Quantum Wealth Summary

- There’s no hiding it: Bitcoin was one of the worst-performing assets during the recent bear market. It has suffered a violent sell-off in 2022.

- However, crypto bulls are slowly easing their way back in — which means that Bitcoin is starting to climb again. In 2023, it has outperformed both the S&P 500 and the Nasdaq indexes.

- So, are there more gains to come? Is this rally sustainable? What does the future for Bitcoin look like?

- Ultimately, good long-term investing is about offense and defence. We aim to play both. We are now looking closely at several value stocks that could form the basis of a resilient, weatherproof portfolio. You’ll find this covered in our Weekly Top 5 Quantum Trends.

Well, you know it.

I know it.

Everybody knows it.

This past year has been stormy for Bitcoin:

- Between November 2021 and November 2022, it suffered a terrifying slump.

- From peak to trough, Bitcoin fell almost 75%.

- As interest rates climbed sharply throughout 2022, the risk appetite for Bitcoin evaporated. And when push came to shove, there were few true believers. What we saw instead was a wild stampede for the exits.

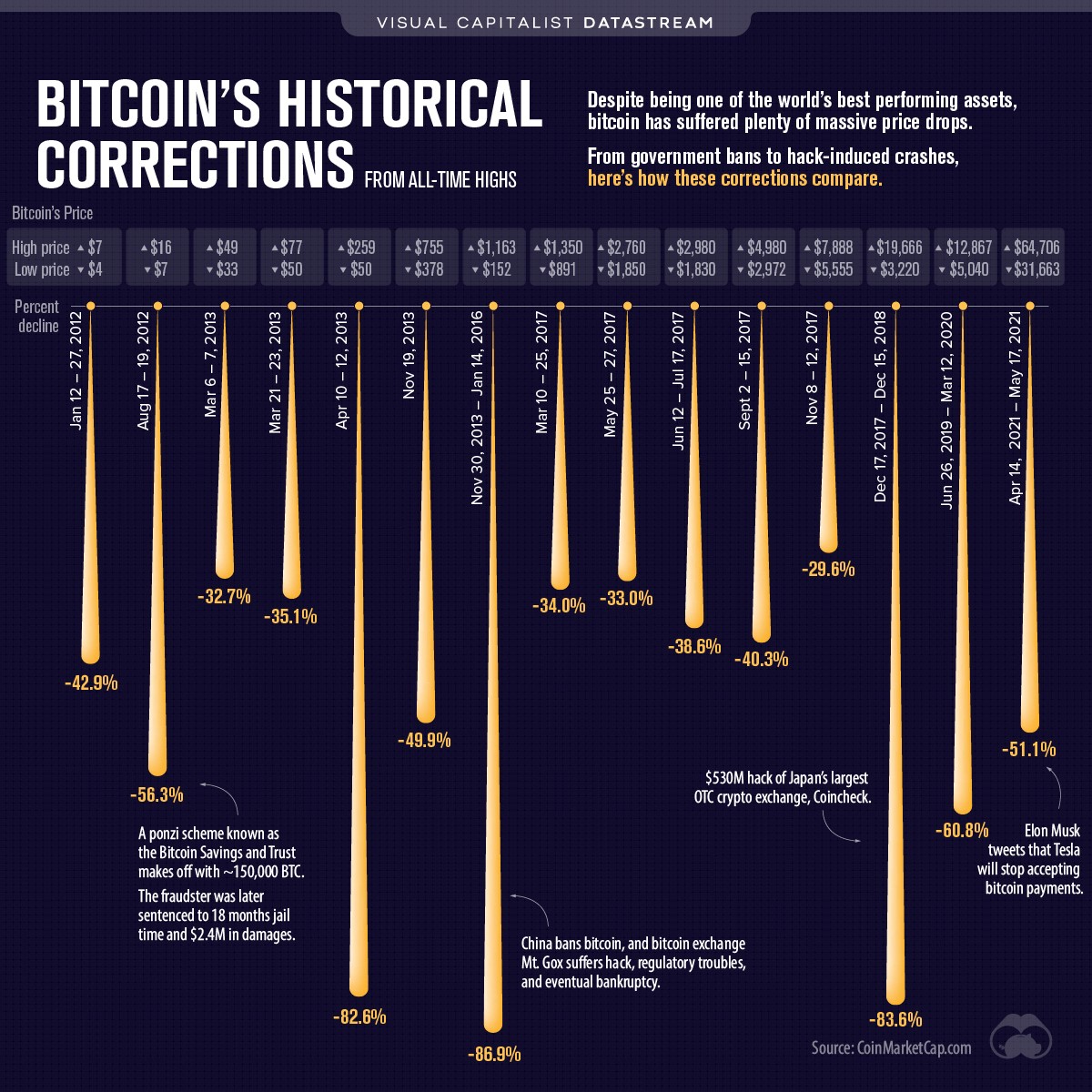

But as horrible as the Bitcoin sell-off has been, it’s nothing unusual. It’s all part of a historical pattern of volatility:

