Violence. Disaster. Scandal.

Have you ever noticed how much bad news there is out there?

More importantly, have you ever noticed how much bad news you actually consume each day? Is it impacting your wealth without you knowing it?

Well, by my estimation, somewhere around 70% of the news reports in the mainstream media today are bad. And that number creeps closer to 100% if you follow outlets that are more partisan.

Consider these emotionally loaded stories, which keep hitting you like a sucker punch:

- ‘Climate change catastrophe!’

- ‘Ever-present threat from Covid!’

- ‘Danger from Russia!’

- ‘Danger from China!’

- ‘Wokeness and cancel culture have taken over!’

- ‘Black lives matter! Defund the police!’

- ‘Trump matters! Defund the FBI!’

Good grief. It’s enough to drive anyone nuts, isn’t it?

Of course, such melodrama isn’t a new thing. It’s been happening since the late 19th century:

- Back then, American newspaper barons like Joseph Pulitzer and William Randolph Hearst discovered a magic formula: ‘If it bleeds, it leads.’

- Basically, if there’s violence, conflict, or death, you can bet your bottom dollar that it will draw eyeballs. And eyeballs lead to higher sales.

- What Pulitzer and Hearst pioneered became known as ‘yellow journalism’ — sensational stories with lurid headlines, designed to shock and awe.

Source: INSH

Source: INSH

In the latter half of the 20th century, there was a brief period in time when Americans enjoyed some relief from sensationalism. Between 1949 and 1987, the Federal Communications Commission enforced a ‘fairness doctrine’. Here’s how it worked:

- By law, controversial issues of public importance needed to be presented in a fair and balanced manner.

- To achieve this, contrasting viewpoints would be delivered through news segments, public affairs programmes, and editorials.

- For example, a left-wing opinion would be challenged by a right-wing opinion, often within the same media outlet.

- In this way, citizens were exposed to contrasting viewpoints, allowing them to make more informed decisions.

