Let’s face it: everybody makes mistakes.

It’s only human.

Most of the time, your mistakes will be relatively small. Like forgetting to clear your outdoor clothesline when it starts to rain. Or forgetting to put your recycling bin on the kerb on collection day.

Whoops. These slip-ups are annoying, yes. But in the grand scheme of things, they are seldom damaging. Seldom memorable. Chances are, you won’t even remember these errors one month from now.

However, if you happen to be working on Wall Street, it’s possible to make mistakes on a bigger scale. More epic. More disastrous. With these kinds of mistakes, it’s not about whoops. It’s about ouch. A lot of ouch.

So, please spare a thought for the bearish investors who have burned through a shocking amount of money this year. As of June 2023, these short sellers have lost an astonishing $120 billion.

Now, is this a genuine tragedy? Or is this a self-inflicted disaster?

Here’s how the bears walked into a bear trap

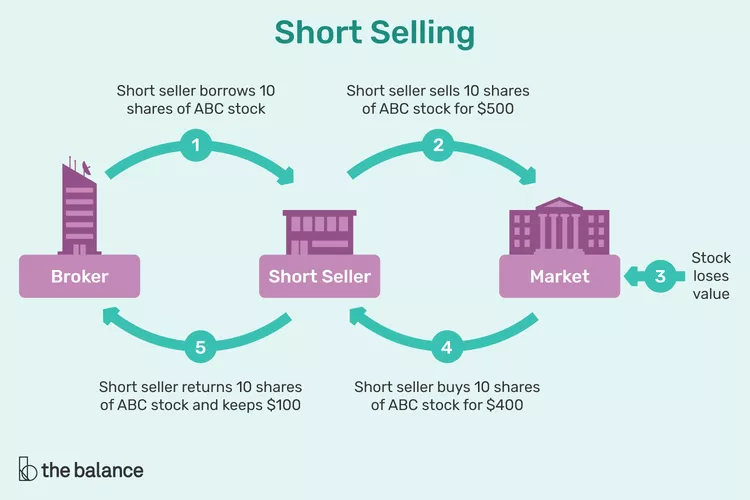

Source: The Balance

Short-selling is one of the black arts of stock trading. You can call it financial voodoo. It’s extremely esoteric, extremely speculative, but it attracts its fair share of devotees. Here’s how it works:

- If an investor is feeling bearish, he might try to profit from the negative sentiment in the market. To do this, he will select a stock that he believes will fall in value.

- To get the ball rolling, the investor will contact his broker to borrow the stock. The broker, in turn, will locate the stock — typically from other investors or brokerage firms — and lend it for a fee.

- So, once the investor has secured the borrowed stock, he immediately sells it on the open market. The proceeds from this sale are deposited into his account.

- Now, all the investor has to do is wait for the price of the stock to fall. When it does, he swoops in. He buys the stock back at a lower price. Then he returns the stock back to the broker. And…voila. He makes a profit on the difference.

- In theory, a 1% downside for the stock might translate to a 1% upside for the investor. And if he is daring enough to use leverage, he could score an even bigger payday on his short position.

But watch out. Here be dragons. There’s unseen danger lurking at all times:

- If the stock price climbs, this may force the investor into short squeeze. This is especially true if he has a contractual obligation to return the borrowed stock on a specific date.

- In desperation, the investor may have to cover his short position by buying back the stock at the worst-possible time. He may even find himself having to do this repeatedly. It’s a death spiral.

- Tragically, the increased demand for the stock may drive the price up even further. This creates a self-fulfilling prophecy, resulting in agonising losses within a very short period of time. The compounding effect is devastating.

- If the investor is relying on leverage, he might also find himself exposed to another horrifying outcome: a margin call. This happens when the broker is asking the investor to deposit additional funds to maintain his required margin. If the investor fails to do so, the broker can forcibly close out the short position at a shattering loss.

So, short squeezes are very painful. In theory, investors can potentially suffer unlimited damage. This is exactly what has happened in 2023:

- The bears keep betting that the American economy will crash and burn — which, in their imagination, could lead to a complete wipeout of the stock market. This kind of scenario is attractive to them. It gets the short sellers salivating because they stand to profit hugely *if* it happens.

- For this reason, the bears have been making all sorts of wild predictions — stretching incredibility — perhaps in hope of encouraging the crash that they so badly crave.

