Who is the greatest action star of the past 50 years?

Well, it’s a pretty short list.

Not many actors would qualify. Not many actors would tick all the boxes.

But among them, one name seems to stand out: Sylvester Stallone.

Source: NME

Of course, some people think of Stallone as a beefcake. Monosyllabic. Wooden. But that couldn’t be further from the truth. He actually has more depth than he’s usually given credit for:

- His trademark droopy eyes and slurred speech are actually the result of a traumatic birth.

- During a difficult delivery, the doctors used forceps on him in a way that was too forceful. They accidentally severed a nerve. This gave Stallone a facial paralysis that would afflict him for the rest of his life.

- He became the target of bullies at school. As a lonely outsider, he found solace in bodybuilding and acting.

Stallone’s own experience as an underdog led him to write a film script about a working-class boxer from Philadelphia. Someone who overcomes great odds to become heavyweight champion of the world. The embodiment of the American dream.

This was how a cinematic legend was born:

- Upon its release, Rocky was a hit with audiences and critics alike. It became the highest-grossing film in 1976, earning over $225 million. Adjusted for inflation, that’s nearly $1.2 billion in today’s money.

- It won Best Picture at the Academy Awards, spawning a series of sequels that would expand upon the mythos of Rocky Balboa.

So, what is it about the character that remains so enduring? Why does he capture the popular imagination? Why do people still root for him after all these years?

- Well, perhaps the answer can be found in the sixth film in the franchise, released in 2006. It’s called, quite simply, Rocky Balboa.

- The plot goes like this. Rocky is now 60 years old. He’s retired. He lives the quiet life, running an Italian restaurant. But Rocky finds himself getting restless. He’s tempted to venture into boxing ring once more. To test himself against a younger opponent. Is this about pride? Or is this about grit?

- Rocky’s 29-year-old son, Robert, opposes this decision. He doesn’t understand why his dad has to step back into the limelight once more. What does Rocky have to prove? Besides, Robert has long lived in the shadow of his dad’s fame. He resents it. He just wants his father to keep a low profile.

Source: World Boxing News

But Rocky is not so easily deterred. He leans on his blue-collar sensibilities, giving a pep talk to his son. The dialogue is stirring:

‘Let me tell you something you already know. The world ain’t all sunshine and rainbows. It’s a very mean and nasty place, and I don’t care how tough you are. It will beat you to your knees and keep you there permanently if you let it.

‘You, me, or nobody is gonna hit as hard as life. But it ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward. How much you can take and keep moving forward. That’s how winning is done.’

Withstanding the pain trade

Now, obviously, Rocky was using boxing as a metaphor to talk about resilience in life. But he could have just as easily been talking about resilience in investing.

One of the most intriguing ideas I’ve come across is the idea of the ‘pain trade’. Investopedia explains it like this:

Pain trade is the tendency of markets to deliver the maximum amount of punishment to as many investors as possible from time to time.

A pain trade occurs when a popular asset class or widely followed investing strategy takes an unexpected turn that catches most investors flat-footed.

Uh-huh. The market is spooky that way. It can deliver shock and awe to investors who are too complacent.

But what does this actually look like, in real life? Well, here are two examples:

- In 2020 and 2021, property investors in New Zealand were rushing to take up large mortgages. They were attracted by ultra-low interest rates, as well as soaring house prices. They were driven by greed. But the market punished them for their hubris. A sharp reversal happened in 2022. These investors received a double-whammy of pain: rising interest rates and slumping property values.

- Meanwhile, throughout 2022, short-sellers around the world made bets that stocks would crash and stay down. They were driven by FEAR — False Emotions Appearing Real. They chose to focus on the negative news, while completely ignoring the positive news. But the market punished them for their negligence. A sharp rebound happened in 2023. These investors received a painful wallop when the market defied their expectations and started climbing.

- Arguably, the biggest loser here would have to be Carl Icahn. He’s an American financier who has burned through an eye-watering $9 billion in short positions. He has raked up a significant margin debt since 2017.

- Carl Icahn admits: ‘I’ve always told people there is nobody who can really pick the market on a short-term or an intermediate-term basis. Maybe I made the mistake of not adhering to my own advice in recent years.’

Good grief. So, what happened here? Why did things go so wrong for these investors?

- Well, they tried to game the market — but the market refuses to be gamed. You have to remember that the market is a force of nature. It’s a highly evolved animal that’s been around for 400 years old. It has a primal will of its own, and it does not suffer fools gladly.

- If you are too positive to the point of being unrealistic, the market will punish you. Likewise, if you’re too negative to the point of being unrealistic, the market will punish you as well.

- Extreme greed. Extreme fear. Indulging in such wild emotional swings will actually do you no favours in the end.