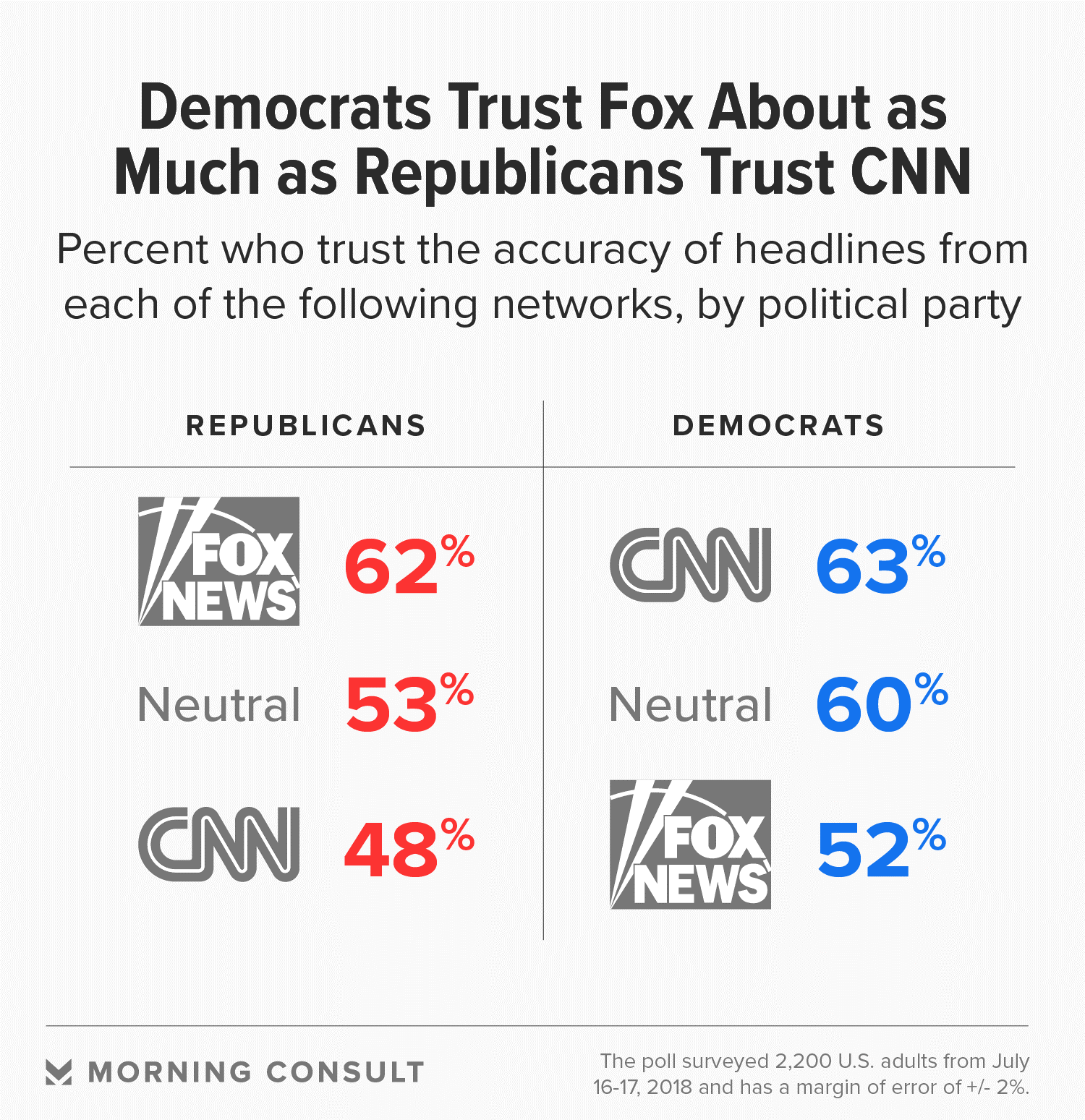

Sadly, the fairness doctrine ended in 1987. And since then, we have experienced a more polarised and fragmented media landscape:

Source: Morning Consult

Indeed, the news has become more competitive and adversarial in recent years. And to make matters worse, our attention spans have shrunk dramatically.

We are more restless and fidgety than ever. And like drug addicts needing an ever-increasing dopamine fix, we find ourselves drawn to headlines that have grown more flamboyant and more exaggerated.

24/7 media invites us to doomscroll at all hours of the day, to our detriment.

On televisions. On computers. On smartphones.

In the words of Doc Brown from Back to the Future: ‘Great Scott!’

Are we addicted to bad news?

Well, it’s all about our subconscious mind.

It’s like an iceberg. You’re only seeing the tip of it.

In Canada, researchers Marc Trussler and Stuart Soroka tried to understand our subconscious relationship with the media:

- They invited participates to take part in a study that involved ‘eye tracking’.

- To achieve this, they set up a camera to measure how participants read articles on a news website.

- What they discovered was stunning. When given the choice between bad news and good news, participants always picked up on the bad news first. Even more remarkably, participants spent more time and effort reading stories with a negative tone.

- Later, when the participants were interviewed, they insisted that they preferred stories with a positive tone rather than a negative tone. The participants also complained that the website was too negative — even though they had intentionally sought out bad headlines. What a contradiction!

In the Netherlands, researchers Ap Dijksterhuis and Henk Aarts carried out another experiment:

- They invited participants to view a series of positive words and negative words being displayed on a computer screen.

- After the test, participants were asked if they could recall and categorise the words they had just seen.

- Incredibly enough, the participants appeared to recall negative words like ‘cancer’, ‘bomb’, and ‘war’ more than positive words like ‘baby’, ‘smile’, or ‘fun’.

The Washington Post has also done its own research, with intriguing results:

- Nearly 70% of Americans say they feel overwhelmed by the news.

- 56% of Americans say the media stresses them out.

- Yet — believe it or not — negative headlines have a 60% higher clickthrough rate.

The bottom line

Well, it’s clear: as human beings, we are suckers for punishment.

It seems that we have an inbuilt negativity bias.

This is why we love watching true-crime documentaries or horror movies. Or even riding roller coasters. On some subconscious level, we crave the adrenaline rush. We love to be frightened. We love to be entertained.

