Here’s a fun fact: the current bear market we’re experiencing is 9 months’ old.

It officially took its first baby steps on January 3, 2022.

It has grown in strength. It has grown in girth. And in its wake, every asset class has been left shivering and retreating.

Property. Crypto. Stocks. Bonds.

All sliding into the red.

This bear feels like a ferocious beast — the mainstream media on both the Left and Right never fails to remind us — but so far, its roar has actually been worse than its bite.

Already, I see people misreading the tea leaves. Giving into irrational fear. Making anxious statements: ‘This time it’s different.’

Different? Really?

Well, Sir John Templeton, one of the greatest value investors of the 20th century, has warned us that these are the most dangerous words to utter: ‘This time it’s different.’

So, are your emotions paralysing you? Are they deceiving you?

Here are some critical facts for you to know:

- The longest bear market in history happened in the early 2000s. It was driven by the dot-com crash. It lasted a total of 929 days — or two and a half years.

- The second-longest bear market happened in 1973-1974. It was triggered by the oil shock. It lasted a total of 630 days — or just under two years.

- The shortest bear market happened in 2022. It happened because of the Covid pandemic. It lasted only 33 days.

So, what happens when you take all these unpleasant events and average them out?

Well, you will see that the average bear market lasts anywhere between 289 to 388 days.

So… roughly a year.

Therefore, you should consider these urgent possibilities:

- Could there be a 50% chance that the next bull market will happen over the next 8 months?

- Could there be an 80% chance that the next bull market will happen over the next 18 months?

- What will happen when interest rates hit their peak? What will happen when central banks decide that the inflation ceiling has been reached? What if interest rates need to drop again? How will the market react?

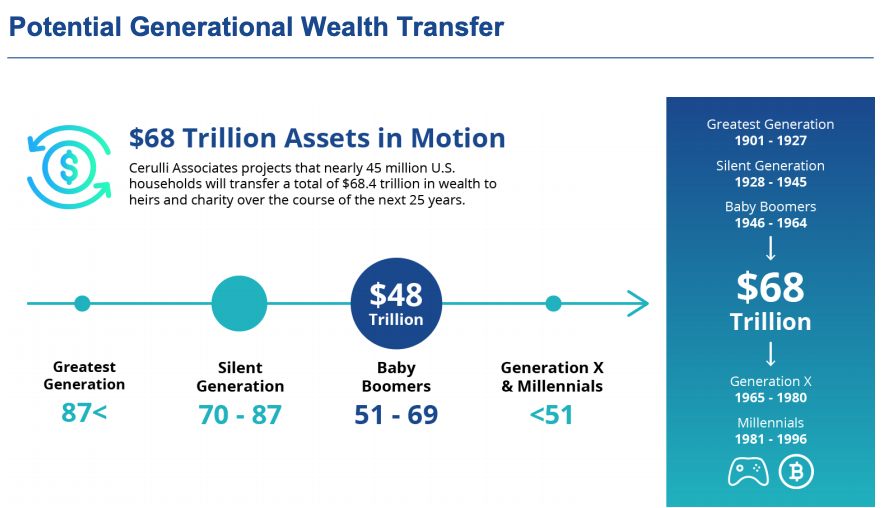

- Given that the baby boomers are the richest generation ever, what will happen when the greatest wealth transfer in human history gets underway? What will happen when $68 trillion worth of assets start to move?

Source: Gabor Gurbacs on Twitter

Indeed, these are mind-blowing questions. And the long-term consequences are huge.

Now, are you still waiting for the market to bottom out before you start investing? Do you want to feel positive before you commit? Are you watching to see what the rest of the crowd does before you do anything?

Be aware: the clock is already ticking. The cycle is already moving along. And the window for a contrarian and counter-cyclical investment strategy will only remain open for so long.

In the words of Warren Buffett: ‘I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.’

Indeed, this bear market has set the bar lower than usual — giving courageous investors the chance to buy into value assets at fantastic discounts.

Sooner or later, the tide will turn. And the bull will make a sudden comeback, trouncing the bear.

You’d better be ready for it.