- One prominent bear is Michael Kantrowitz from investment bank Piper Sandler. In February 2023, he predicted that the S&P 500 would nosedive into catastrophe. He set a price target of $3,225, which suggested a downside of over 20% from the $4,179 peak at that time.

- Meanwhile, another Michael — Michael Burry of The Big Short fame — was also feeling bearish. He said that he was seeing the ‘greatest speculative bubble of all time’ and ‘the mother of all crashes’. In February 2023, he issued this ominous warning:

Source: Benzinga

Unfortunately, for both Michaels, the reverse has happened:

- At the time of writing, the S&P 500 currently stands at $4,567 — a whopping 41% higher than Kantrowitz’s prediction. However, Kantrowitz remains unrepentant. He insists that a disaster is still on the cards. Possibly.

- Meanwhile, Burry is apologetic. He admits that he read the signs wrong. To his credit, he was brave enough to issue a public retraction:

Source: MarketWatch

Indeed, the American economy continues to thumb its nose at the doomsayers, moving forward with strength and confidence:

- In June, private-sector jobs in America climbed by 497,000. This is breathtaking because the consensus estimate only called for 220,000 jobs to be created.

- This has been a consistent theme over the past 14 months. The bears keep saying that rising interest rates will cause the economy to stagger, fall over, and implode.

- But the opposite is true. The nation has never been more resilient.

Neil Irwin of Axios explains the bigger picture:

‘Look, we’ve been talking about these recession fears, these risks that are looming out there for really a year and a half now, this really started in the beginning of 2022 and we’re now almost halfway through 2023. And it just hasn’t happened. This economy has been a freight train. It’s just been chugging along at a steady pace.’

Source: Dribbble

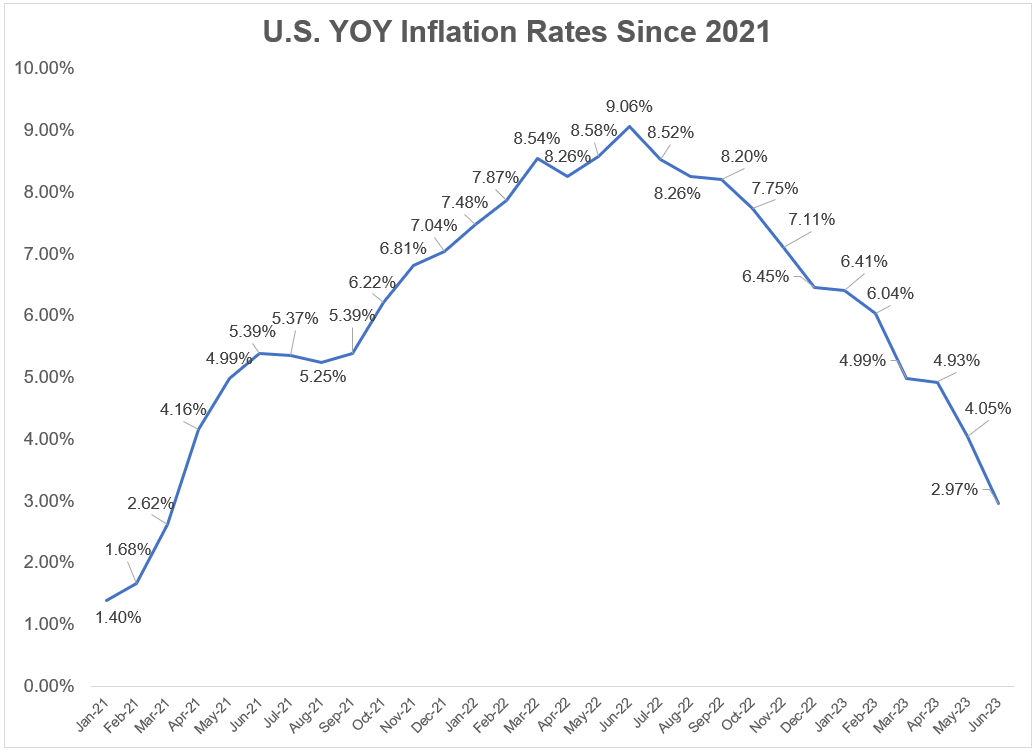

Does this mean that a soft landing is possible for the American economy? Well, consider this:

- Annual inflation, as measured by the consumer price index, peaked in June 2022 at 9.1%.

