Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

Trump was talking about flying cars when he promoted his third presidential bid earlier this year.

‘I want to ensure that America, not China, leads this revolution in air mobility,’ he said.

Source: Weird AI Generations. Twitter @weirddalle.

Will America resurrect Trump as he continues to get dug under in controversy?

I’m not sure. But his genius in spotting the opportunities of our age should not be underestimated.

This month, the bull market has proven arthritic as sticky inflation gets in the way.

That was the lead story of The Economist last month, putting paid to the idea that inflation will roll over with hiked interest rates to yield an easy run.

Source: The Economist

The secondary line — ‘Is China’s economy turning Japanese?’ — also weighed in our part of the world.

Yes, it is right now. I heard from someone in China that the economic mood is pretty sour and some factory stocks of iron ore and key raw materials are down to a few days’ worth.

Apparently, authorities are seeking to ban some negative financial writers. Good luck with that one.

A weak yuan hits the Australasian currencies. And boosts our denominated value in globally held stocks. One more reason to keep diversifying offshore.

But the real protection against the slow-up in real estate preservation picks and industrial defensives came from our kicker.

Yes, in most of our portfolios, we allocate 5% to 20% for more speculative companies. Within that, allocations of one position range from 2% to 4%.

One of those emerging picks is a maker of flying cars, preparing to fully commercialise in the next couple of years.

We started buying this when we saw opportunity in 2022.

What did we see?

Higher risk, yes. But over $1 billion in capital. A founder who reminds us of Steve Jobs. A clear path through regulatory approvals to commercialisation. And key investments from complementary corporates.

How has this done for our clients?

It’s up 200% since January.

Fair enough, this is somewhat outside our usual benchmark of the MSCI EAFE (which did 1.23% for June 2023). But remaining innovative in this game means pushing the envelope when the risk calculation stacks up.

And it’s helped climb us over stick inflation to do more than double our benchmark:

Managed Account performance*

For the month of June 2023, we were up 2.36% across the composite portfolio (total aggregate return across all portfolios following the strategy).

Another month where we jump our MSCI EAFE benchmark (1.23%).

This brings our return for the half year to date (1 January to 30 June, 2023) to 9.10%.

Our average annualised return since inception is 15.24% p.a.

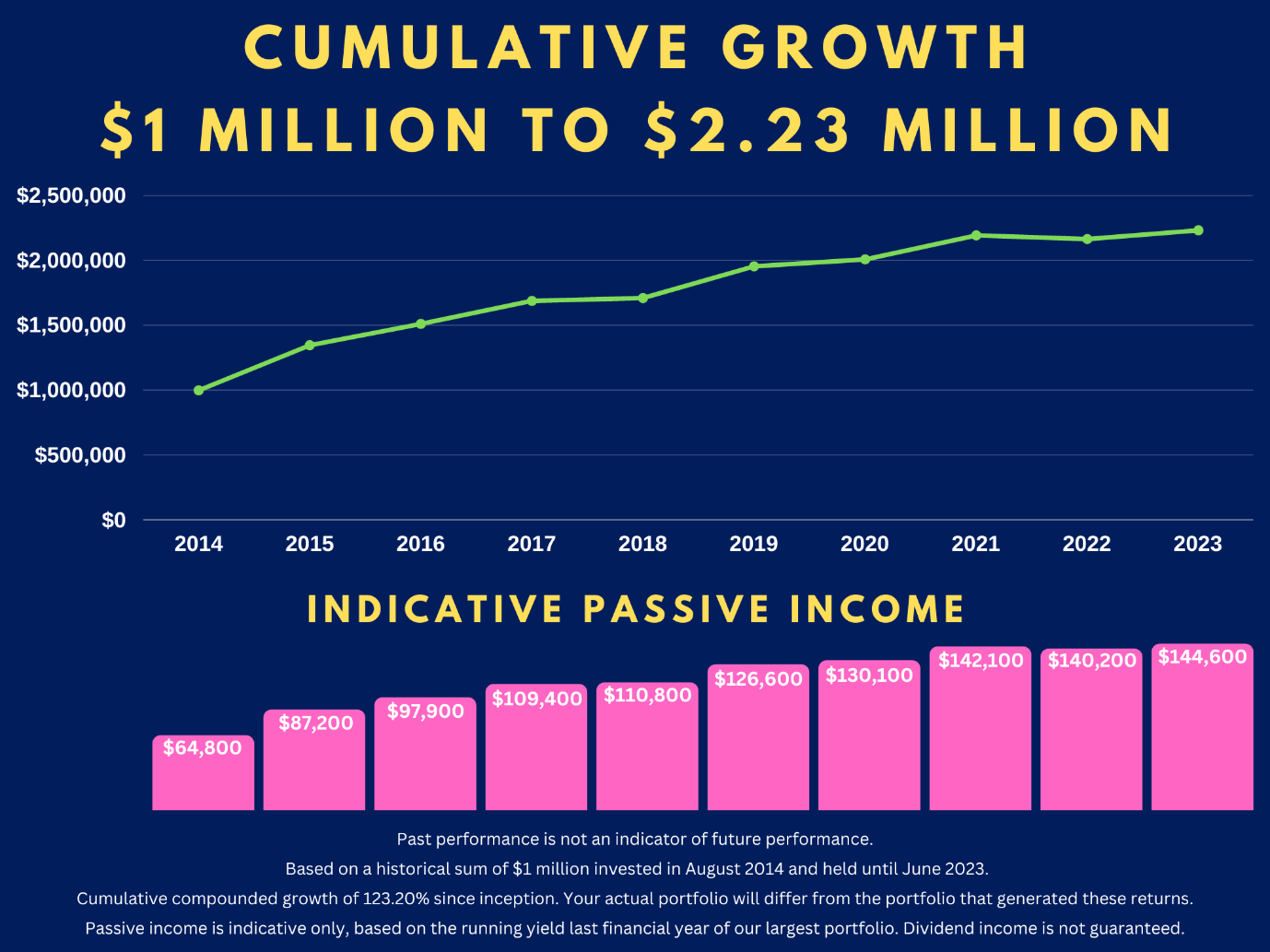

Please see our performance chart for more details.

Our Quantum Income Strategy

If you’re still sitting on the sidelines with cash or intention to invest, I’m going to drop the welcome mat in front of you now.

It’s a good time. We see clear opportunity. Sure, investing is about patience and intense research. It’s also about seeing the next emerging trend. Then things can lift.

With some great passive income while we wait to get airborne.

Here’s what can be possible (from one of our larger portfolios):

Wealth Morning readers are welcome.

✈️ Request your free consultation today.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.