The bottom line

Warren Buffett has some wise words to share: ‘I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.’

So, if you’re wanting to protect and grow your wealth, you need to embrace contrarian thinking right now.

Quantum Wealth Report is our premium news subscription. We are dedicated to exploring financial and investment opportunities around the globe that the typical investor could access.

When you sign up today as a member, you get these benefits immediately:

Get started and receive your first Quantum Wealth Report today:

Start Your Subscription: NZ$37.00 / monthly

Start Your Subscription: NZ$37.00 / monthly

Start Your Subscription: US$24.00 / monthly

Start Your Subscription: US$24.00 / monthly

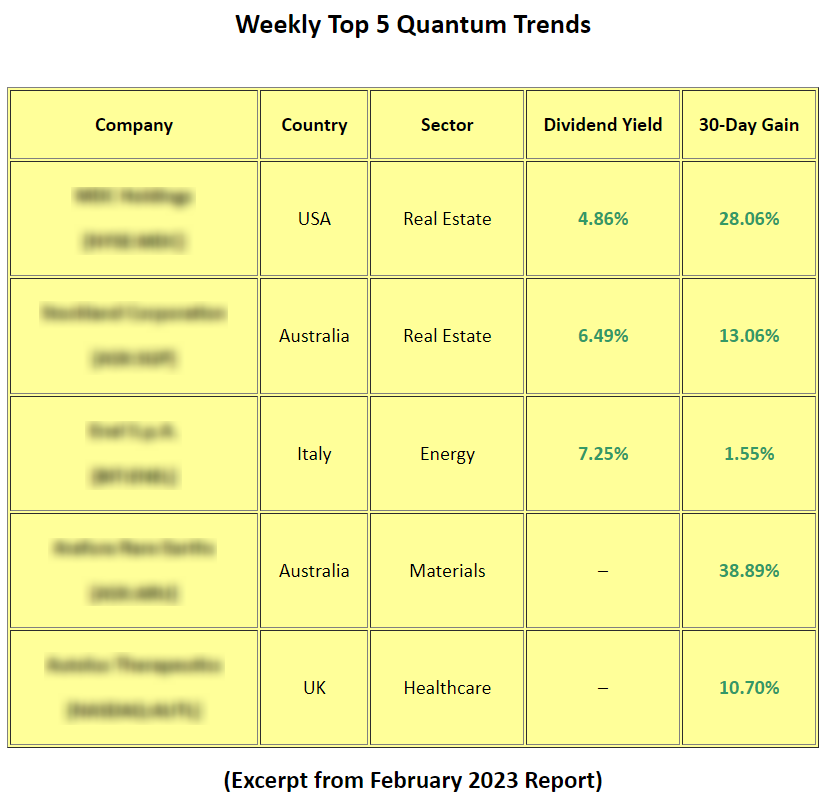

Here’s a taste of the quantum trends that we are seeing on the horizon:

- Baby boomers are healthier and wealthier than any generation before them. They are defying the demographic cliff as they transition into the next phase of their lives, embracing new tech that is helping them to prosper and thrive.

- We are experiencing inflation worries and supply chain disruption. But this is creating an extraordinary opportunity to buy into undervalued property businesses that the mainstream media isn’t telling you about.

- Manufacturing shocks have exposed the global demand for key metals. The world is hungry for minerals to build critical infrastructure. The next commodity boom may be happening sooner than you think.

- Peak Oil is predicted to happen in the next 15 years. As we move away from our reliance on fossil fuels, there could be a lucrative boost in speculative clean-energy opportunities.

- As inflation increases, the banking and insurance industries may weather this storm better than most. Their business models are defensive in nature and rich in dividend yield. Potentially, this makes them ideal for investors searching for resilient value.

Rest assured, we will be covering all this and more in your Quantum Wealth Report.

This could be your moment of moments.

To defy the trend. To empower yourself. To show courage.

You only really have two choices: act decisively now…or live to regret it in 18 months’ time.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Login

Login Managed Accounts

Managed Accounts Quantum Wealth

Quantum Wealth

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.