It’s a bubble where we live.

Although only a 12-minute ferry journey to central Auckland, Devonport is a world away.

An early marine suburb, it’s quiet, historic, and cut off — with only one road to enter or exit by the golf course.

Source: Devonport Heritage

Of course, that one road on a weekend or at school pickup time can become a gridlocked source of delay and frustration if you want to go somewhere by car.

But I had always wanted to live here. And, in 2011, we made that dream a reality.

These days, it’s a ‘love-hate relationship’. The old house always in need of work. The picturesque yet familiar beauty sometimes locked by the road. The ‘moasting’ of some residents. (Moasting is boasting disguised by moaning over the trivial aggravations of idyllic lives).

But when you love a place more than you hate it, that’s when you know it is home.

So, it came as a shock the other week when the real Auckland and its problems came for once to our sleepy side of town.

My teenage son wanted to take some photos of the full moon over Auckland Harbour. So he ventured out with his camera.

When he came back with nothing, I asked why.

There was a group by the sea, sleeping in their car. They made him nervous. He didn’t want to hang around.

People sleeping in their cars in coastal Devonport as the nights cool — I guess it is one place where they might find peace and a degree of safety.

How did we get to this?

The property market

It’s joked that, next to rugby, New Zealanders’ other religion is the property market.

Kiwis love buying, doing up, renting out, and selling homes. They love planning their next move. Whether that is to a more prestigious suburb or a lifestyle dream beyond the city.

The key doctrine of this religion is that the grass could always be greener somewhere else.

For property investors, property ownership promises a secure future. A comfortable retirement.

Today, the trouble is that landlords find themselves somewhat banished to a desert of compliance and tax disincentive. While hopeful first-home buyers face crippling mortgages on urban shoeboxes.

New Zealand is no longer ‘God’s Own Country’ for property. The quarter-acre section — let alone 600 sqm section — for many is confined to municipal history.

The reasons why New Zealand home prices are among the most unaffordable in the world have been well documented:

- It’s too hard to build. Councils and laws are too restrictive. Land is artificially controlled. Urban zones are around 4.5 times as expensive as adjacent rural land.

- Urban infrastructure is constrained and councils have no incentive to provide it.

- Building regulations are too burdensome and existing providers of materials lack price competition.

- High rates of net migration have brought more people than the housing stock or construction industry could cope with.

- Tax policies incentivised the holding of housing as an investment for capital growth. And capital gains were very positive for more years than not.

Yes, we’ve failed to build enough homes. It’s too hard. And we’ve spent 30 years playing a game of musical chairs in the great church hall of the property market.

One gets up. One sits down. One rents another chair out.

Let’s be frank: this has caused housing hell.

The state-housing wait list sits at over 23,000 applicants.

In quiet suburbs at night — right across Auckland, actually — you’ll see people sleeping in cars.

On any night, there are about 10,000 people in emergency housing across the country. The other side of the housing crisis that costs taxpayers around $1 million a day.

In New Zealand, over 100,000 people (2018 census) experience severe housing deprivation. A shocking number of about 1 in 50 New Zealanders.

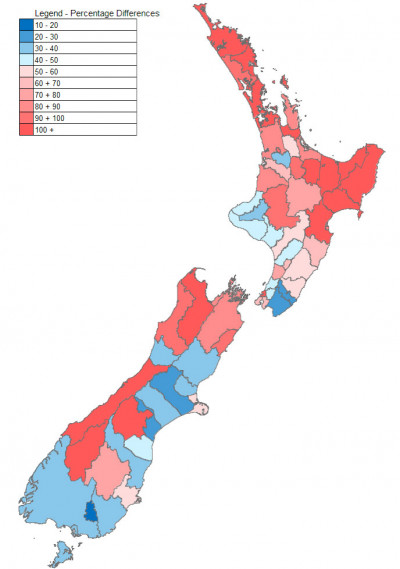

Some parts of the country experience higher levels of deprivation than others. But it is widespread:

Rate of severe housing deprivation per 10,000 people. Census 2018.

Source: Ministry of Housing and Urban Development

What is the solution?

The best way to address problems is to identify them.

As I mentioned above, the 5 key reasons are zoning, infrastructure, building, immigration, and tax treatment.

Today, we have the lowest rate of home ownership since 1951. To return New Zealand to the property-owning democracy it once was, we need a reform government:

- Land zoning needs to be opened up.

- Councils need incentive to add infrastructure. The ACT Party has proposed legislation for GST sharing.

- Building needs deregulation. Add an insurance scheme and common-sense approvals for materials used in similar jurisdictions.

- New Zealand needs skilled immigration. But population gains over GDP growth will have a negative effect on GDP per capita and pressure housing. Immigration policy needs to be subject to Treasury RIA (Regulatory Impact Assessment). There needs to be due diligence on the costs and benefits with a specific directive on housing.

