So, here’s a question: what are the two things that you won’t find in a casino?

Well, here’s the answer: no clocks and no windows.

There’s a very good reason for this.

The interior design of a casino is designed to make you lose track of time. The atmosphere sucks you in. It encourages you to keep on gambling.

‘Five more minutes,’ you say. ‘Just five more minutes.’

Click-clack. Click-clack. Click-clack.

And…before you know it…five minutes becomes five hours.

Good grief. What did all the time go?

Source: Travel Triangle

This is called ‘temporal distortion’. It happens because your perception of time is elastic. It can be stretched, depending on your emotions.

Ultimately, it can only mean one thing: the house will always win in the end. This is a statistical certainty.

In fact, it doesn’t really matter what game you choose to play. Slot machines. Pachinko. Roulette. Blackjack. Poker.

They are all designed to hook you and reel you in. And the longer you play, the greater the odds of the casino gaining the upper hand.

If you have a compulsive addiction, you’ll quickly find yourself on the road to financial ruin.

In 2013, The Wall Street Journal examined the habits of punters over a two-year period. What they uncovered was staggering. Heavy gamblers lost money 95% of the time. And even casual gamblers lost money 87% of the time. Crikey!

So, at this point, it’s fair to ask: does the stock market operate like a casino? Are the odds stacked against you? Are you’re destined to lose in the end?

These are big questions.

Million-dollar questions.

Well, let’s take a look at what the historical data tells us.

