Are we going into a deep, dark recession this year?

Here in New Zealand, things aren’t looking great.

Friends and neighbours fret over their mortgages. High streets are littered with ‘for lease’ signs. Wages are not keeping pace with inflation. Materially, we seem to be going backwards.

So I was somewhat surprised to see American numbers at the end of last year:

- –7% fewer people were on jobless claims, compared to a year ago.

- Durable goods orders for factories were up +11.2% YoY.

- Annualised GDP expansion was +2.9%.

- Personal disposable income rose +6.5%, faster than personal spending.

In other words, US incomes appear to have kept pace with inflation. And this very large economy continues to produce new jobs, despite some well-publicised layoffs across the tech sector.

This would go part way to explaining why equities were off to such a rally in January 2023. And why, globally, a pending recession may end up shallower than you think.

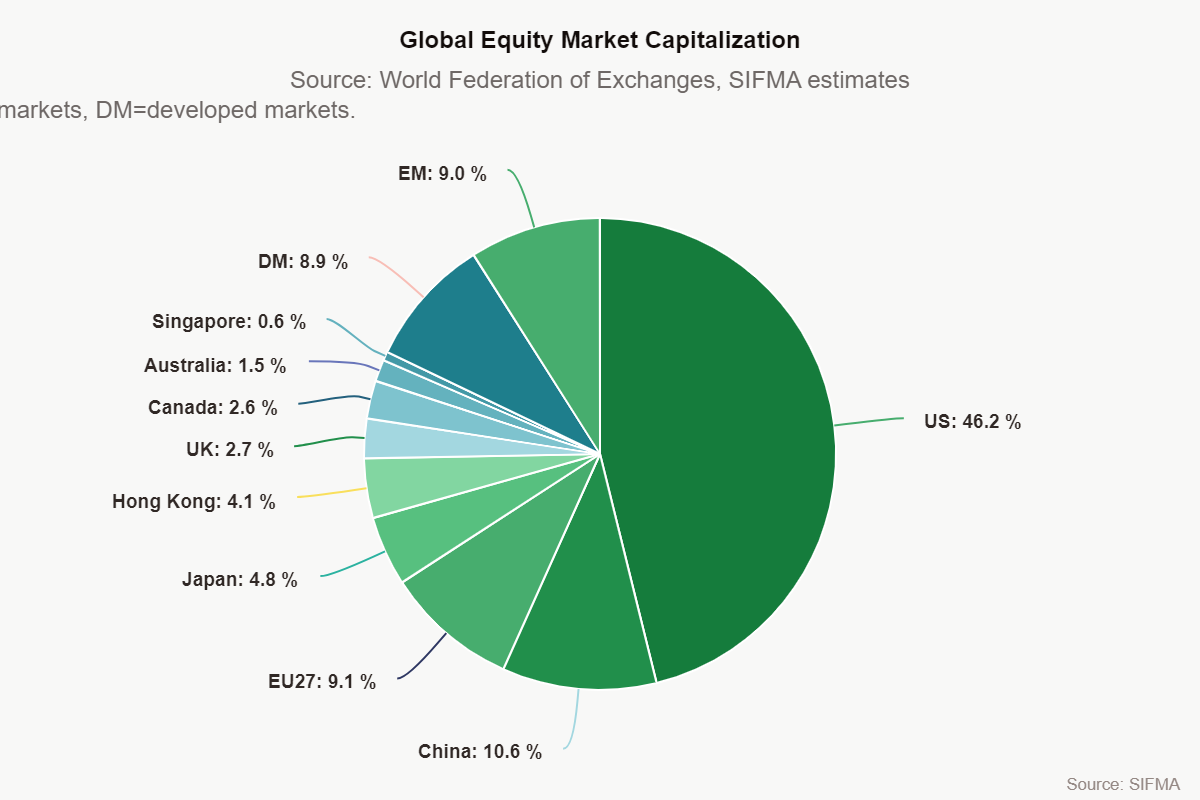

The US represents nearly half of total global market capitalisation in stocks:

The free market

One reason for US economic strength is the quality of its free market.

Yes, this does not lead to perfect outcomes. There is inequality. A few capture outsized gains.

But don’t discount the freedom and opportunity afforded to entrepreneurs. This allows for the creation of very successful businesses.