- So, this begs the question. What is the better approach? Well, no surprise here. It comes down to the old-school classic: a resilient, steady approach. A Goldilocks personality. Not too hot. Not too cold. Just right.

- Embracing this might allow you to withstand the pain trade. It might also allow you to dodge all the noisy headlines and market tremors that come with it.

The power of dividend investing

During the last bull run, there was a lot of boastful talk. Chances are, you may have heard some of it:

- ‘Look at this Kiwi property that rose 40% in just two years!’

- ‘Look at this lithium stock that soared 40% in just two months!’

- ‘Look at this crypto token that skyrocketed 40% in just two weeks!’

All this sounds sensational, yeah. But historically speaking, such outliers don’t represent the big picture. Over the long-term, most of the wealth out there isn’t built by home runs. It’s actually achieved through base hits.

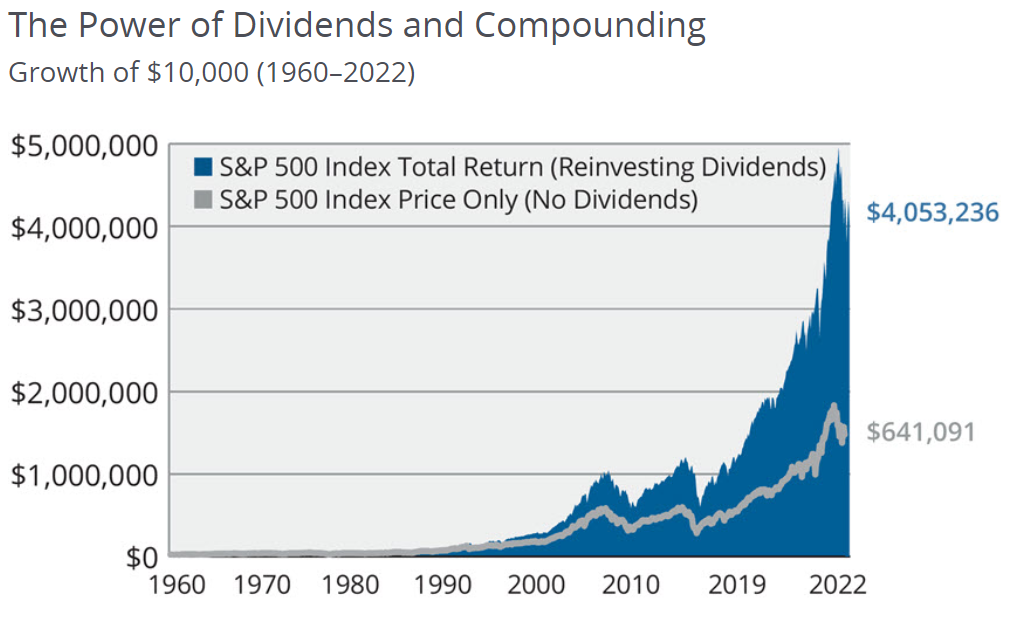

Don’t believe me? Well, here’s some historical backtesting for your consideration:

- From 1960 to 2022, 69% of the returns of the S&P 500 index can be attributed to reinvested dividends and the power of compounding.

- How significant is this? Well, very.

Source: Hartford Funds

- If an investor relied on capital growth alone, a sum of $10,000 invested in 1960 might have only yielded around $640,000 by 2022. But if that investor was smart enough to include dividends, that same $10,000 might have yielded around $4 million. This is an astonishing difference, isn’t it?

- So, the conclusion is clear: for the average investor, aiming to get base hits is a much better strategy than hoping to get a home run.

- Don’t get me wrong. Prospering during the sunny days is wonderful. But prospering during the rainy days is even better — especially when you have dividends to see you through the dreary weather.

A critical boxing lesson

Source: Letterboxd

The Rocky films are great entertainment. But they are also deep musings on life. You will notice one recurring theme in these movies:

- Rocky Balboa is seldom the most skilful boxer in the ring. He doesn’t have the most fanciful moves. But what he does have, more than anything else, is pure grit.

- Rocky can endure pain better than his opponents — and he wins through sheer physical conditioning and mental resilience.

What is true in boxing is also true in investing:

- It’s not about how hard you can hit. It’s about how hard you can get hit and keep moving forward.

- Dividend income may be humble, but it’s surprisingly powerful. The steady progress that an investor achieves may lead to formidable results in the long-term through compounding.

- More importantly, dividend income may allow investors to withstand the pain trade. Regardless of the economic cycle, they can adapt and overcome.

- So, ask yourself: are you positioning yourself with a good income-generating portfolio for the long run? Are you robust enough? Are you resilient enough?

It’s time to have your say

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.