Quantum Wealth Summary

- Becoming ‘work optional’ means generating as much income as possible from your capital.

- It also means growing your capital and investing it as efficiently as possible.

- Expensive housing markets can tie up capital. They can prevent more people from becoming financially independent.

- In today’s research, we look at a leading energy company with a dividend approaching 10% and potential growth prospects.

- We look at the benefits of assembling a portfolio for income, growth, and financial freedom.

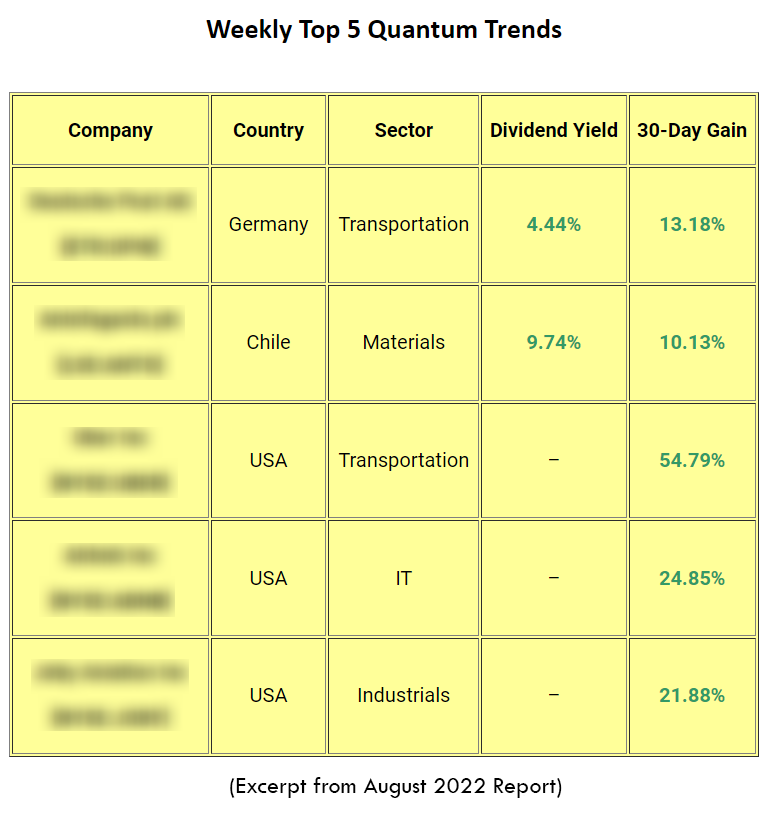

- And we cover the top-5 Quantum Wealth trends we’re seeing across the world’s financial markets this week.

I’ve been investing in financial markets since I was 17.

As the years go by, you find yourself distilling the reasons for what you do. And most of the best reasons come down to relationships. You want more time to spend with family and friends.

For me, the greatest outcome of an investment strategy is to become ‘work optional’. This means your portfolio generates enough passive income that you can decide the work you want to do — or retire completely.

I reached the early stages of this scenario some time ago. Yet I choose to keep working quite long hours. Because I see a purpose in helping others develop portfolios that can provide this freedom to them as well.

Of course, that’s a very difficult process. This world is not a stable one. Markets bounce around like ships in rough seas. You have to navigate opportunities for the long run and have faith that matters like inflation and war will resolve.

Here in New Zealand, our housing market actually disadvantages investors

It makes becoming ‘work optional’ more difficult than, say, in many parts of the United States.

I bought my first home in 2000 in Auckland for around $200,000 when I was in my mid-20s.

Today, that home is reportedly worth over $1.2 million. And the home I currently live in, potentially over $3 million.

The problem with this equation is that capital gets tied up in expensive housing. Most New Zealanders have the lion’s share of their wealth in their own home — or perhaps a rental property or two.

This capital may be inefficient on the road to becoming ‘work optional’ and financially free. Capital in housing provides a roof over your head — or if used as a rental, a very low net yield compared to other potential investments.

But you are a Quantum Wealth reader…

You likely have more capital than most and are wondering where you can generate more income.

You want to know where you can most efficiently use your capital to create a better life.

Well, if you’ve been reading for any length of time, you’ll have seen some ideas.

Here’s another one with potential beyond these shores.

During times of high inflation, energy and utilities are a good place to look for robust income. Some of these companies have great yields.

Unfortunately, a good many of them seem expensive. For example, Contact Energy [NZX:CEN] offers a dividend over 6% p.a. But the stock’s P/E is currently over 30. Meaning it could take you 30 years to pay off this investment unless earnings increase.

But what if there’s a large energy generator that actually appears undervalued? Where you could get a high dividend at a reasonable price? And where there’s the potential for some recovery growth?

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.