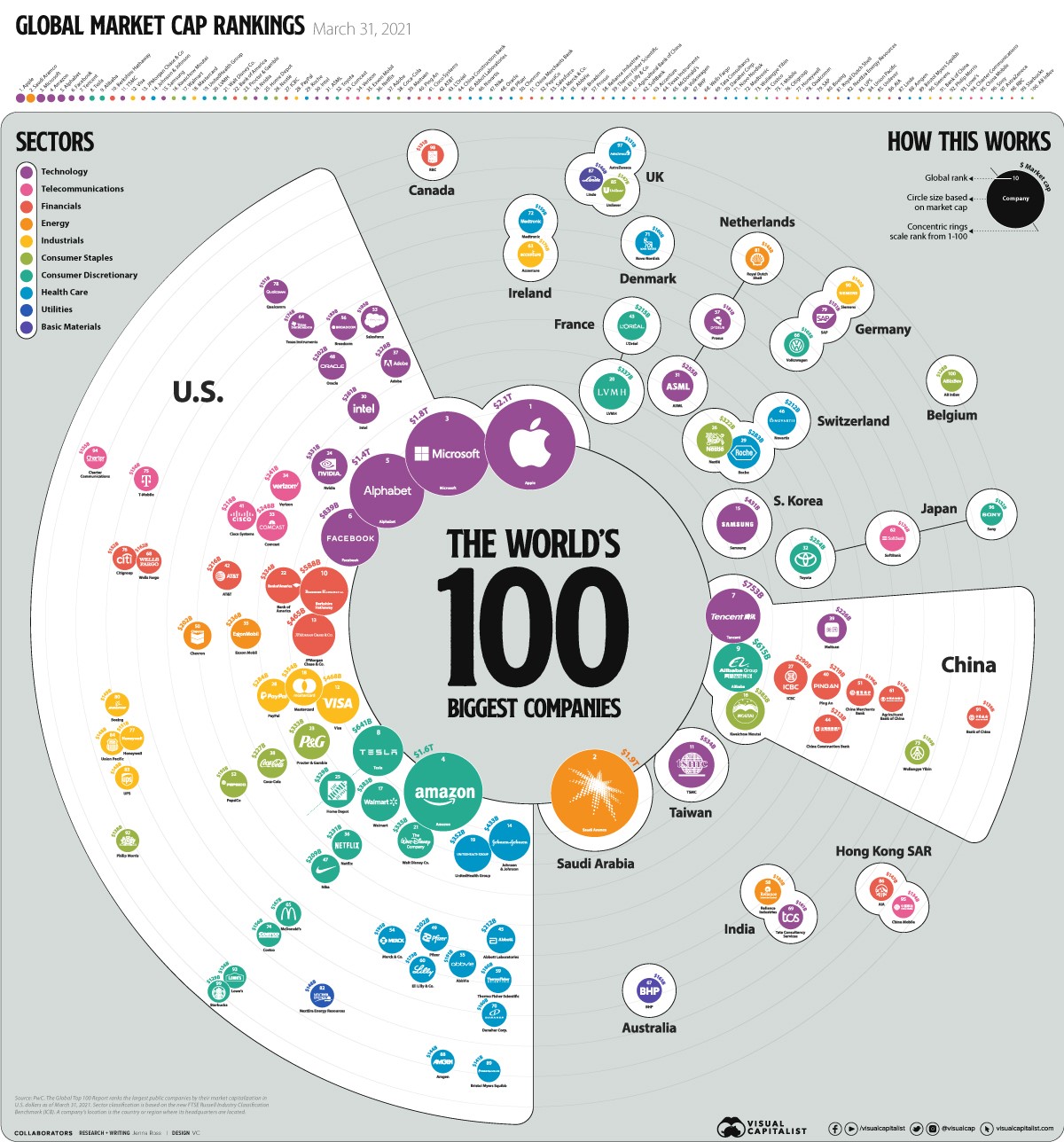

Excepting oil giant Saudi Aramco, the largest handful of companies in the world today (by market cap) are the result of American innovation.

[ Click to enlarge ]

Source: Visual Capitalist

Economies need businesses to deliver goods, services, and wage growth.

Entrepreneurs need the freedom to create new businesses. And an environment where businesses can flourish.

This is why the US continues to outperform. And why its companies do too.

If you drill down to actual levels of income inequality, there is not a huge difference between more free market economies in the OECD and less. The reality is most OECD countries run mixed-market systems.

Compare the Gini coefficient (0 = complete equality, 1 = complete inequality) for income:

- US in 2021 was 0.375

- New Zealand in 2020 was 0.320

- Australia in in 2020 was 0.318

- UK in 2020 was 0.355

The more useful picture is to look at market dysfunction.

In my experience, wages are lower in New Zealand, while house prices are higher compared with the above economies.

This creates a two-step level of inequality tied to the equity levels in housing.

If you own your own home — or a good deal of the equity in it — your income after housing cost is going to be much greater.

This suggests regulation impacting housing and many businesses in New Zealand is overbearing. In our industry, we seem to face higher levels of regulation than we would in the US, without clear benefit.

Investing in tomorrow’s great companies

Investors today want to find the great companies of tomorrow.

If we look at these businesses at the top of the tree for market capitalisation, we also see very rapid share price growth:

- Apple Inc [NASDAQ:AAPL] — 79,878% since 1983.

- Microsoft Corp [NASDAQ:MSFT] — 247,900% since 1986.

- Amazon Inc [NASDAQ:AMZN] — 110,144% since 1997.

- Alphabet Inc [NASDAQ:GOOGL] — 3,499% since 2004.

- Tesla Inc [NASDAQ:TSLA] — 12,421% since 2010.

Even the lowest gainer, Google, has managed annualised growth of over 184% per year.

To put this into perspective, many believe Auckland house prices performed ‘extremely well’ over the past 30 years. In actual fact, it was only growth of 7.4% per year before inflation, rates, and upkeep costs.

Whereas Apple and Microsoft have paid dividends over and above their growth.

Return on investment

Warren Buffett has outperformed market indexes.

He seeks out businesses ‘he can understand’. But if you drill down further, a consistent selection criteria is a very simple one: return on investment (ROI).

Companies he invests into tend to be very good at turning capital into return. Often at levels of 30% or more.

That’s something we seek in allocations to the Wholesale Portfolios we manage. And in the companies we report on for our Quantum Wealth premium news subscription.

I encourage you to look for companies with great ROI. That are very efficient in turning capital into return.

And I encourage you to keep fighting for freedom, so entrepreneurs can create jobs, wealth, and growth.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Vistafolio services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.