Crystal balls. Silver bullets.

Are you looking for them?

Well, you’re not alone. Everyone wants them as badly as you do.

Psychologically, our hunger for crystal balls and silver bullets usually manifests itself in two key ways of thinking:

- ‘I think I know what’s going to happen next…’

- ‘I think I know how to protect my wealth…’

And yet your assumptions could be wrong. No, not because you lack education or exposure. But because you’re a human being. And it’s only human to misread situations. Because of bias. Because of emotion. Because you’re swayed by what other people in your circle say or do.

Morgan Mousel, in his great book The Psychology of Money, explains it like this:

Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

Indeed. How true.

This is why some people took on a huge mortgage just as the Auckland property market was peaking — only to see house prices dip and interest rates climb, which has caused them emotional aggravation these past few months.

This is also the why some people loaded up on cryptocurrency just as the speculation was reaching a crescendo — only to see the bubble pop and damage them horribly, especially if they used borrowed funds.

It’s human to make mistakes.

That’s why we see such mood swings in the economy.

Boom. Bust.

Greed. Fear.

So…what’s the solution to all this? Is there a better way forward?

Well, of course, I can’t give you personal financial advice. But in the interest of pursuing a higher level of clarity and wisdom, I want to dig deep. I want to take some of your most pressing concerns, then give you measured insights…

Your burning questions answered

‘I’m terrified! People like Robert Kiyosaki and Harry Dent are predicting that the global economy is finished. I want to sit still. I want to wait things out.’

Mm-hm. I understand how you feel. Prophets of doom say the most provocative things, don’t they? Things that shock and scare you.

But let’s try to be rational. Let’s look to the other side of the aisle for a more balanced response.

Sir John Templeton is a legendary investor. Money magazine called him the greatest stock picker of the 20th century.

Templeton had a humorous response for people who keep waving the doomsday flag. He said that the most dangerous words in investing are, ‘This time it’s different.’

Templeton observed that people tend to overreact. They get overly greedy when the market is high, and they get overly fearful when the market is low.

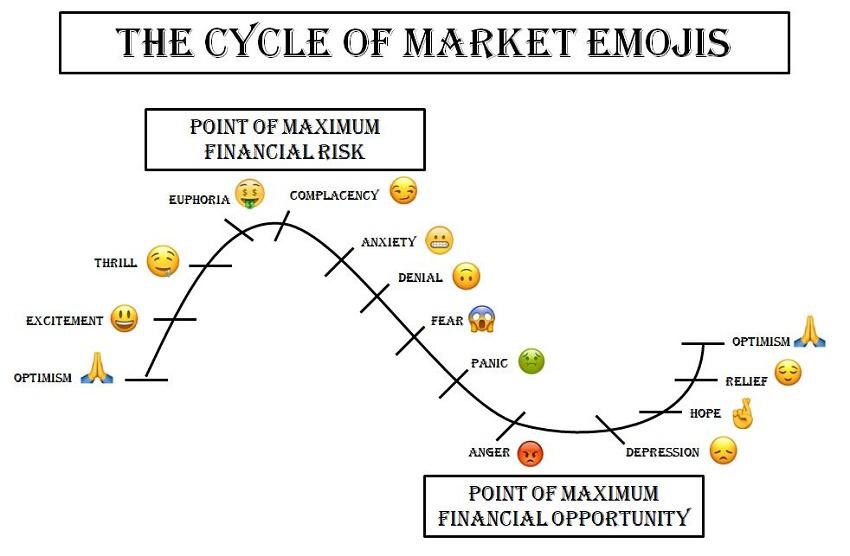

This chart sums it up perfectly:

Source: Forbes

Anxiety, fear, panic. They act as sister emotions to excitement, thrill, euphoria.