- Now, fast-forward to the present. The latest figures for June 2023 show that annual inflation has slowed to 3%.

- The Federal Reserve does look like it’s making significant progress in the fight against inflation — and it’s being helped by a Goldilocks scenario where the economy is staying remarkably robust.

Source: A Wealth of Common Sense

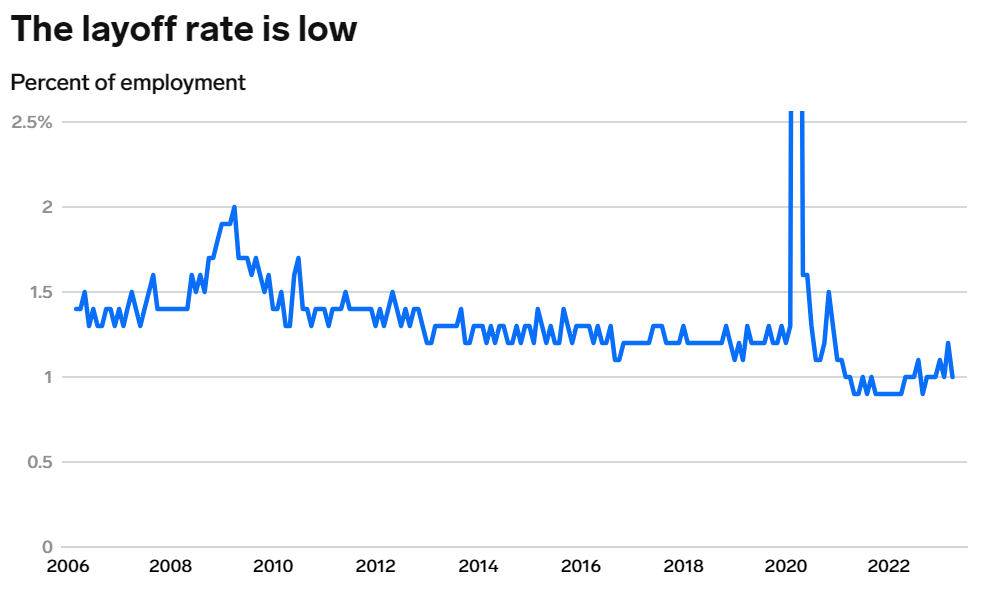

Source: Insider

Source: US Department of Labor

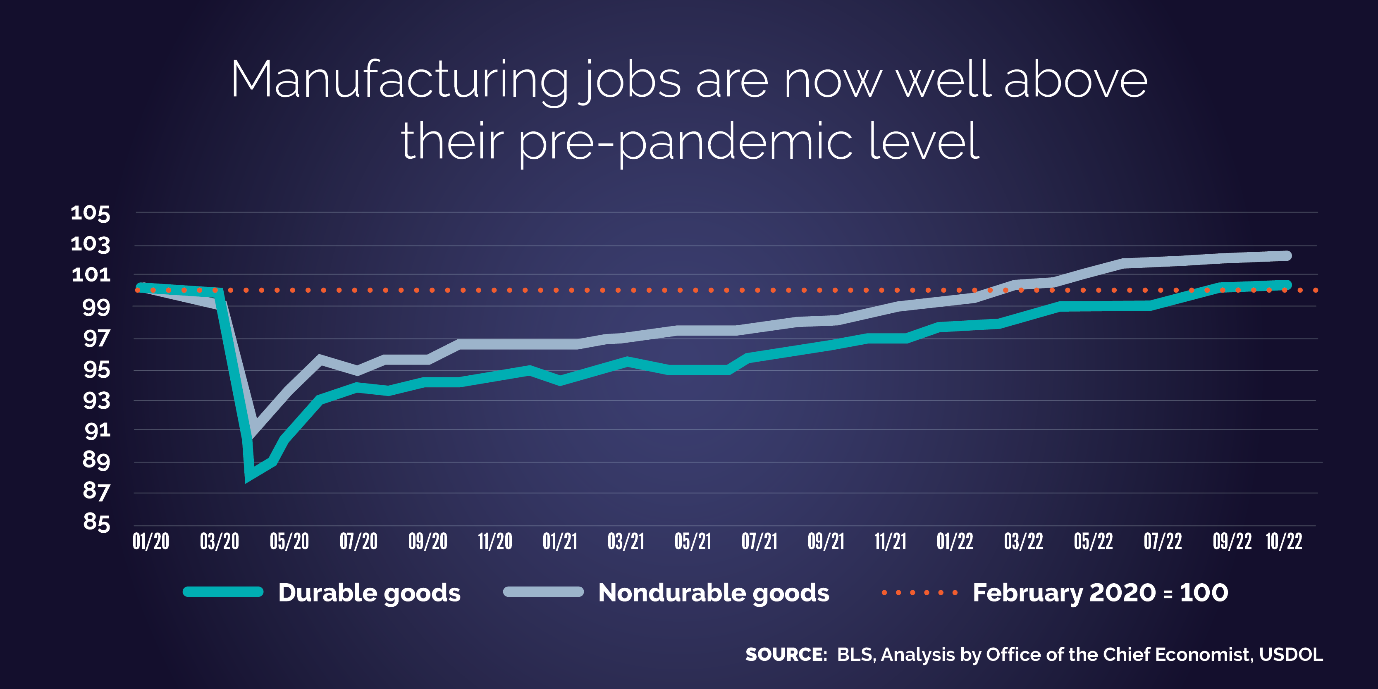

Here are three critical facts that you need to pay attention to:

- Firstly, the unemployment rate is actually lower than the pre-pandemic average. The labour market is stronger than it has been in years.

- Secondly, foreign direct investment in American manufacturing is experiencing a boom. The figure is now than double the pre-pandemic level.

- Thirdly, spending on goods and services are getting back to normal. Volatility is returning to the pre-pandemic level.

- So, overall, America is clearly open for business — and business is ticking along just fine. The naysayers are wrong. Covid did not kill America, and rate hikes certainly won’t.

