Quantum Wealth Summary

- The British pound is at its lowest point in a generation, relative to the US dollar. This means that the UK may be the most undervalued market in the developed world. Is it time to take advantage of this opening?

- One British company has a strong and resilient presence in financial services. It is presenting excellent value, paying a dividend of 7%. Could courageous investors who seize this chance stand to benefit over the long-term?

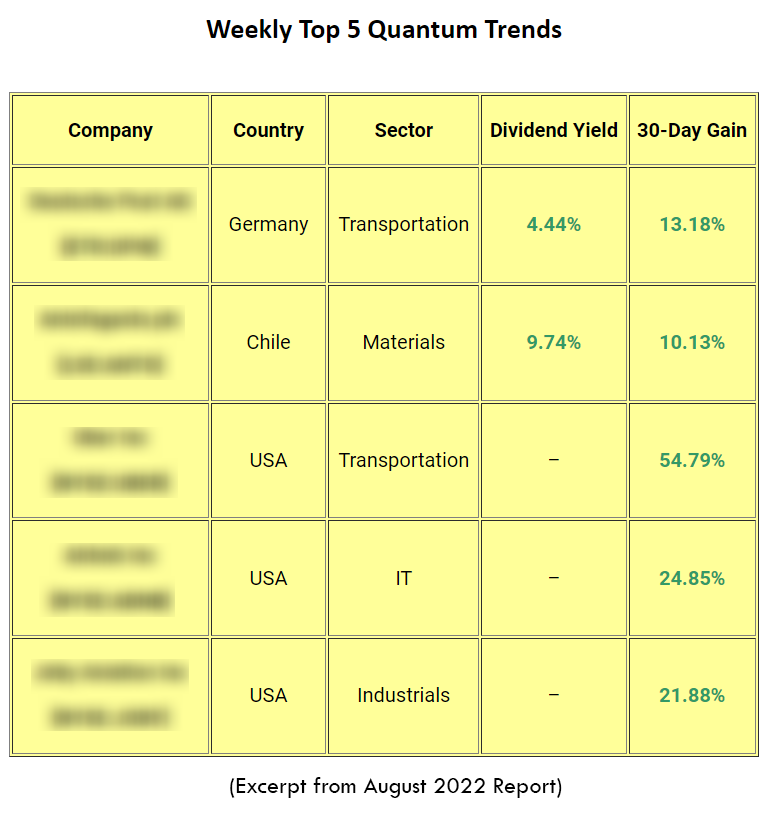

- As a bonus: we also reveal our Weekly Top 5 Quantum Trends. These are the most impactful global opportunities that we are currently watching this week.

‘The sun never sets on the British Empire.’

Growing in Malaysia, I was well aware of this legacy.

The British ruled the region for over a century — and they certainly left their mark:

- At school, I was taught the Queen’s English, and I read Enid Blyton and Charles Dickens.

- In Kuala Lumpur City, I could see the old colonial administration buildings still standing proudly. And all across the country, I could see the plantations, railways, and ports that the British had established. They formed an economic nexus that linked the past with the present.

- It was about tradition. Heritage. Identity.

Source: National Geographic

Of course, such a sweeping legacy doesn’t come without its fair share of controversy. It’s true that colonialism had a dark side. It left some problems in its wake.

For example, the racial/religious divide that continues to plague relations between the Malay and non-Malay communities. Also, the massacre at Batang Kali — labelled Britain’s My Lai — remains haunting.

Still, if we choose to put raw emotion aside, it’s clear that the impact of British rule has been largely positive and incredibly uplifting:

- When they granted Malaysia independence, they did so in a clean and orderly way. They left the country with a functioning parliamentary system, a skilled civil service, as well as sprawling infrastructure. Everything a fledgling nation would need to survive and flourish.

- Also, credit where credit’s due — British-led Commonwealth forces managed to confront and defeat a home-grown communist insurgency. It’s a triumph that’s made all the more remarkable because America failed to do the same in Vietnam.

So, it’s for these reasons and more that many Malaysians continue to hold a nostalgic, rose-tinted view of Britishness.

For example, the vast majority of my childhood friends have chosen to pursue their university studies in the UK. Several have even married British people.

Indeed, from Harry Potter to James Bond, from the royal family to football, Britain continues to loom large in our popular imagination. It is a cultural superpower, with an extraordinary presence that shapes our past, present, and future.

Source: Sky Sports

Of course, these days, it’s become fashionable for cynics and pessimists to say that Britain is exhausted. Finished. No longer a credible nation.

This sentiment seems to have become even more strident since the passing of Queen Elizabeth II, who was arguably Britain’s greatest diplomat during her lifetime.

For the critics, closing the curtain on the Elizabethan era is akin to closing the curtain on Britain itself.

But to have such a negative and defeatist mindset is to overlook the truth. Here are some key facts:

- The UK is the sixth-largest economy in the world.

- The UK is the third-largest recipient of foreign direct investment.

- Its capital, London, is the second-largest financial centre globally.

So, the UK still remains a force to be reckoned with. In fact, what is unique about the London Stock Exchange is the composition of it. It has an unusually high ratio of dividend-paying companies that are now sitting at relative value:

- This makes British assets diamonds in the rough — especially those companies in the finance sector that exhibit defensive qualities in this inflationary environment.

- Rational investors with keen instincts will see a weak British pound relative to the US dollar not as a doomsday scenario but a golden ticket. A strategic entry point.

- Right now, the UK may very well be the most undervalued market in the developed world. In particular, one British company has a strong and resilient presence in financial services, paying a dividend of 7%. It may be presenting a once-in-a-generation opportunity. Could courageous investors who seize this chance stand to benefit over the long-term?

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.