Source: Visual Capitalist

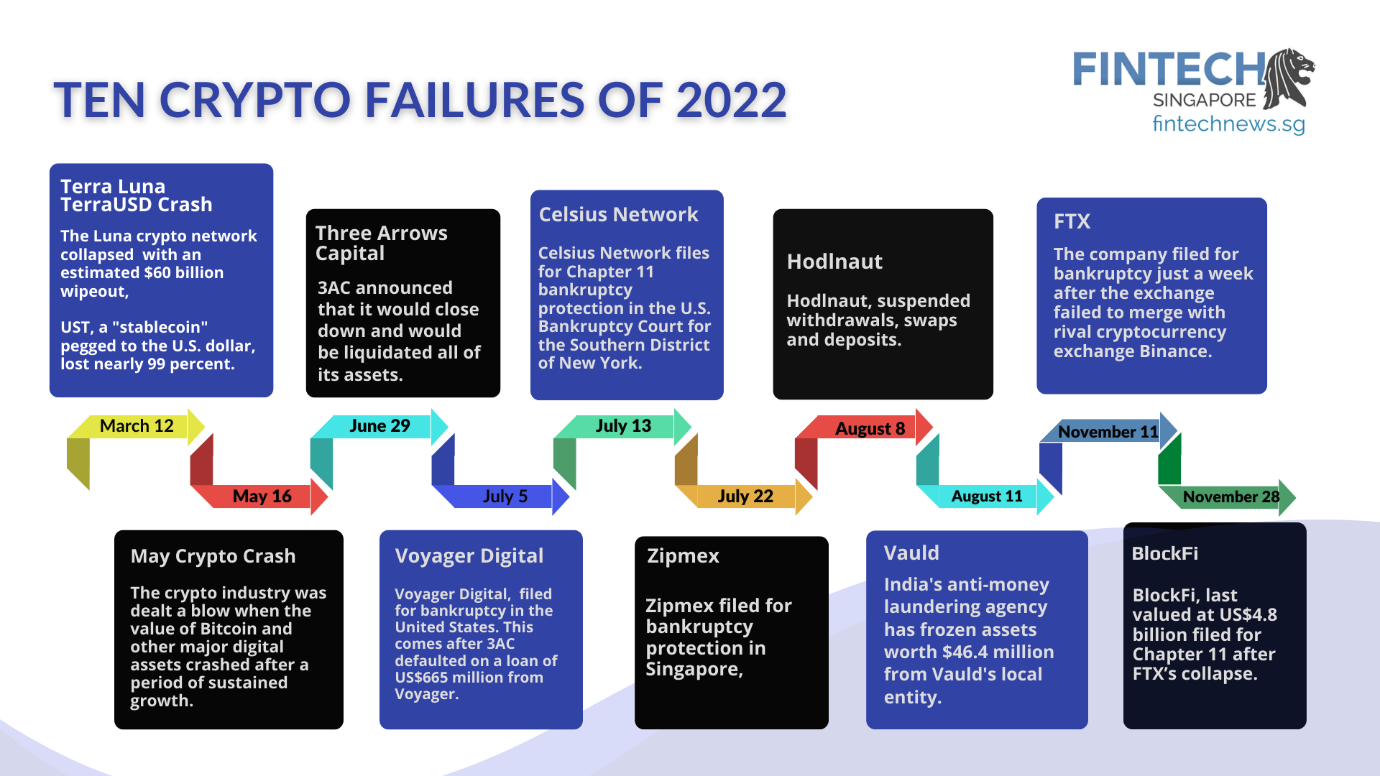

Interestingly enough, Bitcoin has experienced such huge price swings over the years that the asset itself no longer makes the news. Instead, in 2022, it was the wider collapse of the crypto ecosystem that grabbed the headlines:

Source: Fintech Singapore

People call this ‘crypto winter’, and for good reason:

- The speed and the ferocity of these bankruptcies have caught many investors off-guard.