- In the words of Warren Buffett: ‘Never bet against America.’

Source: MarketWatch

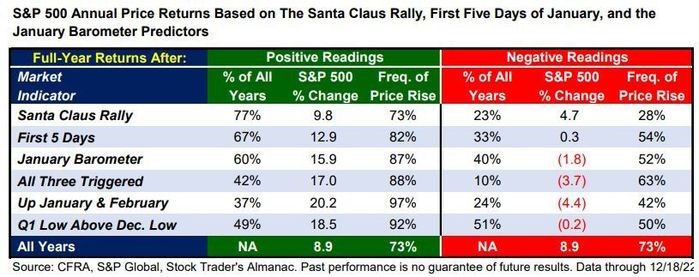

As an investor, what you need to understand is that the stock market tends to price in future optimism. And we saw this being represented in the January Indicator Trifecta. These are 3 powerful buttons being activated at the same time. Here’s why you should care:

- The Santa Claus Rally, the First Five Days Early Warning System, and the January Barometer were all triggered earlier this year. They showed green.

- The sequence goes like this — we experienced a stock market rally for the final five trading days of 2022, as well as the first two trading days of 2023. We also experienced a gain over the first five trading days of 2023. And, finally, we had a rally for the entire month of January 2023.

- These seasonal indicators suggested an 88% chance that the market’s direction would be positive for the rest of the year.

