‘I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.’

—Winston Churchill

A friend of ours isn’t usually that political.

She and her husband work hard to look after their family. They enjoy the beautiful outdoors of New Zealand.

But with talk of a possible wealth tax — and rumours that one may actually be under consideration — she was seething.

Her parents, now well into retirement, worked hard all their lives. They had a small business working seven days a week. They paid their fair share of tax.

One now needs full-time care.

They don’t qualify for government help, so are paying upwards of $1,500 per week.

This will likely exhaust their remaining savings and investments. But a wealth tax on these would mean they may also have to sell their home to meet the payments.

Everything they have worked so hard for is now at risk.

How is that fair?

Our friend is now impassioned to vote. Any way she can to ensure Labour and the Greens do not continue to govern beyond October.

Fighting talk? Well, I’ve since spoken to others. And have never seen normally relaxed people so angry.

There is disbelief. Then fury. Then the question of ‘what would you do?’

But before we get carried away…

What exactly has been proposed?

I’ve not seen any concrete proposal by the government. Only rumours via the Q&A show that something could be going before Cabinet.

On 26 April, Revenue Minister David Parker revealed the findings from a tax survey of ‘311 of our wealthiest citizens’.

It revealed, on average, they paid only 8.9% tax on their economic income.

This can be misleading when news outlets grab that out of context and make it a headline.

You see, economic income is income from all sources, including capital gains on investments.

Most of these gains won’t yet have been realised as income.

The actual tax on the realised income component is likely to be more around 30%.

What’s more certain is the Green Party do have a specific wealth tax policy:

‘Introduce a new tax of 1% on an individual’s net wealth above $1 million and 2% on an individual’s net wealth over $2 million. This would affect the top 6% of wealthiest New Zealanders.’

I suspect it would affect far more than 6%.

Work hard, grow your business, employ people, increase wealth — and boom! You’re now liable for wealth tax.

It could drive many to have to sell their assets, including family baches, farms, shares, and businesses.

Of course, there are deferral options in the policy document. But this could turn financial planning into a nightmare.

Some would see New Zealand has no place to aspire toward much wealth anyway.

Some would leave. Likely to Australia, where there is now a clear four-year path to citizenship for Kiwis. Others who hold British or European passports may head there.

Certain levels of wealth — as little as €500,000 — would qualify many for residency visas in other jurisdictions.

A seasoned investor friend said he would consider returning to the UK. And he made a very perceptive comment:

‘It just goes to show with your investing: you need to be nimble, diversified, and have assets in other jurisdictions.’

But more about that later.

What is the likelihood a wealth tax could come here?

The current universal superannuation system does risk becoming unaffordable as the population ages.

Recent poor performance on the trade deficit front continues to show that New Zealand struggles to pay its way in the world. The country has been importing more than it exports. And is not receiving enough capital investment to make up the shortfall.

For a small country at the bottom of the world with significant natural resources, capital investment to harness those resources is vital.

A capital gains tax was rejected despite the last Tax Working Group’s recommendation. It was not popular with the electorate.

There were also concerns it would discourage vital capital investment.

But a wealth tax is somewhat different. If, as the Greens allege, only 6% of voters are affected, this could be a different conversation.

According to them, a wealth tax could raise $7.9 billion in its first year.

Given taxes on individuals raised $54 billion last financial year, this is significant.