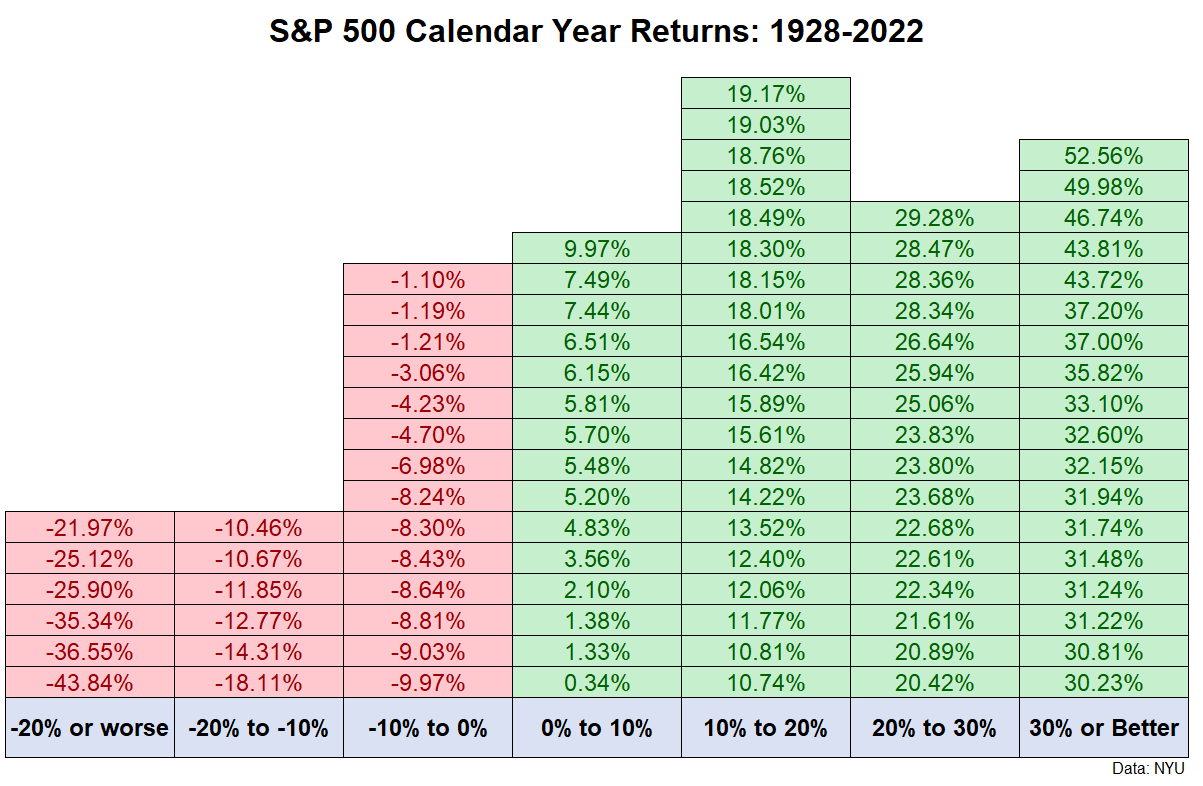

Source: A Wealth of Common Sense

This chart covers the performance of the S&P 500 index over a 95-year period. You can see some fascinating information here:

- There have been 69 years where the market was positive.

- There have been 26 years where the market was negative.

- So, overall, there have been more green years than red years.

- This represents a long-term winning streak of around 73%.

Of course, on the far end of the scale, you will see some sharp corrections. We’re talking about market declines of 20% or more:

- These are black-swan events. They receive a lot of attention. They create dramatic headlines. But the reality is that such crashes are very rare. They represent only six years out of 95. That’s roughly 6% of the time frame measured.

- In the grand scheme of things, such crashes are statistically small — but of course, they feel magnified because the media has a habit of sensationalising them.

Source: A Wealth of Common Sense

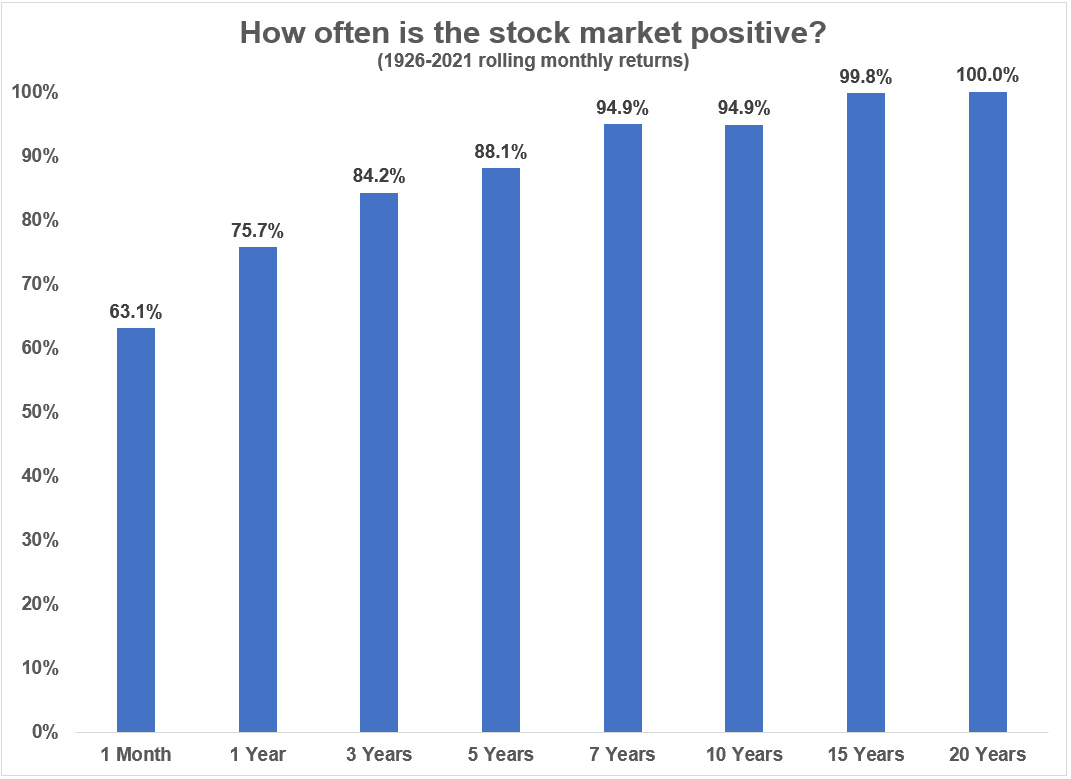

So, given the fact that the stock market tends to drift upward over the long run, is there an optimal time to stay invested? Well, you can look at this breakdown of market performance, measuring the period from 1926 to 2021:

- You will start to see an interesting pattern here. The longer you stay invested in the market, the better your chances of success are.