Source: Bloomberg

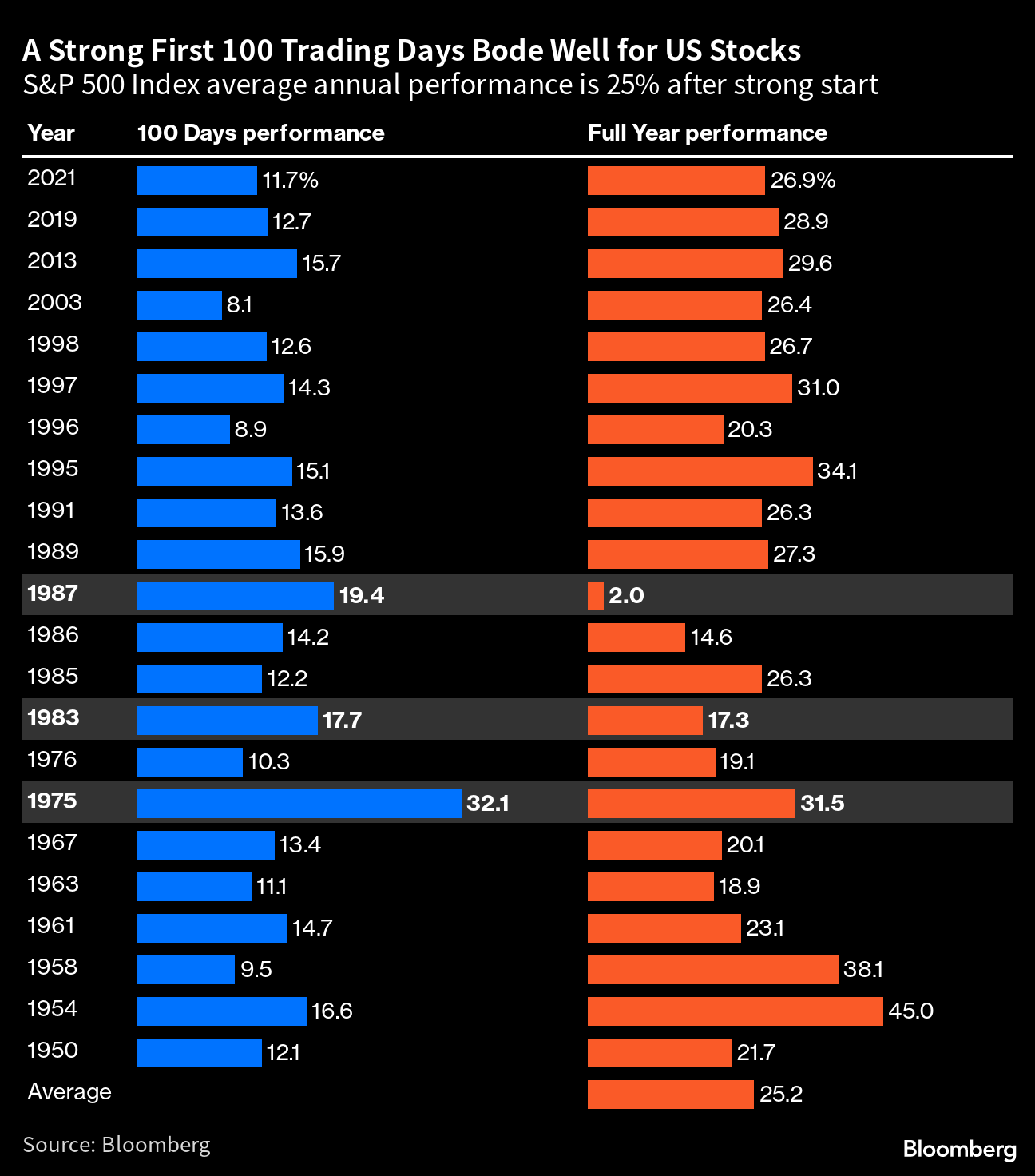

Not enough? Well, later in 2023, we saw even more credible evidence emerge:

- The stock market rallied during the first 100 days. It looked strong.

- Based on historical data going all the way back to 1950, this suggests an 86% chance that the market will be positive for the rest of the year.

Shockingly enough, the bears have chosen to ignore all these trends — and they have lost $120 billion. Their short positions have become unsustainable. They are being punished for their folly. According to Reuters:

Global hedge funds rushed to unwind bets that U.S.-listed stocks will fall, as a persistent rally threatens their performance, JPMorgan Chase and Goldman Sachs told clients in reports.

“For hedge funds, shorts have been a challenge since early June especially,” JPMorgan said, adding the unwinding of short positions got ‘extreme’ in recent days.

A U.S. bull market has caught portfolio managers off guard, as they positioned earlier in the year for an economic downturn amid interest rates hikes, sticky inflation and geopolitical tension. Such short covering could, in turn, give fuel to the equity rally, further complicating the picture for remaining short-sellers.

Well, forget about whoops. This is about ouch. If you need a reality check, just look at this headline here:

Source: Quartz

Indeed, what is interesting is that almost no one anticipated how this year would play out:

- In fact, only three prominent analysts made a correct prediction for a bull market in 2023 — Tom Lee, Ryan Detrick, and Ed Yardeni. They acted as lone voices in the wilderness.

- So, what convinced them to break away from the pessimistic crowd? Well, quite simply, they kept their eyes open. They observed that inflationary pressures would be easing and a deep recession would be avoided.

- Of course, their analysis was contrarian. But they were right on the money. The fear was oversold — which represented a golden opportunity for savvy investors who were able to look beyond the noise.

You need to act courageously now

So, are you still listening to the bears?

Are you still following their prophecies of doom?

Well, it might be time to reconsider.

