Quantum Wealth Summary

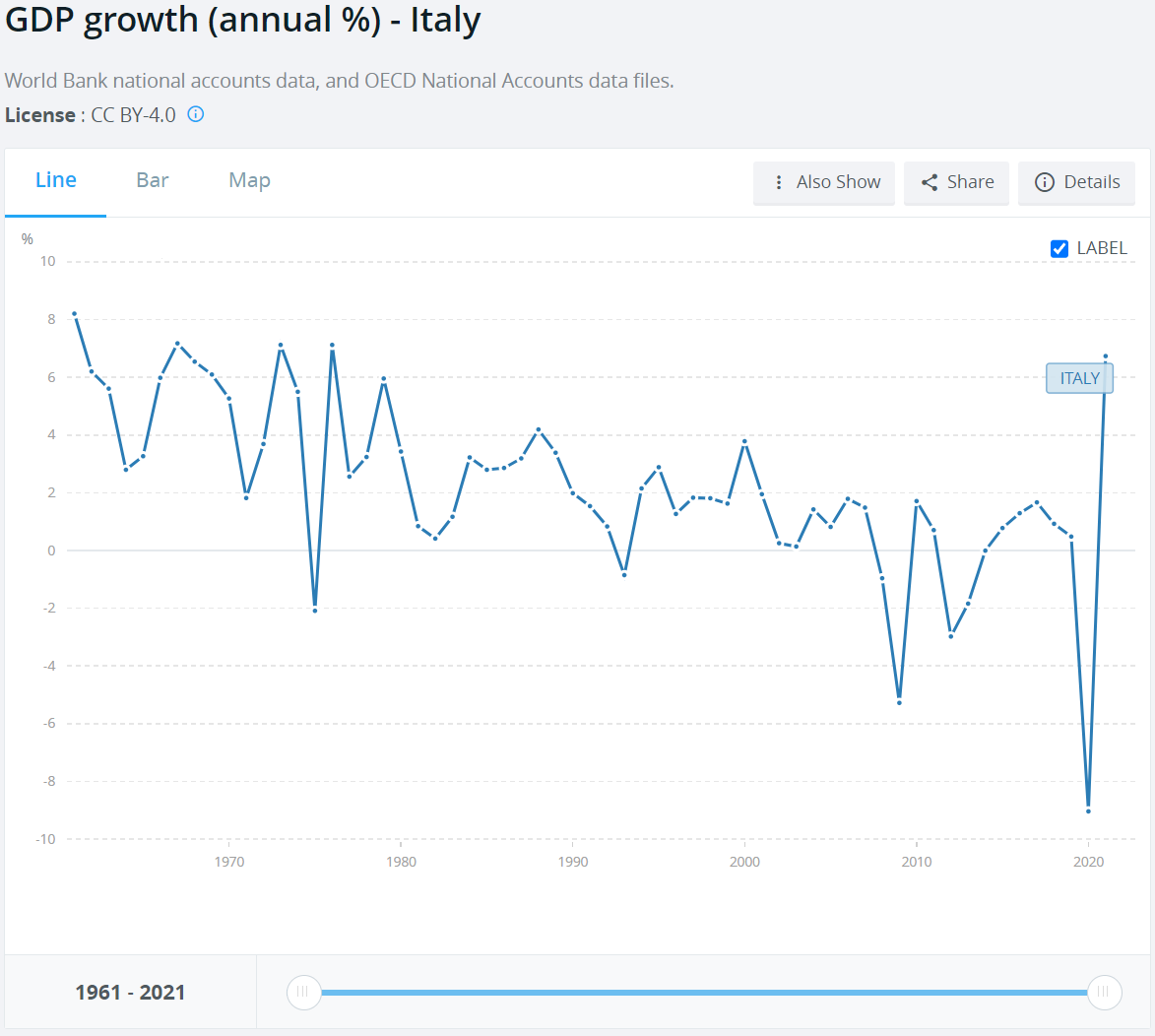

- Italy enjoyed an economic miracle from its postwar rebuild through to the 1970s. It later stagnated with an ageing population and low productivity. But could that be about to change?

- We now report on one Italian company with a low valuation and global footprint that could be ready to break out with new technology.

- Regular dividends are the key to passive income, and in this case, we look at the sustainability of a yield of over 6.5% p.a.

When I was a kid, I had a friend whose dad was a rich lawyer.

He bought a new car every couple of years. One occasion, on the country roads of Taranaki, he overtook us at breakneck speed.

I envied his cars. In particular, an Alfa Romeo Sprint. A nimble, sporty little number.

Alfa Romeo Alfasud Sprint, 1980. Source: YouTube

From the Fiat 500 to mass-market Alfas around the word, these cars were a symbol of the start of the Italian miracle. And perhaps, in the case of the Alfasud Sprint, the end.

Alfasud — Sud meaning south — saw production move to the much poorer southern part of the country following government incentives.

Legend has it that these cars, a masterpiece of design, were let down by inferior steel from Eastern Europe that rusted out. And poor labour relations leading to shoddy workmanship.

Between 1951 to 1973, Italian GDP growth averaged over 5% per year. Yet, by the 1980s, decline had set in.

Today, the country has barely grown since joining the EU in 1999. This union does not appear to have helped the competitiveness of the many family firms that make up the economy.

Source: The World Bank

Yet today, under the dynamic and conservative new government coalition led by Giorgia Meloni, could the nation be about to turn a corner?

I’m a great believer that Creative Destruction inevitably leads to new growth.

I’m also a believer that it’s far easier to make money in the stock market when you buy a beaten-down company in a put-upon economy that is about to turn a corner…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.