- Once you hit the 10-year mark and beyond, the odds get hugely better.

- This appears to suggest that time spent in the market is better than trying to time the market.

Source: Money Sense

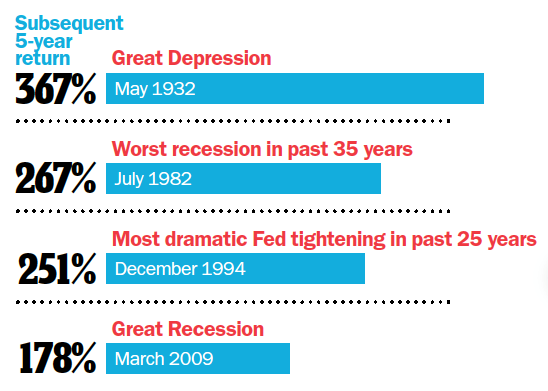

Interestingly enough, even when economic disasters do happen, they don’t tend to derail the market’s progress. You can look at the aftermath of some of history’s worst corrections. The subsequent 5-year return has been very strong:

- The biggest growth spurts appear to happen after the biggest crisis events.

- Historically, this seems to suggest that long-term investors who are courageous enough to buy into the fear eventually benefit from the market’s resilience.

However, as happy as the track record is for long-term investors, the outlook for short-term speculators looks surprisingly sour. This is particularly true of people who engage in high-frequency trading:

- In 2020, an economic study in Brazil uncovered some stunning statistics. Over a two-year period, 97% of day traders lost money. Only 1.1% earned more than the Brazilian minimum wage. Only 0.5% earned more than the salary of a bank teller.

- Here’s what’s shocking. These folks are losing money even despite the fact the market has seen more upside than downside. More sunny days than rainy days. More bulls than bears.

- It’s clear that high-frequency trading — where speculators hold positions for as little as a few hours — is a close cousin of casino gambling. The risk of getting burned is simply too high to consider.

- So, do long-term value investors enjoy a decisive advantage over short-term speculators? Well, if history is any indication, the answer is yes. Absolutely.

- Ultimately, there’s a clear-cut difference between investing and gambling. One builds wealth through buying and holding. One destroys wealth through frivolous Russian roulette.

Source: The Economist

It’s time to dig deeper

Warren Buffett, everyone’s favourite value investor, says this: ‘The stock market is a device to transfer money from the impatient to the patient.’

Buffett’s business partner, Charlie Munger, also chimes in: ‘Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.’

So, right now, here’s what you need to think about:

- Are you trying to build up your skills as a long-term value investor?

- Are you trying to identify the value available on the market today?

- Are you trying to understand how the global environment is changing?

These are big questions. Critical questions. And if they are important to you, you need to act now. Please accept my exclusive invitation. Come join our Quantum Wealth Report.

To date, we have investigated and exposed over 90 hidden ideas. From property to energy; from artificial intelligence to cryptocurrency; we are doing a deep dive into the latest quantum trends.

These are cutting-edge insights that could change your destiny — if you have the courage and conviction to follow through.

Ask yourself: are you concerned about your family’s well-being and happiness?

Well, if you are, this is the best time to act. And this is the best place to start…

💡 [ LIMITED TIME OFFER, EXPIRES SOON ] Get your first 3 weeks for only US$1 / NZ$1.50

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.