- FTX, Celsius, Three Arrows have fallen like a string of dominos, leaving investors unable to withdraw their money at the worst possible time.

- Sadly, many of these businesses appear to be Ponzi schemes. They robbed Peter to pay Paul. What they created was a flimsy house of cards. And all it took was a stray gust of wind to bring it all crashing down.

- What’s the final toll? Well, approximately $2 trillion in wealth has been wiped out. To put that into context, that’s the equivalent of Italy’s GDP. Lost. Gone.

- The US Securities and Exchange Commission has responded with a proposed crackdown — targeting so-called stablecoins being issued by companies like Paxos and Binance.

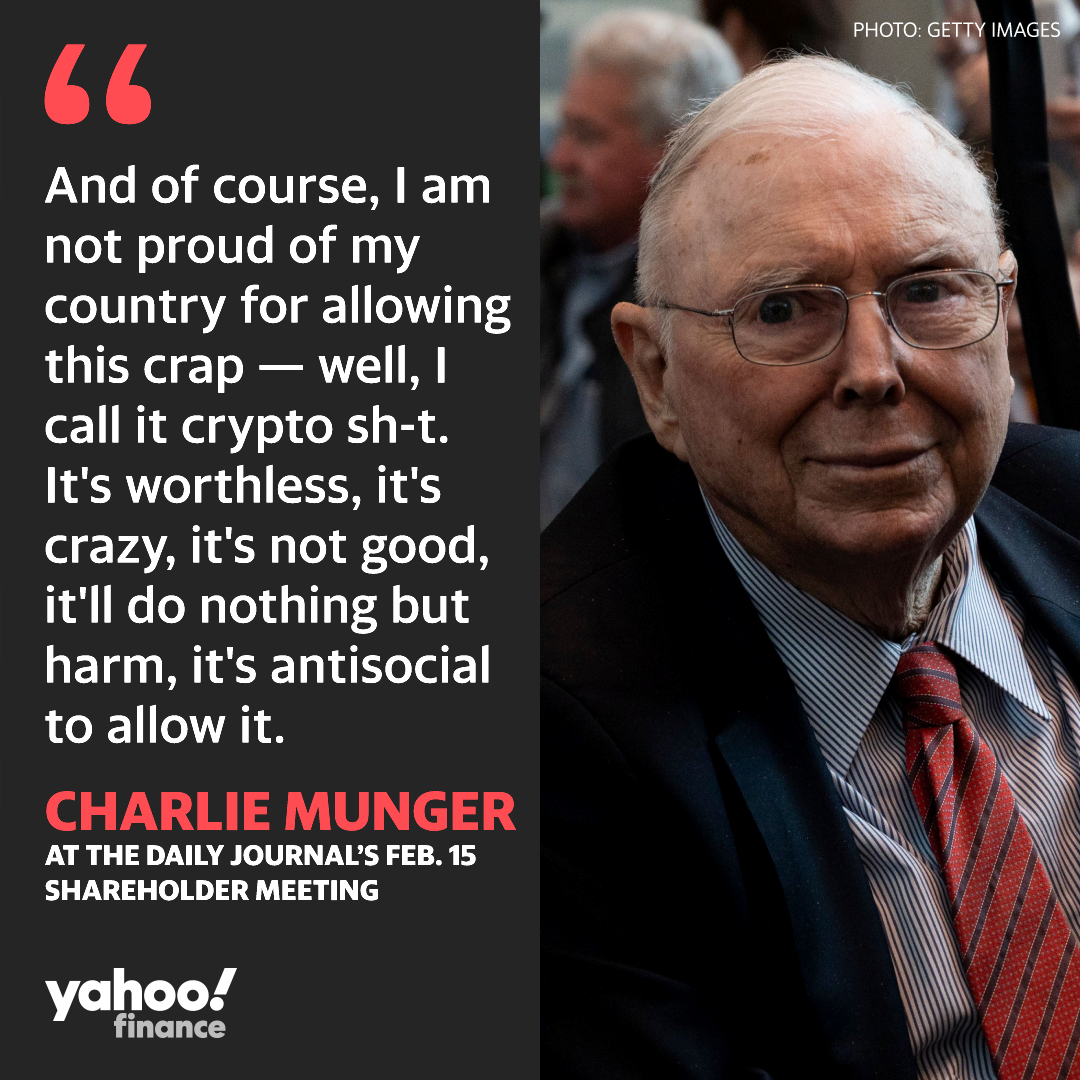

- Charlie Munger, Warren Buffett’s business partner, has some choice words to say about cryptocurrency:

