The year was 2008.

It was the season of the fear.

Every man, woman, and child — along with their dog, cat, and goldfish — were panicking.

And why not?

America was being hit hard by the subprime mortgage crisis. The S&P 500 index plunged over 38% that year. The nation was struggling with the worst recession since the Great Depression.

‘The end is nigh,’ screamed the prophets of doom. ‘America is finished. It will never recover from this.’

Source: Medium

However, amidst the noise, Warren Buffett — the Oracle of Omaha — had a different opinion. He believed that what was happening was just a temporary blip on the radar.

So Buffett wrote to the anxious shareholders at his investment company, Berkshire Hathaway. He offered them some measured wisdom:

- Buffett explained that he had been running the Company for 44 years.

- He observed that the stock market had delivered a market gain during 75% of those years.

- He predicted that the next 44 years would probably offer a roughly similar percentage in terms of gains.

In other words, the sun would keep on shining. The birds would keep on singing.

Certainly, Buffett remained optimistic despite the fear. And his evergreen message could be summed up like this: ‘Never bet against America.’

Of course, being optimistic was the hardest thing to do in 2008.

Everyone was caught up in the crisis of the moment. Emotions ran wild. The word on the street was that this was a civilisation-ending event.

But…of course…it wasn’t.

Source: CNBC

Ultimately, Warren Buffett was proven right.

The financial storm soon passed.

The markets eased back into growth mode.

A new cycle began.

But…here’s where things get interesting:

- Not even Buffett could have predicted how incredibly strong the comeback would be.

- America experienced the longest economic boom since the Second World War; a relentless bull market running 12 years.

- From March 2009 to December 2021, the S&P 500 index enjoyed a compounded gain of over 500%. Extraordinary.

So, it’s clear: over the long-term, markets tend to drift up.

No war, no recession, no rumour will keep the market down for too long.