Despite the recent bullish upswing, we are still seeing opportunities to buy into high-value assets at a sharp discount. It’s not too late to start investing for the next stage of the cycle.

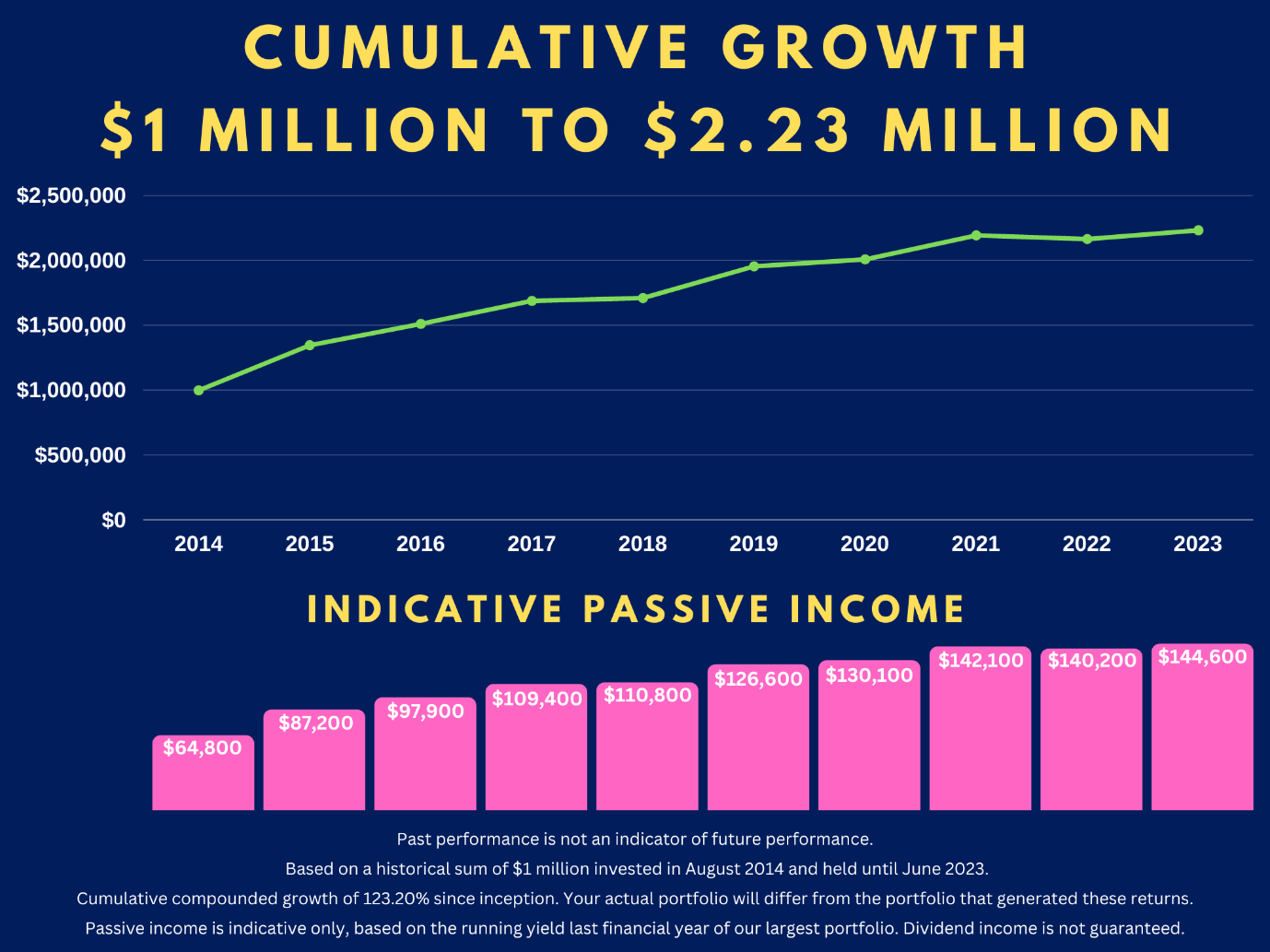

Right now, our Wealth Morning Managed Accounts are designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

Ask yourself: is this something you urgently need to act on?

Come talk to us.

We are opening for limited consultations on our Managed Accounts Service. (Available until Monday, 31 July).

🎯 Apply for your consultation now.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.