How do you feel about connecting on Zoom?

A few weeks ago, I had to attend a Zoom meeting with 38 people.

It wasn’t a subject of great interest. I confess I found myself tuning out. And investigating what happened to the Zoom Communications [NASDAQ:ZM] share price.

Uh-oh. Had you invested in Zoom at the height of the pandemic recovery in October 2020, you’d have seen the stock crumble from ~$550 to around $85 today.

At a price to earnings ratio over 25, it still seems expensive.

I’ve never liked the business. Or substituting face-to-face communication with screens.

Sure, it’s necessary if people are out of town. But that call I mentioned earlier? All the participants were in Auckland. We’d have been far more engaged in person.

Zoom is like substituting a nice café brunch with a bad frozen meal. Like one of those I unwittingly bought when living in Europe. Only to later learn it contained horse meat.

So, with the pandemic in our rearview mirror — though the economic overhang is to be discussed — we’d like to invite you to our next event…

The Investor Café: Inflation’s Revenge

Like many in the markets, I want to believe that central banks will soon have inflation under control. Because unemployment is so low, a harmful recession seems improbable.

This implies:

- Good companies will continue to recover and grow. So will their share prices and dividends.

- Real estate should hold its value now that interest rates have stabilised.

- Investors can start looking for growth opportunities.

But it’s a question of what your view is based on.

Unemployment, at least here in New Zealand, may not be as low as we think. Underutilisation means many people aren’t reaching their economic potential.

On one hand, I hear about dire shortages of nurses, hospitality workers, and fruit-pickers.

On the other, I hear of people applying for over a hundred desk-based jobs. And getting only one interview.

The published unemployment rate by Stats NZ is 3.3%.

This number is based on face-to-face and phone interviews with a sample of 15,000 people. They’ve been selected to take part in the Household Labour Force Survey for two years.

Here’s what it takes to count as unemployed:

- Not have done any work — including part-time.

- Be available for work in the week surveyed.

- Have actively sought work in the four weeks before the survey.

- Have applied for a job or inquired about work in this time.

Though the method is internationally standard, it’s quite a high bar. It doesn’t count large numbers of people who may be underemployed or underutilised.

The other way to look at this is the number of people on Jobseeker Allowance.

As of July, the proportion of working-age people on an unemployment benefit was 5.4%.

Since you need to be down to around your last $8,000 in savings ($16,000 for a couple), by definition people on Jobseeker haven’t accumulated huge savings. Likely they’ve experienced lower-paid work.

Finally, there’s the underutilisation rate. For me, this is the most useful number when considering the efficiency of an economy. In New Zealand, this is around 9.2%.

It would seem there’s low unemployment amongst those in hard, real jobs that are not in the highest pay quartiles. From fruit-picking to plumbing to nursing.

But if you want to sit at a desk and earn into six figures, there’s a much higher chance of being underutilised.

What this means is don’t rely too much on positive unemployment numbers when mitigating the risks of inflation and recession.

Instead, look at what’s happening to real prices and company earnings.

Home prices here in Auckland look to have fallen 15%. Add in inflation at around 7% and that’s a real fall of 22%.

If interest rates have to go much higher, falls could be deeper. It appears they will have to.

Yet, globally across the businesses we monitor, I’m also seeing many company earnings hold up reasonably well.

Pent-up-demand from the pandemic — along with supply and labour constraints in key areas — have increased prices. And companies in strong positions are able to increase their prices to sustain, if not grow margins.

The big question now is how far central banks will have to hike up interest rates to tame inflation?

Clearly, many have failed their inflation targets by a long shot over the past 18 months.