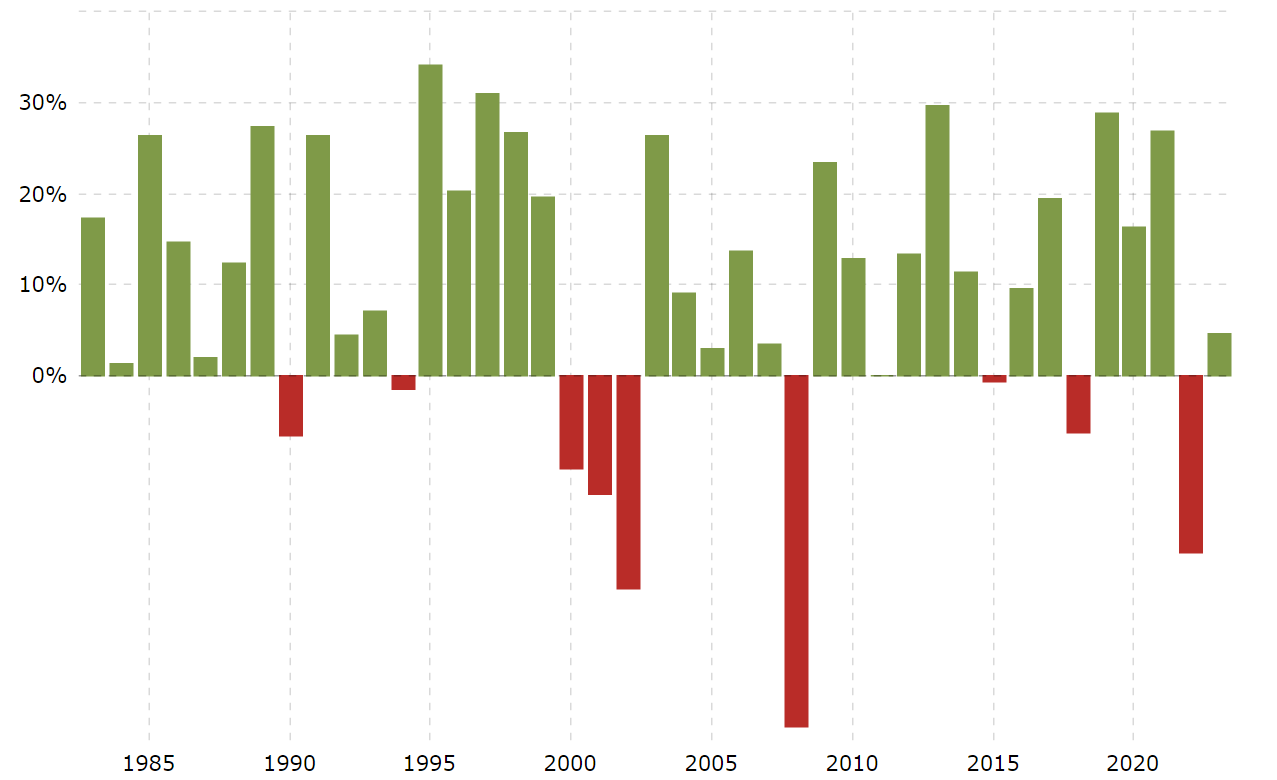

Now, for your historical interest, here’s what the annual percentage change for the S&P 500 has looked like over the past 40 years:

Year | Annual Change |

2023 | 5.02% |

2022 | -19.44% |

2021 | 26.89% |

2020 | 16.26% |

2019 | 28.88% |

2018 | -6.24% |

2017 | 19.42% |

2016 | 9.54% |

2015 | -0.73% |

2014 | 11.39% |

2013 | 29.60% |

2012 | 13.41% |

2011 | 0.00% |

2010 | 12.78% |

2009 | 23.45% |

2008 | -38.49% |

2007 | 3.53% |

2006 | 13.62% |

2005 | 3.00% |

2004 | 8.99% |

2003 | 26.38% |

2002 | -23.37% |

2001 | -13.04% |

2000 | -10.14% |

1999 | 19.53% |

1998 | 26.67% |

1997 | 31.01% |

1996 | 20.26% |

1995 | 34.11% |

1994 | -1.54% |

1993 | 7.06% |

1992 | 4.46% |

1991 | 26.31% |

1990 | -6.56% |

1989 | 27.25% |

1988 | 12.40% |

1987 | 2.03% |

1986 | 14.62% |

1985 | 26.33% |

1984 | 1.40% |

1983 | 17.27% |

Current as of 26 January, 2023, at 11:30am NZST

Source: Macrotrends

Here’s what you need to know:

- The pattern does match up with Buffett’s observations. Yes, there’s a lot more green than red across 40 years. The market has delivered a positive gain 75% of the time.

- It is rare for the market to stay negative beyond one year. During this time frame, the only ‘black swan event’ was the dot-com crash of the early 2000s.

- The S&P 500 has experienced a spectacular rise across 40 years — compounded growth of over 2,800%.

- It’s important to note: we are still in January 2023. The year is still in its infancy. The numbers will continue to roll in as we speak.

Our opportunity for you

Of course, we human beings have a negativity bias:

- We tend to obsess over the fact that the market was down by over 19% in 2022.

- But how quickly we forget that the market has enjoyed compounded growth of over 500% from March 2009 to December 2021.

Well, try looking at the bigger picture. Pain in the short-term is necessary for happiness in the long-term.

Therefore, corrections are actually healthy. Desirable, even. Because the end of one cycle promises the beginning of a new one.

Rebirth. Renewal. Rejuvenation.

So…are you avoiding the market? Or…are you embracing the market?

Weigh it up.

Here at Vistafolio, we are helping our Eligible and Wholesale Clients regain control of their destiny by building a roadmap to financial freedom.

At the moment, we have our eye on investment targets in Australasia, Europe, and North America. We are especially keen on resilient sectors like infrastructure, energy, and commodities.

It’s about protecting your wealth. Growing your wealth. Gaining passive income.

So, are you looking for guidance? For direction?

Come talk to us. We’re now offering an initial free consult for Eligible and Wholesale Clients. We’d love to hear more about your financial goals and dreams.

🌎 Click here to register your interest today.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Vistafolio services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.