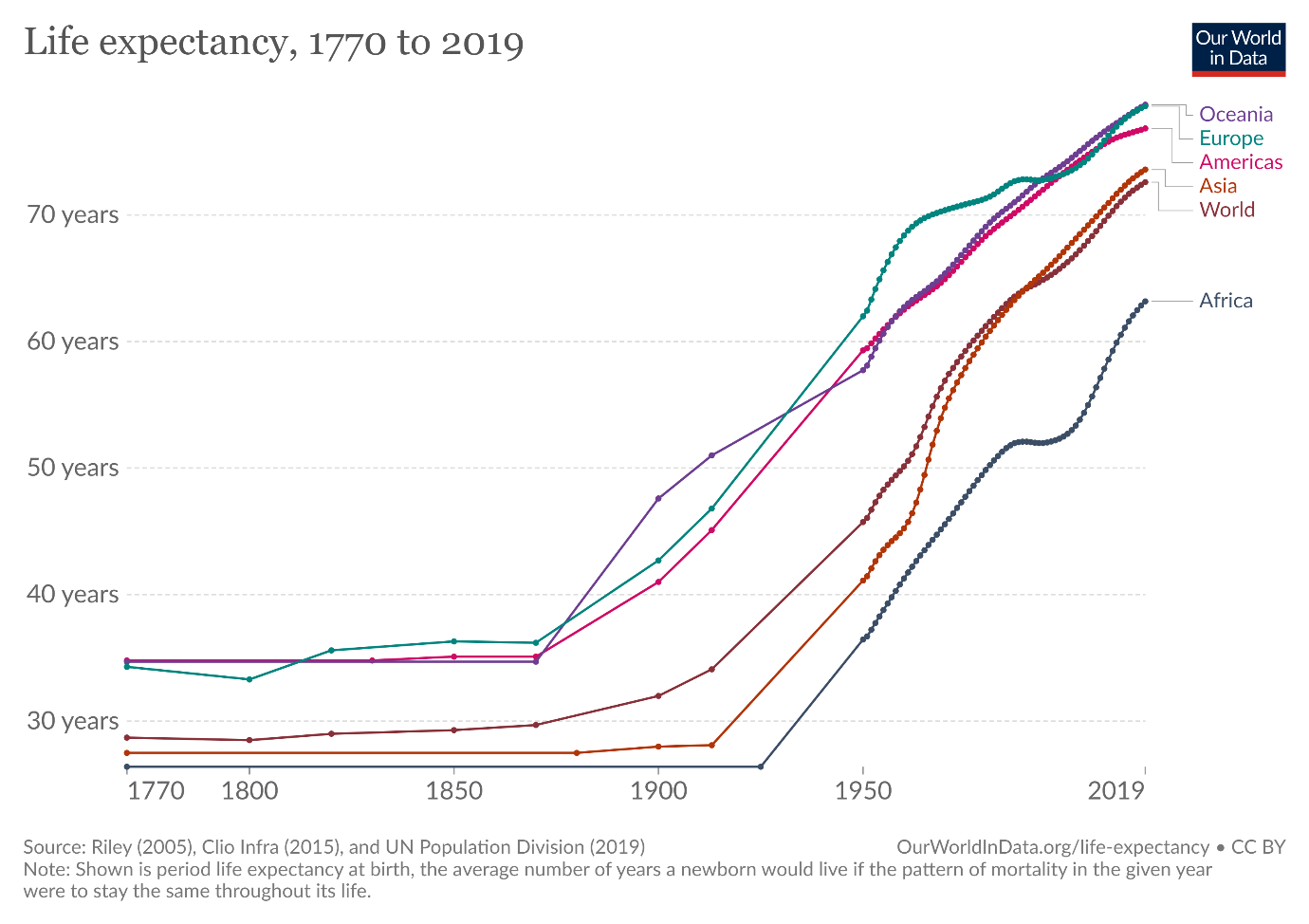

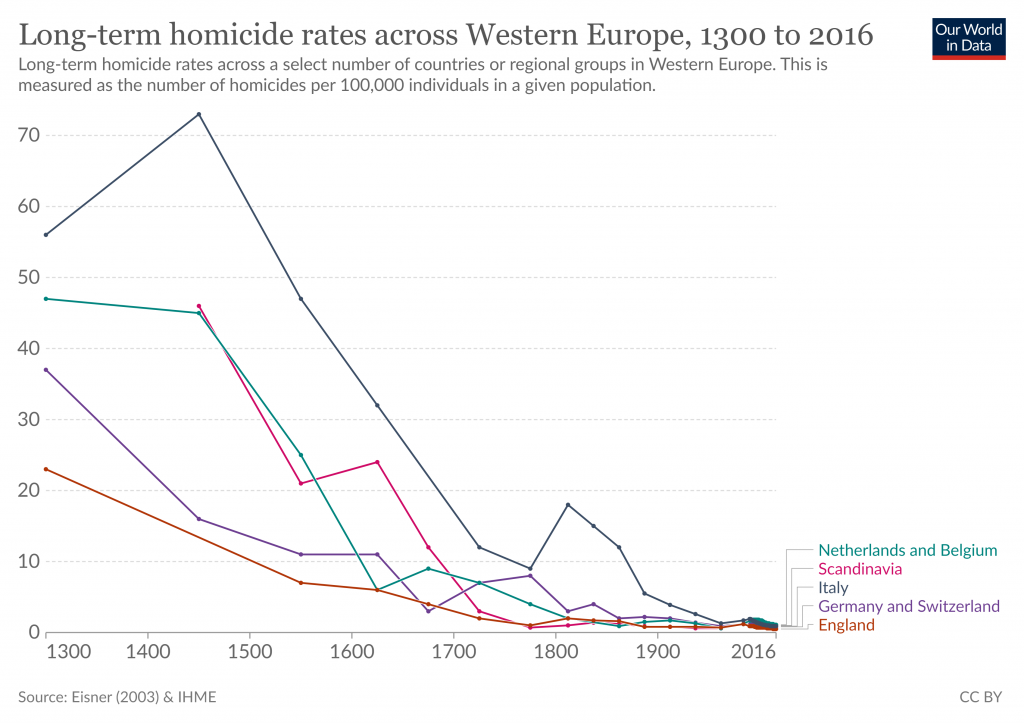

But strip away the sensationalism and melodrama. You might be surprised to discover that the human race is actually becoming happier, healthier, and more productive in the long run:

Source: Our World in Data

Source: Our World in Data

- In 1770, the average life expectancy of a human being was around 35. In 2019, it’s well over 70.

- In 1820, the number of people living in extreme poverty was 89% of the global population. In 2015, it’s only 10%.

- In 1800, the number of people who couldn’t read and write was 88% of the global population. In 2016, it’s only 14%.

In other words, positive improvements that happen across generations take place at a slow and steady pace. These events are not perceptible in the short-term, so we don’t give them as much credit as we should.

Positivity is not entertaining. Positivity is not newsworthy. But positivity is perhaps more factual than negativity.

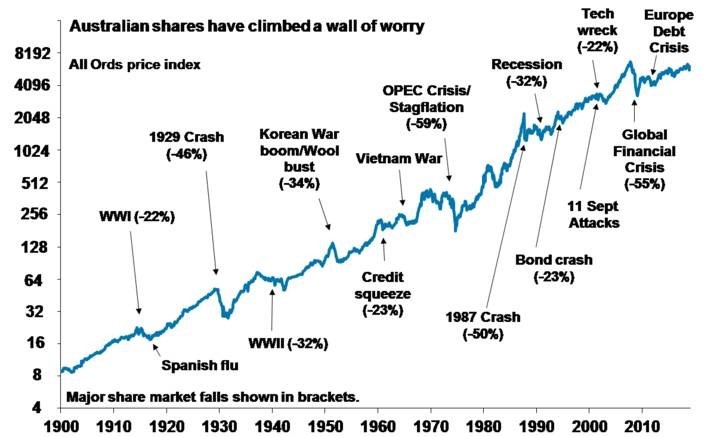

Likewise, the process of building wealth works the same way. The running joke is that economists have predicted 9 out of the last 5 recessions — and they almost always misjudge the length and severity of crisis events:

Source: AMP

So…have you ever noticed how much bad news there is out there?

More importantly, have you ever noticed how much bad news you actually consume each day? Is it impacting your wealth without you knowing it?

Indeed, the headlines put fear in you.

Therefore, you fear to invest.

Therefore, you fear to make a decision.

But in the words of Peter Lynch: ‘Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.’

So…maybe it’s time to look past your fear? Maybe it’s time to free your mind? Embrace the long-term prosperity that you deserve?

Here at Wealth Plan, we are helping our Eligible and Wholesale Clients regain control of their destiny by building a roadmap to financial freedom.

From farmers to small business owners to property investors, we understand their hopes and fears. And we’re showing them how to transform and optimise their money so they can reach their desired destination.

We are now offering guidance in the following areas:

- Diversifying Your Wealth Base and Navigating Global Markets

- Financial Independence and Retirement Planning

- Wholesale Managed Accounts

- Wholesale Investment Consultancy

- Trusts, Structuring, and Taxation Concerns

It’s about protecting wealth. Growing wealth. Gaining passive income.

So come talk to us. We’re now offering an initial free consult for Eligible and Wholesale Clients. We’d love to hear more about your financial goals and dreams.

🌎 Click here to register your interest today.

Kind regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.