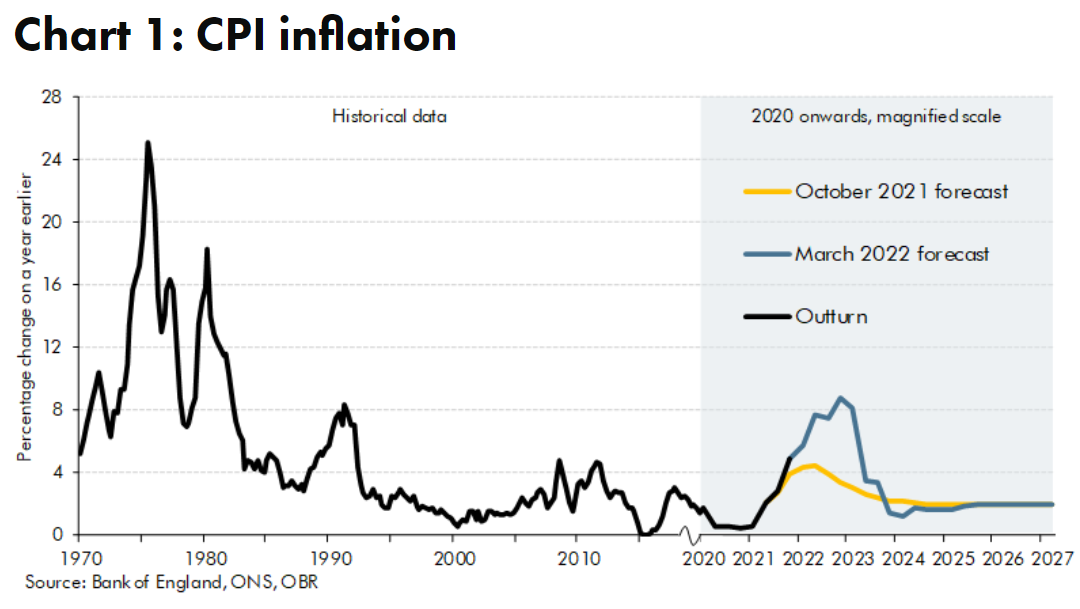

If we look at one of the worst cases — the UK, inflation was estimated at 10.1% in July. Citicorp predicted this would reach 18% in early 2023.

This takes us back to the oil shocks of the 1970s:

What the investment bank is saying is that the central bank is way behind the curve. And by necessity, interest-rate hikes will go far higher than anything they’re currently predicting.

This trend would apply in New Zealand, too, particularly given the risk of external shocks in a much smaller economy.

As with the pandemic, the conservative economists at these banks appear to have been too slow to pull on their pants. And now we are all exposed.

Here in New Zealand, we’re starting to see a shift. Kiwi investors are being forced to become more sophisticated.