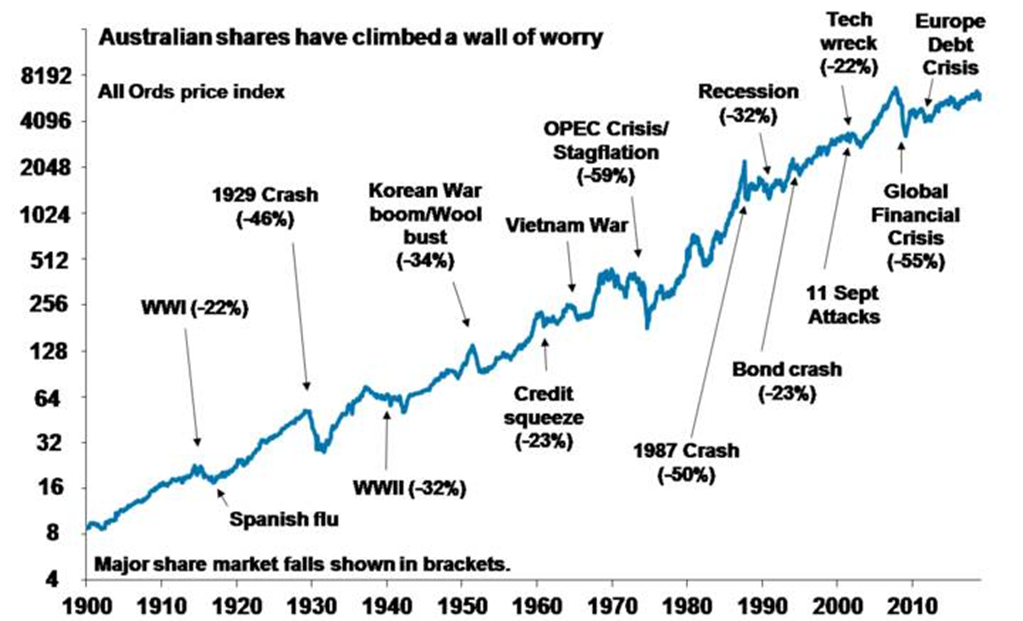

However, what history shows us is that the water eventually finds its own level. And the market soon finds its own equilibrium. This has happened despite the onslaught of disasters, wars, and recessions that we’ve endured over the decades.

Source: AMP Capital

Warren Buffett, the Oracle of Omaha, reflects on this:

‘In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.’

So…is the fear oversold? Is the fear always oversold?

Well, yes. Probably.

The folks who declare that the economy is finished haven’t had a good track record. Ever.

But…maybe aliens from Mars might invade us next month. Kill us all. Pound the economy into dust. And then the prophets of doom will finally be proven right.

However, rationally speaking, what are the odds that the sun will still be shining and the birds will still be singing a year from now? It’s probably better than you think.

‘Okay. Maybe the prophets of doom like to exaggerate. But, still, you can’t deny the amount of negativity out there about the economy. Why is there so much bad news? Surely there’s no smoke without fire?’

Well, the news is something that almost never happens. That’s why it’s the news.

Interestingly, we are the first generation in human history to have access to so many forms of media — radio, television, newspapers, social media. Unfortunately, such information overload can mislead us into thinking, ‘This time it’s different.’

Consider this. The average bull market lasts roughly five years. Meanwhile, the average bear market lasts roughly one year.

Oddly enough, people tend to notice if the market is down 20% over the course of one year. But they don’t usually notice if the market is up 80% over five years.

