Quantum Wealth Summary

- From 2009 to 2021, we experienced 12 years of pure joy. The market was buoyant. A rising tide lifted all boats.

- In 2022, the cycle finally turned, and we entered our first real bear market. The collective mood soured. Fortunately, it’s still possible to find a safe harbour in defensive sectors.

- We take a look at 4 stocks that have shown incredible resilience, delivering returns of +89%, +32%, +29%, and +15% recently. Here’s the inside story of why these companies have performed so well.

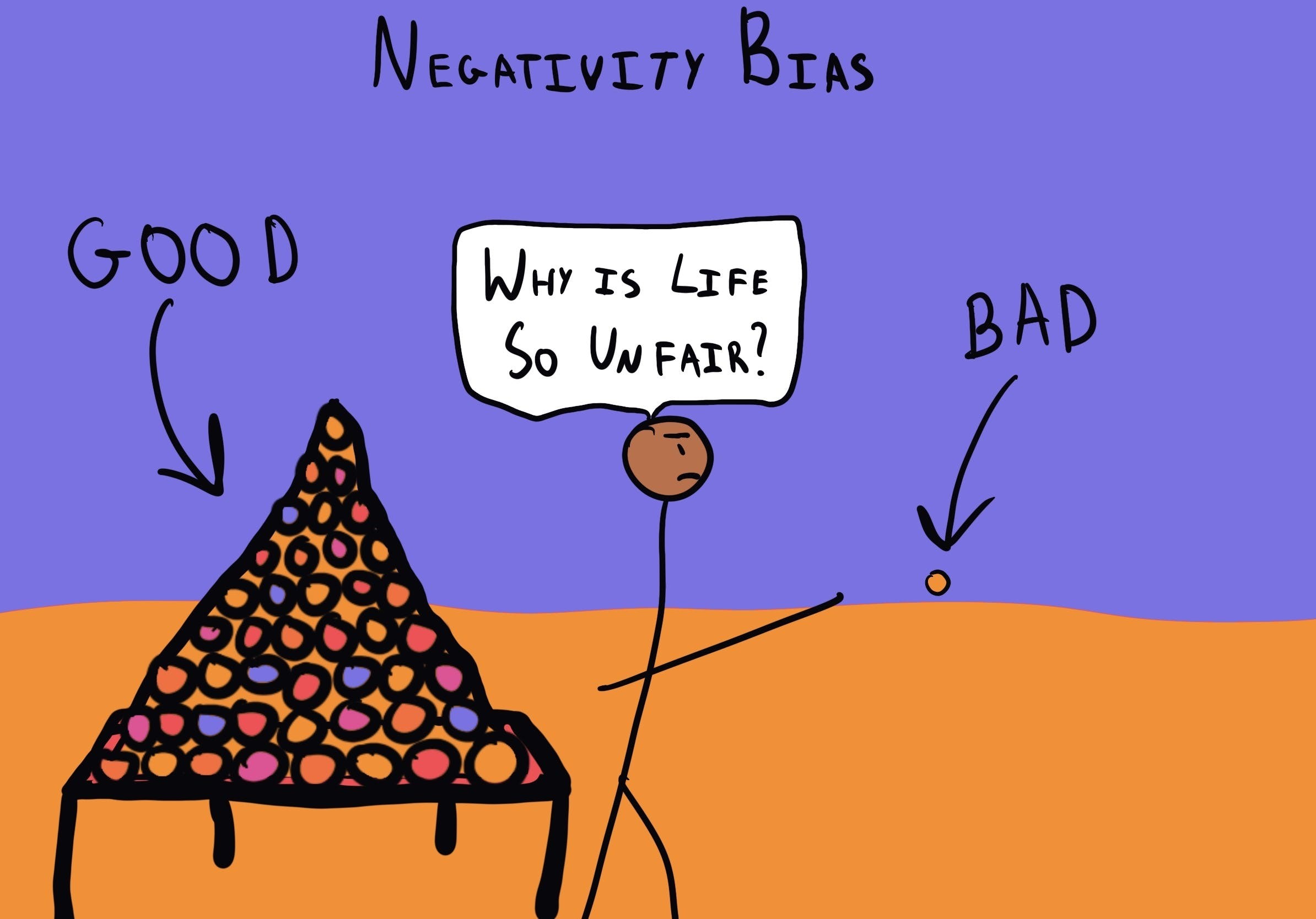

Here’s the strangest thing about human nature: our emotions have the ability to distort and warp time.

Uh-huh. You might have already noticed this. Time doesn’t move in a linear fashion. It doesn’t move at a steady pace. It can compress when we’re feeling good. And it can expand when we’re feeling bad.

Indeed, time flies or time drags — depending on how happy or how sad we are.

Here’s why our fickle mood matters:

- From March 2009 to December 2021, we enjoyed the longest economic boom since the Second World War. The S&P 500 gave us gains in excess of 500%. And our joy seemed to fly by without us noticing it very much.

- Then, from December 2021 to October 2022, the S&P 500 fell over 24%. And we began to obsess over that pain point, counting every second of it, imagining the worst. Our grief, quite literally, acted as a drag on our perception of time.

Source: The Decision Lab

It’s morbidly fascinating, isn’t it?

Of course, 2022 will be remembered as the year where we truly felt the bite of the inflation monster. Interest rates climbed. Debt got more expensive. And our access to easy money evaporated.

Did you fixate on the doom and gloom?

Well, that’s natural. It’s only human.

But watch out. If you spent too much time feeling sour, you might have actually missed out on a sweet dose of positivity: the 4 best-performing stocks on our investment radar.

Yes, surprisingly enough, these companies have actually defied the pessimistic mood by delivering gains of +89%, +32%, +29%, and +15% recently.

Their performance has been extraordinary, given the circumstances.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.