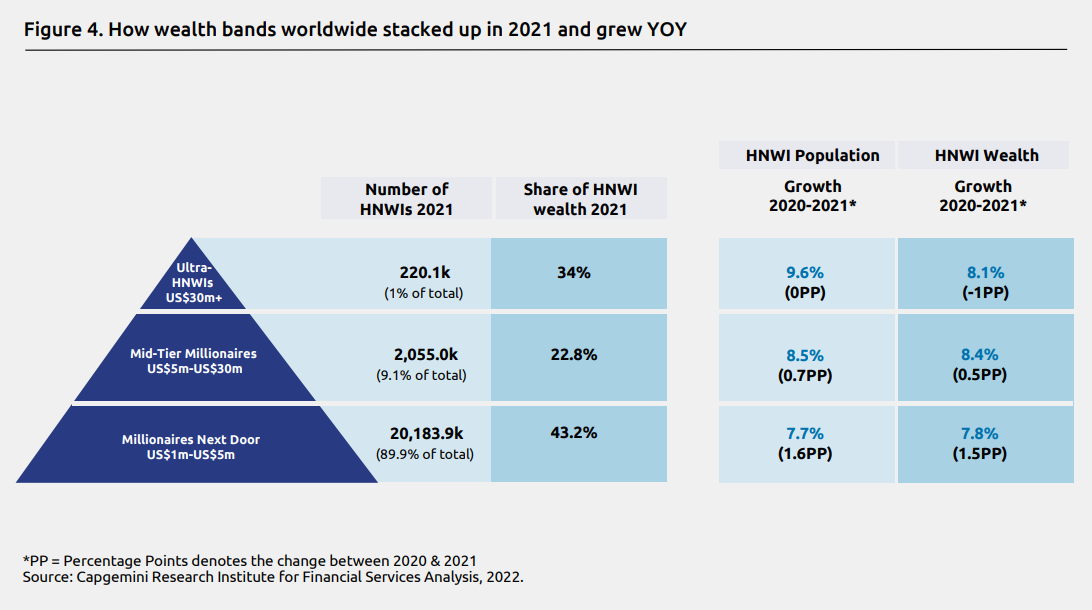

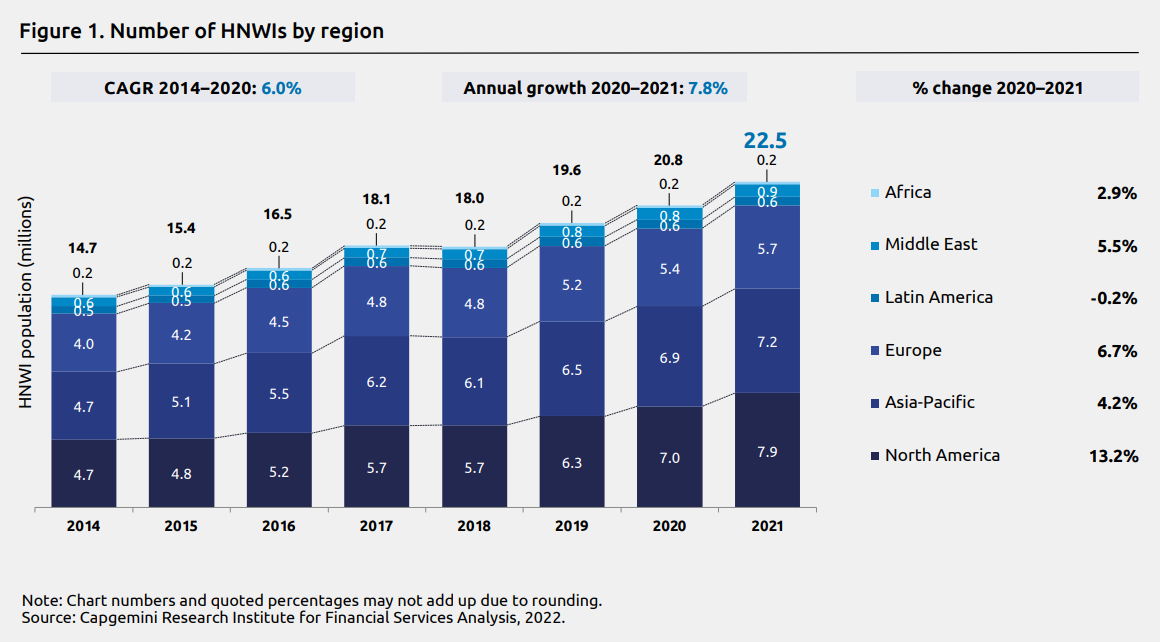

We’ve seen this with HNWI investors worldwide. They’re building the lion’s share of their wealth in equities — shares in business. Not in property.

The vast majority of these are ‘millionaires next door’. Mum-and-dad investors. There are over 20 million of them worldwide:

Here is how these investors, on average, allocate their wealth:

In our Investor Café event in September…

…we’re going to be covering why is inflation so deadly to wealth…

…and how can you fight back!

I’ll share with you some experiences from my friends in Argentina. The inflation nation.

In the US, the Fed has already been more hawkish than expected on interest rates vs inflation. So, too, has Adrian Orr here.

We’ll be discussing:

- How far will central banks have to play ‘catch-up’ — and what does that mean for investors?

- How far could interest rates go to get inflation under control?

- Where can you invest to protect your wealth?

- Where can you gain solid income and try to keep abreast of pernicious inflation and galloping interest rates?

- What’s the future outlook for markets — and which sectors could outperform?

Right now, we’re seeking expressions of interest for what may become a series of regular economic discussion events.

👉 Could you please complete the quick survey here and let us know your preference for days and times?

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.