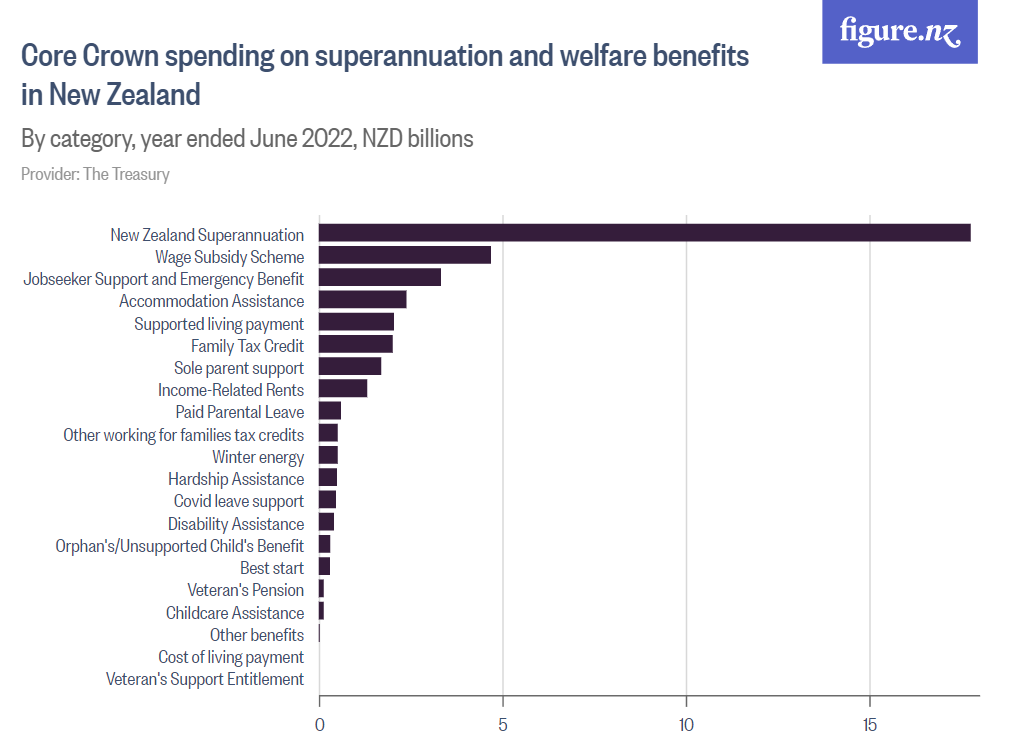

It is also just under half the $17.8 billion spent on superannuation.

While the government appears to have ruled out any new taxes in this year’s budget, it’s clear that tax policy will be a key election issue.

Further, I recently found the PPTA (teachers’ union) ‘supporting a campaign for a fairer tax system’ in one of their newsletters.

They were promoting a PledgeMe campaign by Tax Justice Aotearoa. A group specifically making the case for a wealth tax on their website.

Bizarrely, at the time of writing, they had raised over $4,000 from people who seem to want to saddle this economy with more tax and discouragement.

If you are willing to donate toward the formulation of wealth tax policy, why don’t you make a donation to a much-needed community service? St John. The Cancer Society. The Salvation Army.

What would be the effect of a wealth tax?

What the economically illiterate and envious do not realise is that it would cause such damage to the New Zealand economy. That the entire tax take could be decimated within a few years.

Many would take their skills, businesses, and wealth offshore.

If that happens across the owners of capital — particularly those with larger businesses, property, or share portfolios — you erode your productive sector fast.

A wealth tax would be like dropping a nuclear bomb on central Auckland. The fallout would reverberate across the economy. The radioactive damage warning other investors from around the world to stay away.

Unemployment would rise quickly. Healthcare, education, and superannuation would all have to be scaled back.

A First World country risks falling into the Third World.

You can imagine the conversations with prospective investors and migrants.

‘Yes, I’d love to come to New Zealand. I know it’s such a beautiful, peaceful, and free society. I could invest in a business there.’

‘You know there’s this wealth tax?’

‘Oh…we’ll need to look into that.’

Then radio silence as the economy rots.

What would you do?

Let’s put things in perspective.

A wealth tax in New Zealand is unlikely to be implemented. It may well be a doomsday red herring to scare superannuitants into accepting means-testing or a later retirement age. Even when they’ve paid taxes all their life.

Clearly, there is a coming black hole in the tax system.

Capital gains are not effectively taxed in New Zealand, even when the assets are sold.

But as a country so far from overseas markets, we need incentives for business investment here. And adding taxes on wealth or capital will not help.

The solutions we do have are to increase wealth, not to tax it away.

- Invest in skills and education.

- Make our economy leaner, smarter, and more competitive.

- Encourage capital investment with attractive — not off-putting — tax conditions.

- Our prosperity has always started with small businesses. Make small business more attractive, with a lower company tax, and a threshold on tax free income to help people get started.

- Stop incentivising passive property investors unless they are building new homes. Incentivise productive businesses that employ people, generate income, and pay tax.

- Reduce bureaucratic cost across the economy, which is reducing wealth, investment, and the ability to earn our way in the world via exports.

- Invite the best and brightest migrants we can find from around the world to help fill skill shortages and invest in businesses and jobs. That does not mean turning on an uncontrolled tap and straining infrastructure.

How investors are positioning themselves

Money is made in productive businesses.

With risks on the horizon, diversification remains the one free lunch in finance.

Investing savings in global shares means you have your wealth spread around different markets and jurisdictions. It is denominated in different currencies, such as AUD, EUR, or GBP.

There is already an existing system for taxing foreign investments called FIF — Foreign Investment Funds.

You pay the Fair Dividend Rate — or in years when the market is down and you make no gains, it may be possible to use the CV (comparative value) method.

It is unlikely a capital gains tax will be applied to international shares, since this system is already in existence. Of course, a wealth tax would likely apply to all.

Yet investors with foreign investments may be positioned to move jurisdictions if they have to.

But note: New Zealand tax is levied on your worldwide income.

So you’d essentially need to move permanently. Such that you no longer have a ‘permanent place of abode’ in New Zealand. And you become tax resident in your new country. That’s a complex tax conversation to have.

Hard to believe we’re having this conversation?

Most Kiwis want to be productive. And that means generating and investing capital to produce a wealthier economy for everyone. Not clawing away the ability to do so with a wealth tax.

If you have any feedback on this article or would like to discuss it further, please reach out to us on [email protected]

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.