- While ACT and National want to restore interest deductibility for landlords, I’m not so sure. Focusing the incentive on build-to-rent (BTR) could increase the total housing supply. On existing houses? Often, that just incentivises people into subpar investment.

It all comes down to facilitating economic building around our cities. And encouraging truly productive investment.

When housing policy works it doesn’t fuel speculation or deprivation. Home ownership is desirable, as is the construction of rental housing. It’s even better done at scale.

If the golden goose of rental homes has been slaughtered, what then do investors invest in?

There are lessons overseas.

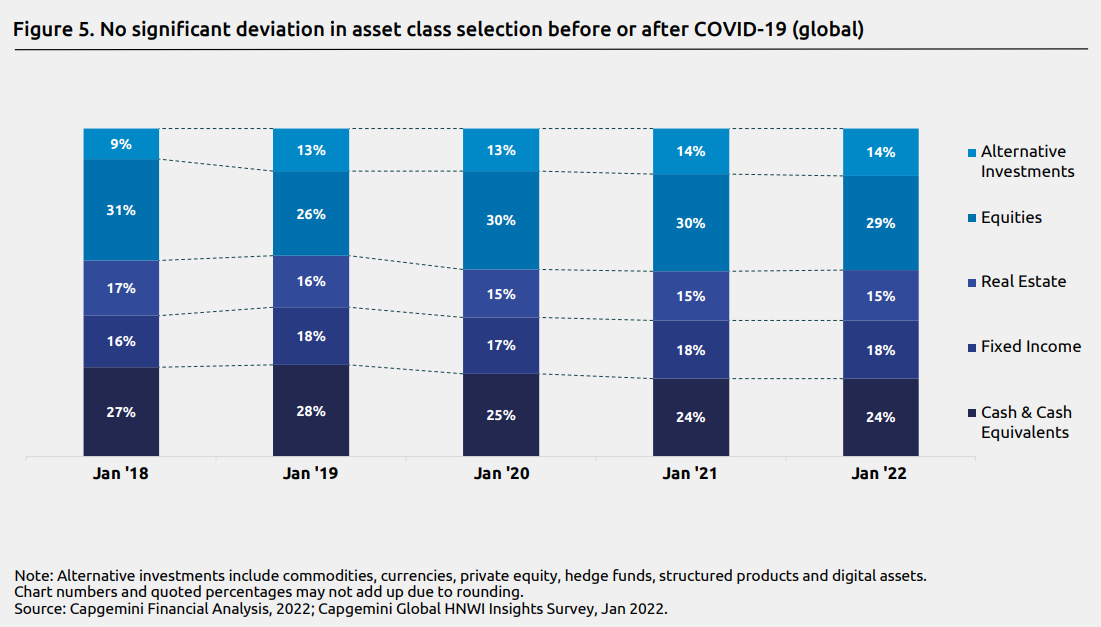

If we look at HNW (High Net Worth) investors around the world — those with over $1 million to invest beyond their primary residence — DIY real estate is not the main focus:

Around 30% of HNW investment goes into equities. Stocks and shares.

Now, that’s not to say that these investors don’t own lots of real estate beyond their home.

They probably do. Since many dividend-paying listed investments are companies investing in real estate at scale.

Let me give you an example.

You probably know of Kiwi Property Group [NZX:KPG] as the owner of the sprawling Sylvia Park Shopping Centre. It owns and manages about $3.2 billion of property.

Part of its portfolio is ‘build to rent’ (BTR).

Their first community is set to open in 2024 with 295 residential apartments next to Sylvia Park.

Artist’s impression, Sylvia Park BTR precinct. Source: Kiwi Property Group

Tenants will be offered long-term leases, fixed rents, and amenities like co-working spaces, lounges, and gymnasiums.

As a commercial investment and new build rental, gearing used is likely fully tax deductible.

This approach makes more sense to me than incentivising someone to rent out an old place that probably is due for a bathroom update or new roof. Leave that needed housing stock to first-home buyers.

Newly built units with such amenity also look appealing. Yes, I like my Devonport garden. But it takes a lot of time. Time I could be investing elsewhere…

At the time of writing, KPG shows a gross dividend yield of 9.8% p.a. and a NTA (net tangible assets per share) of $1.31. The current share price is around 90c.

While this share price is down with the wider property market, it indicates there are alternative ways to gain exposure. Through deeply liquid financial markets.

If you’d like to see more news on this area, I encourage you to add a premium subscription to our Quantum Wealth Report.

Until midnight Sunday (30 April), we’d like to offer you this subscription to try at just $1.50 for your first 4 weeks.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them.

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback.

It encourages us. It helps us to do better. It helps us to reach further.

So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

❤️ Please click here to review us now on Trustpilot.

Thank you so much in advance for your kindness and generosity.

Your readership keeps us going!

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice, nor does it suggest the suitability of any investment type for any person. Seek independent financial advice from an authorised financial advice provider to discuss your own situation.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.