Quantum Wealth Summary

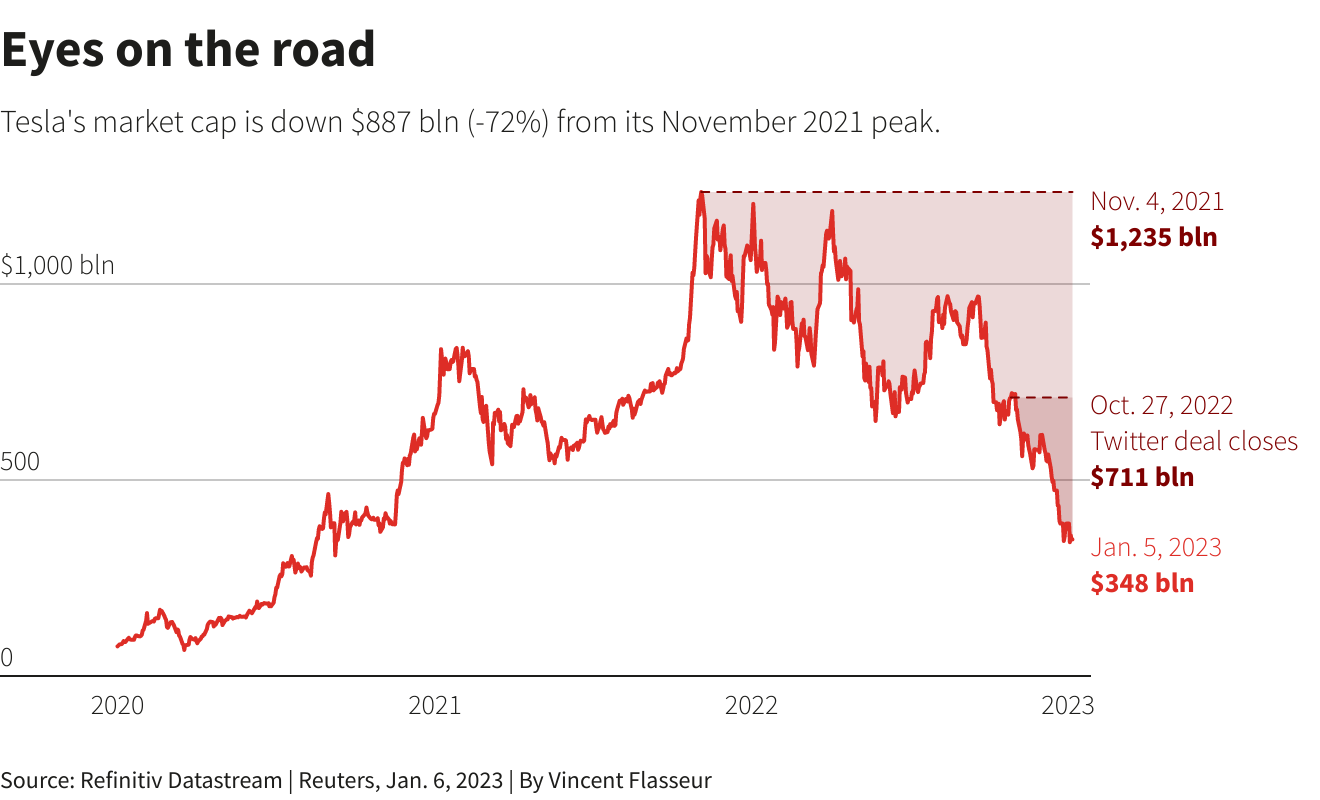

- What you need to know: Tesla was one of the worst-performing mainstream stocks in 2022. From peak to trough, it fell over 70%. However, in 2023, Tesla’s share price appears to be bouncing back. It has surged by over 80% this year.

- Why it matters: Supporters of Tesla are feeling restless. Will the Company continue to cruise along on old glory? Or will a lack of progress and innovation eventually cause its momentum to stall out?

- Here’s the state of play: We consider aother brand that may offer an alternative to Tesla — as well as explore several other value stocks that could form the basis of a resilient, weatherproof portfolio. You’ll find this covered in our Weekly Top 5 Quantum Trends.

Is Elon Musk a genius inventor?

Well, his supporters seem to think so.

They hail him as a visionary for setting up Tesla [NASDAQ:TSLA] and leading the Company to global prominence.