Source: Yahoo Finance

Ouch. That’s a bit harsh. Sure, we’re living in a jittery environment for crypto. But after experiencing such a bloodbath, maybe there’s light at the end of the tunnel? Maybe the worst of the carnage is over? Well, possibly:

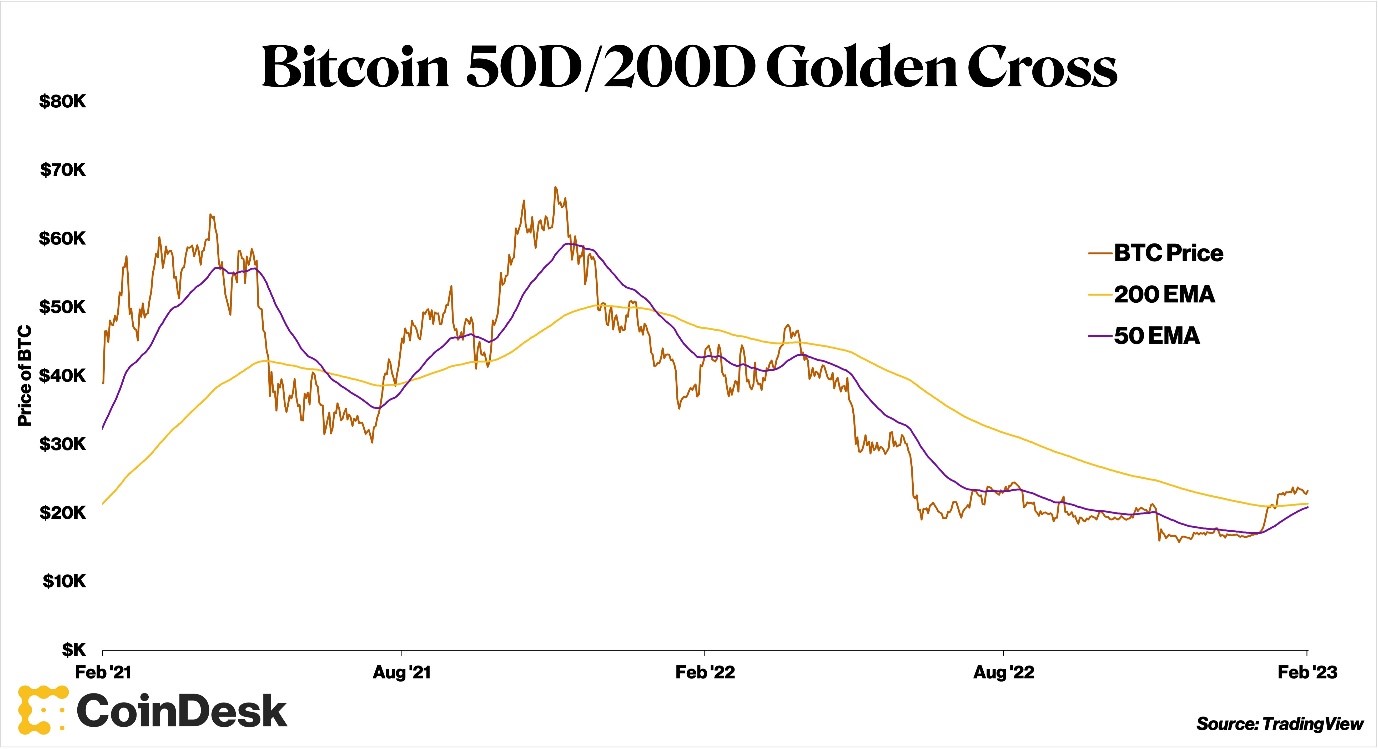

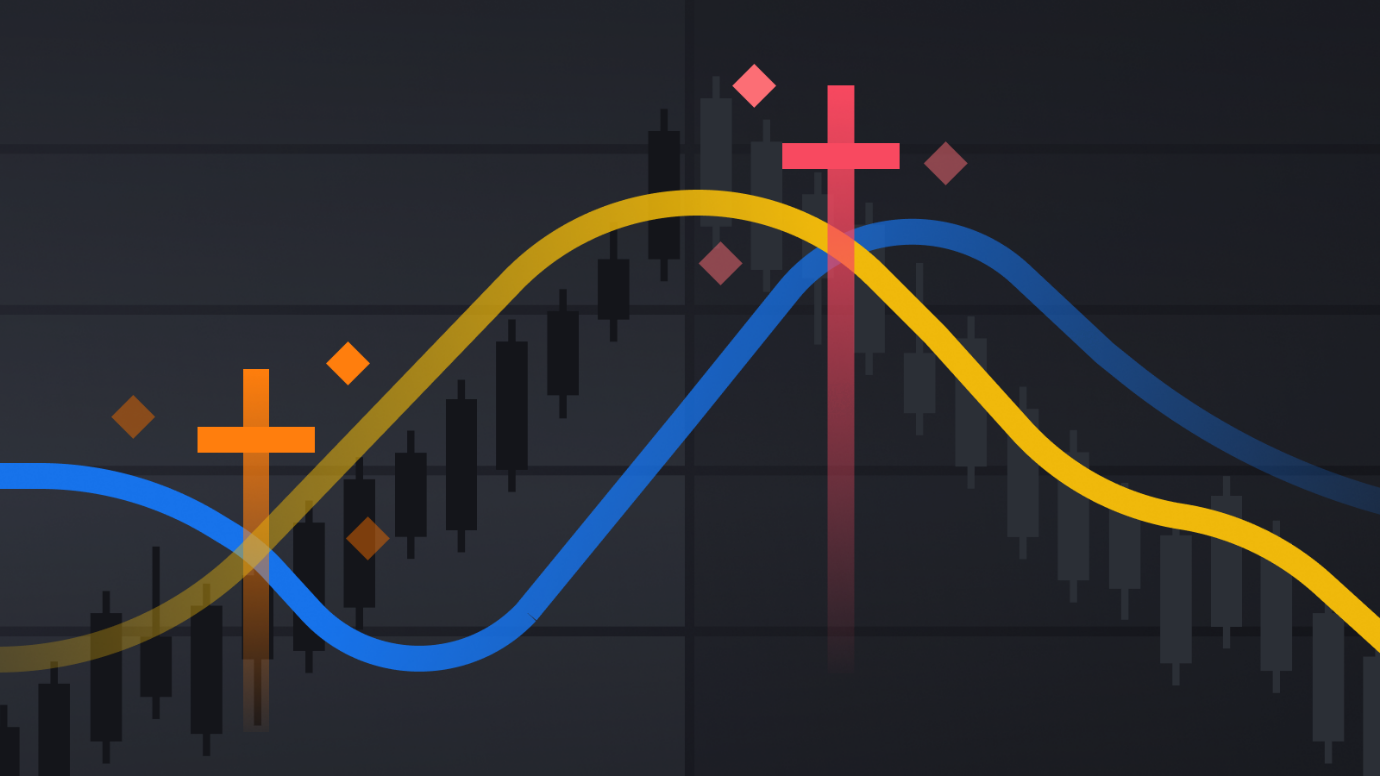

- In February 2023, Bitcoin experienced a significant event — its first golden cross in quite a while, allowing it to defeat the death cross.

- This is very rare. Since 2015, a golden cross for Bitcoin has only appeared on six previous occasions.

Source: CoinDesk

Source: Binance Academy

So, what does it mean? Why does it matter? Well, I’ll give it to you in plain English:

- A death cross is usually seen as a bearish signal. This happens when the 50-day moving average of Bitcoin crosses below the 200-day moving average. This suggests that crypto may be headed for a pessimistic downward trend.

- Meanwhile, a golden cross is usually seen as a bullish signal. This happens when the 50-day moving average of the Bitcoin crosses above the 200-day moving average. This suggests that crypto may be headed for an optimistic upward trend.

So, at the moment, here’s what the situation for Bitcoin looks like in 2023:

- It’s up over 35%, year to date.

- By comparison, the S&P 500 is up over 5%, and the Nasdaq is up over 12%.

- Slowly, carefully, the crypto bulls appear to nibbling back into Bitcoin.

- So, are there more gains to come? Is this rally sustainable? What does the future for Bitcoin look like?

- For speculative investors with a higher appetite for risk, this moment may represent both opportunity and danger.

- But watch out: you shouldn’t allow your emotions to get the better of you. Now, more than ever, you need to be rational. Don’t buy into Bitcoin until you read this…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.