful state of mind — despite his poor decision-making — he still benefited in the long-term. This is because he hitched his wagon to the stock market. And the magic of compounding was enough to do the rest.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them.

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback.

It encourages us. It helps us to do better. It helps us to reach further.

So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time:

❤️ Please click here to review us now on Trustpilot.

Thank you so much in advance for your kindness and generosity.

Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.