With almost religious New Age zeal, they praise him as being singlehandedly responsible for ushering in the electric-vehicle revolution.

Source: Current Affairs — Adda247

Except…the truth is a bit more complicated than that. It’s somewhat darker. Somewhat messier. Because it wasn’t Elon Musk who actually set up Tesla:

- To get to the heart of the matter, you will need to turn back the clock. The date? July 2003. The place? San Carlos, California. The key personalities involved? Martin Eberhard and Marc Tarpenning.

- These were the men who originally founded Tesla. They were forward-looking American engineers, and they were trying to do something that had never been done before: disrupt the centre of gravity for the automobile industry.

- You see, traditionally, Detroit has been known as the capital for car manufacturing. But Eberhard and Tarpenning wanted to challenge that and shift automaking to a new frontier: Silicon Valley.

- Eberhard had a striking vision for Tesla. He wanted it to be ‘a car manufacturer that is also a technology company’.

- Eberhard and Tarpenning believed that three ingredients that would propel Tesla forward: the battery, the computer software, and the proprietary motor.

- A third employee would soon join Tesla — Kiwi expat Ian Wright — and together, they would go looking for venture capital.

- They quickly found it in Elon Musk, who was flush with $100 million cash after the sale of his PayPal [NASDAQ:PYPL] venture to eBay [NASDAQ:EBAY].

- In February 2004, Musk agreed to provide the seed capital of $6.5 million for Tesla — and he joined the Company, even as Wright left to pursue other interests.

Source: Carscoops

- At first, Musk’s focus was narrow. He only supervised the product design for the Tesla Roadster, the Company’s first-generation electric vehicle. Meanwhile, Eberhard (as CEO) and Tarpenning (as CFO) were responsible for the actual day-to-day running of the Company.

- But things soon got incendiary. As Musk’s appetite for expansion grew, what followed was a clash of personalities. In 2007, Musk was serving as the chairman of Tesla’s board of the directors. He led a revolt to depose Eberhard as CEO and install himself as leader. In the aftermath, Eberhard and Tarpenning would depart the Company.

- Now free to reshape the Company in his image, Musk would push ahead with ever greater ambition. Cementing his place in our popular imagination. Making Tesla the first automaker to hit the mainstream with EVs.

- In the process, the Company’s valuation surged to over $1.2 trillion, with Musk himself being christened the richest billionaire on Earth.

So…the man. The myth. The legend:

- Of course, you know the old saying — history is written by the victors. Indeed, in the case of Elon Musk, this is quite literally true.

- He has built his personal brand on being rebellious and uncompromising. For him, the status quo is something to be confronted, then shattered, then reconstructed. Lather, rinse, repeat.

- Which is why, apparently, Musk took on the challenge of buying Twitter for $44 billion and making it his pet project.

Source: Le Monde

This acquisition has arguably been the most painful in recent business history. The corporate haggling that took place between April and October 2022 was turbulent. And when Musk eventually did succeed in installing himself as boss of Twitter, he immediately carried out mass layoffs:

- Reportedly, at least 70% of the pre-Musk era employees are now fired. At last count, the Company’s workforce has plunged from 7,500 to less than 2,000.

- This lean-and-mean approach is par for the course for Musk. He has vowed to make the platform open to free speech, as well as profitable.

Source: Vista Social

- Unfortunately, Musk’s biggest problem is this: despite having over 300 million users worldwide, it seems that very few of them are actually willing to pay to use the platform. As of January 2023, only 290,000 people have signed up to pay a monthly charge for Twitter Blue, a premium subscription service.

- The pricing for Twitter Blue? $8 a month for desktop computers, and $11 a month for mobile devices.

- The revenue from Twitter Blue is extremely measly. It comes up to an estimated $28 million yearly. This is not nearly enough to service the $12.5 billion loan that Musk took on to buy Twitter in the first place. He is paying roughly $1 billion in annual interest payments alone.

- If this is Musk’s attempt to engage in virtue signalling, it’s proving to be a very costly one. Despite hollowing out its workforce and operating on a skeleton crew, Musk’s attempt at transforming Twitter isn’t working yet. The Company is long way from being profitable — if ever.

- Musk himself admits that Twitter today is probably only worth $20 billion — which is a sharp drop from the $44 billion he originally paid to acquire it in the first place.