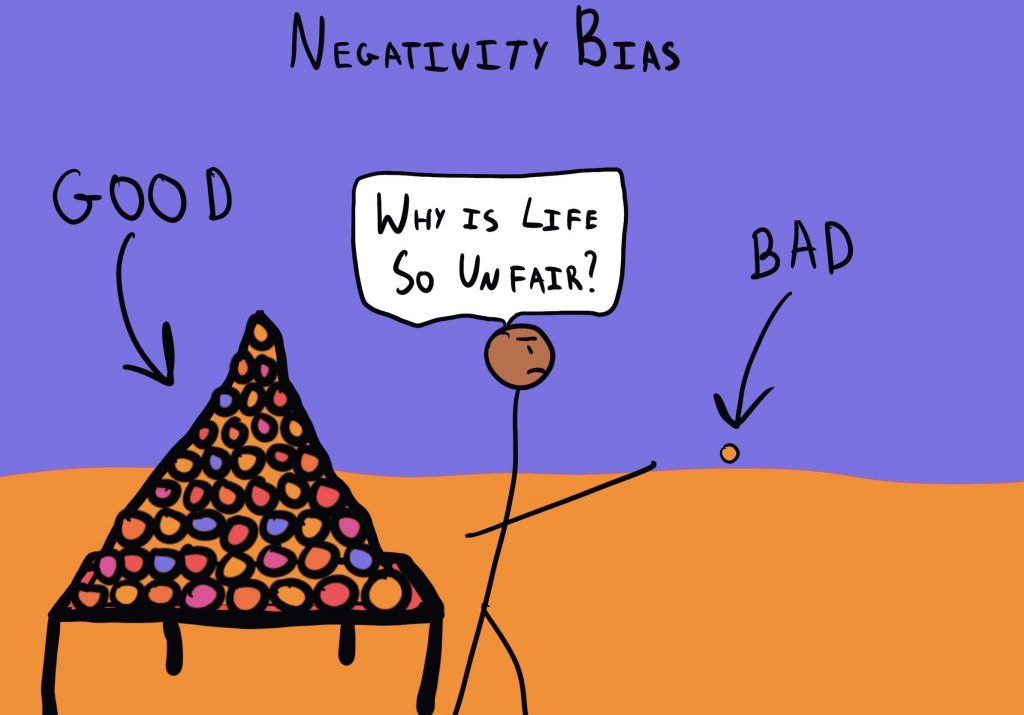

Source: The Decision Lab

It’s human nature to have a negativity bias. Meaning, we perceive bad events more strongly than positive events. And our kneejerk reaction is more immediate as well.

The people who give us the news — whether left or right — have figured out how to attract our eyeballs: ‘If it bleeds, it leads.’

Consider this: negative headlines have a 60% higher clickthrough rate than positive headlines. And negative words like ‘cancer’, ‘bomb’, and ‘war’ tend to register more with readers than positive words like ‘baby’, ‘smile’, or ‘fun’.

Well, it’s no wonder Robert Kiyosaki and Harry Dent keep pressing the fear button. It works!

‘Are you saying that I should be feeling positive about investing? Come on. Even if you ignore the alarmists like Kiyosaki or Dent, most experts seem to agree that we’re in trouble. This must be the worst time to invest.’

Ah, yes, the experts again. They’re the ones who said that Ukraine would collapse within 72 hours in the face of a Russian invasion. Did they misjudge the situation? Well, as it turns out, the Ukrainians have not only held out for over six months now, but they have actually succeeded in pushing the Russians back. Extraordinary.

Also, what about the experts who said the US dollar was finished and about to collapse? Well, as it turns out, the US dollar surged to its highest level in 20 years. This happened in April 2022, outperforming even Bitcoin this past year. Incredible.

Well, hey, there’s no shortage of opinions out there. We live in the age of 24/7 media — and we are being bombarded with more punditry than ever before.

But maybe it’s time to look past all that? Maybe it’s time to aim for more balance? More rationality? More courage?

Which brings me to my next point…

Our Investor Café Event is happening next week!

Will you be coming?

This is your chance to join other mum-and-dad investors. Have a lunchtime discussion in a comfortable, relaxed setting.

No lectures. No presentations. Just an honest sharing of views.

You get to ask Simon Angelo and I your questions. You can tell us your concerns, your fears, your uncertainties. And we’ll give you some general insights about what’s really happening in the global economy.

We’re going to discuss the current inflationary spiral and the threats and opportunities that could create:

- How far will central banks have to play ‘catch-up’ — and what does that mean for investors?

- How far could interest rates go to get inflation under control?

- Where can you invest to protect your wealth?

- Where can you gain solid income and try to keep abreast of pernicious inflation and galloping interest rates?

- What’s the future outlook for markets — and which sectors could outperform?

👉 Limited Spots Available — Book Your Seat Now!

⚡ Entry Price: $25 (Covers Lunch: Pizza and Coffee)

Level 26, HSBC Tower, 188 Quay Street, Auckland 1010

Friday, September 23, 2022

12.00pm – 1.00pm

If you have burning questions, this is the time to check in with us.

Let’s have a deep and enriching conversation.

We look forward to seeing you at our Investor Café Event!

Regards,

John Ling

Analyst, Wealth Morning

(These events provide news, commentary, and general information only on financial and economic trends. They represent the speakers’ personal opinion only. They should not be construed as any financial or investment advice. To obtain financial advice for your specific situation, please consult an authorised Financial Advice Provider.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.