- Now, in an attempt to remedy the situation, Musk has announced an equity grant for existing employees. In his words, this involves ‘very significant stock and other compensation awards, based on performance’. The problem here is clear: morale at Twitter is at an all-time low, and Musk needs to stem the exodus of talent.

So, is Musk losing his focus? Is he spreading himself too thin? Well, here’s what’s at stake:

- Musk is currently serving as CEO of three companies at the same time — Twitter, Tesla, and SpaceX.

- He may be a genius — but he’s still human. And it does feel like he’s getting distracted at a time when he can ill-afford it.

- In 2022, we were hit with a bear market that was incredibly vicious for tech stocks. Tesla, in particular, experienced a punishing sell-off. The damage appears to be compounded by the fact that Musk was absent at the helm:

Source: Reuters

- From peak to trough, Tesla lost over 70% of its share price.

- The Company fell from a valuation of $1.2 trillion to just $350 billion.

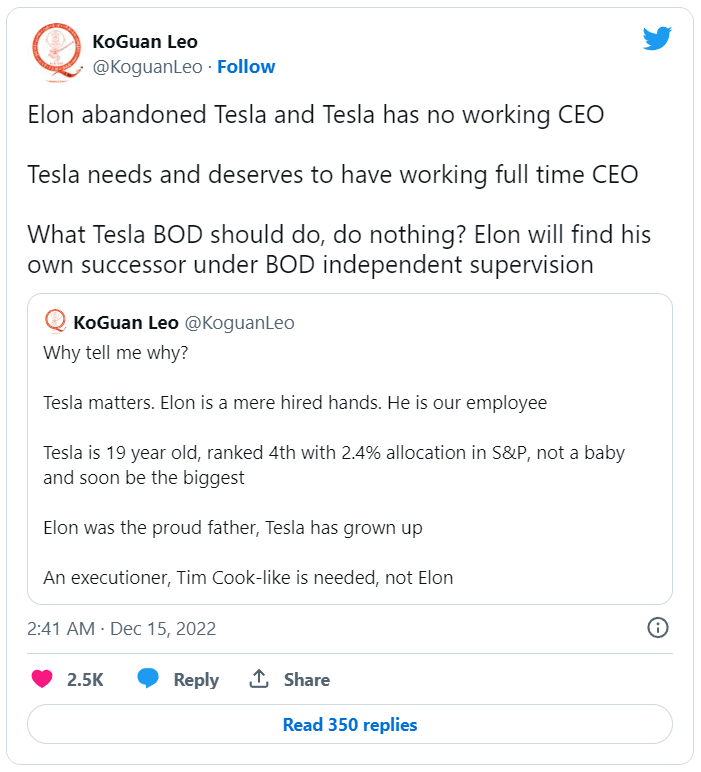

- This has led to a fierce backlash from Tesla’s supporters. Among them is KoGuan Leo, a Singapore-based billionaire who owns around 22 million shares in Tesla. Leo publicly voiced his disapproval, and ironically enough, he did it on Twitter.

Source: Channel News Asia

These are harsh words, indeed. But to his credit, Elon Musk appears to be taking the criticism on board:

- Instead of juggling his workload between companies, Musk has made a rare concession: he will aim to appoint a successor as Twitter CEO by the end of 2023. In his words: ‘I will resign as CEO as soon as I find someone foolish enough to take the job! After that, I will just run the software & servers teams.’

- In the meantime, Musk has promoted Tom Zhu — a Chinese New Zealander who was previously Tesla’s chief officer in China — to the second-highest position in the Company. Zhu will now oversee the assembly plants in the US, as well as sales operations in North America and Europe.

- Zhu appears to be a very capable executive in his own right. But he has his work cut out for him during this difficult time. The Company is facing rising competition and a more jittery economic environment.

- Fortunately, in 2023, Tesla’s share price appears to be bouncing back. It has surged by over 90% this year. The bulls seem to be getting braver. They have started buying into the stock once more.

- Is this a make-or-break moment for Tesla? To get answers, I want to dig deep into the Company’s fundamentals. I want to do a forensic analysis of Tesla. And most of all, I want to uncover an honest picture of Tesla’s future.

- As a bonus: I will explore one golden alternative to Tesla. This could be ideal for value-minded investors who want exposure to electric vehicles but are eager to diversify beyond Elon Musk…

Subscribe Now

Subscribe Now Login

Login Managed Accounts

Managed Accounts Quantum Wealth

Quantum Wealth

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.