2016 was a most fascinating year. Unforgettable.

I was sitting at a trading desk in Europe as two events unfolded. Events that the mainstream, the majority, did not expect or predict.

The first was the vote in the UK to leave the European Union — Brexit.

The second was the election of Donald Trump as President.

Both brought seismic shifts to the geopolitical and economic landscape. Both presented unique opportunities in the financial markets.

Those able to predict the unexpected were better positioned.

The most compelling case for a likely Brexit was overlooked. Betting shops reported that a lot more money was wagered on ‘Remain’. Few drilled down to the actual number of bets. By quantity, rather than total sum, there were more individual bets for ‘Leave’.

Look at this position scientifically. Without bias. Here was one of the most representative polls available. A larger number of people were already ‘casting a fiver’ (their vote) on Britain leaving.

The election of Trump seemed even more of an outlier.

At first, his odds of becoming the Republican nominee seemed a joke. When he did, most pollsters predicted he would then lose the Presidential election to Hillary Clinton.

Yet, again, if you examine the facts with scientific objectivity, his success should not be so surprising.

- He was a known brand name with years of television work behind him from The Apprentice.

- He showed mastery at both gaining and manipulating media attention (though they later turned on him).

- He articulated winning issues for the Republican voter base. Controlling immigration, building a wall, and championing American manufacturing.

Most pollsters are part of the Washington DC political establishment. They did not want to admit an outsider like Trump had an outsized chance.

It was the same with Brexit. The pollsters, the pundits, were London-based. Attached to the global order of things. They could not imagine leaving the EU.

Subconsciously, the analysis and reporting we saw on both these outcomes in the US and the UK had probably become biased.

The lesson of 2016 is to find and then concentrate on the objective facts. Particularly if they are nuanced. And even if you may not like what they mean.

Implications for investors

A common question people grapple with is how to best plan for financial independence or retirement.

Of course, everybody wants to have their money working for them. They want money to draw on that is not tied to showing up at work on Monday.

Conventional wisdom is to invest savings in a way that balances rewards with the risks you’re prepared to take.

When financial markets stumble, as we saw in May, this leads many to make predictions that might be false:

- ‘Markets are falling, I’m losing money. This is not a good time to be investing.’

- ‘We could be entering a recessionary period. It will be better to have cash.’

- ‘If there is a wider market crash, the impact on my wealth could be irrecoverable.’

For some, Brexit in 2016 felt like the end of the UK. The economy would contract. It was time to dump British equities.

If we look at the factual situation, things are different:

- Some of the best buys in the markets are picked up during bear markets. That’s when Warren Buffett tends to go shopping.

- Strong companies with great assets can be temporarily underpriced. Those courageous enough to swoop could claim future growth.

- During times of inflation, some companies may be able to raise prices and maintain their value over the longer run.

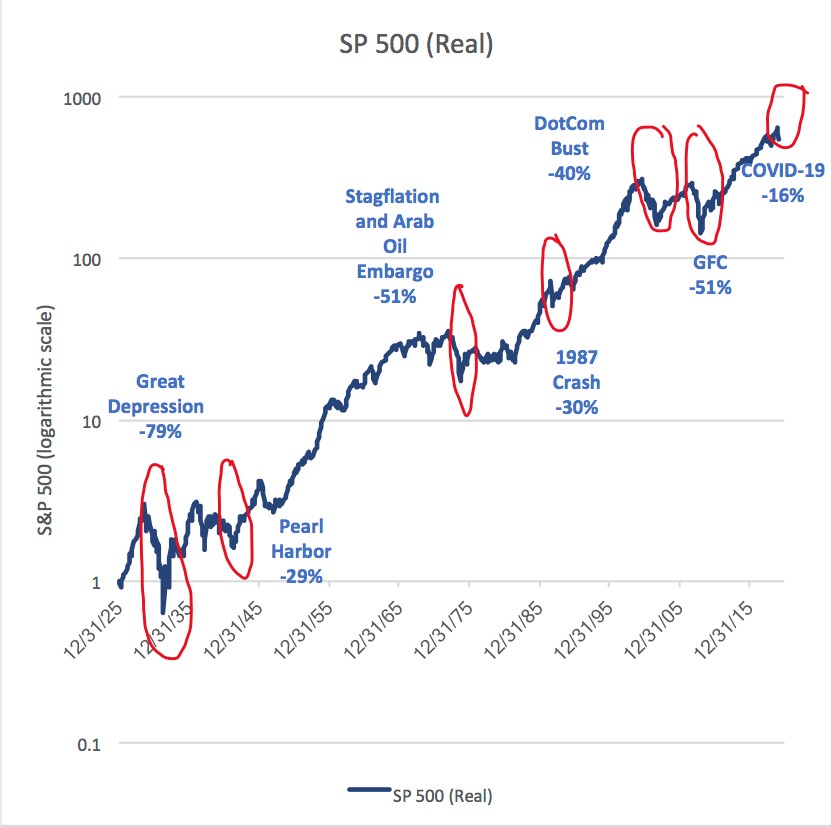

The historic position of the US market supports this. There are, from time to time, deep drawdowns. But there is also recovery. And greater levels of growth.

Source: Sensible Financial

Investing in ‘red-circle events’ can pay off. Though it takes some courage.

And, of course, past performance does not predict the future in finance.

Though it may be reasonable to assume that if an economy is growing, companies within that economy will grow too. Some more than others.

Investing for me is then finding companies that will grow and produce income over the longer term. There will be bumps along the way.

This requires putting aside your fear. Your desired outcome or expectation. And looking purely at the facts.

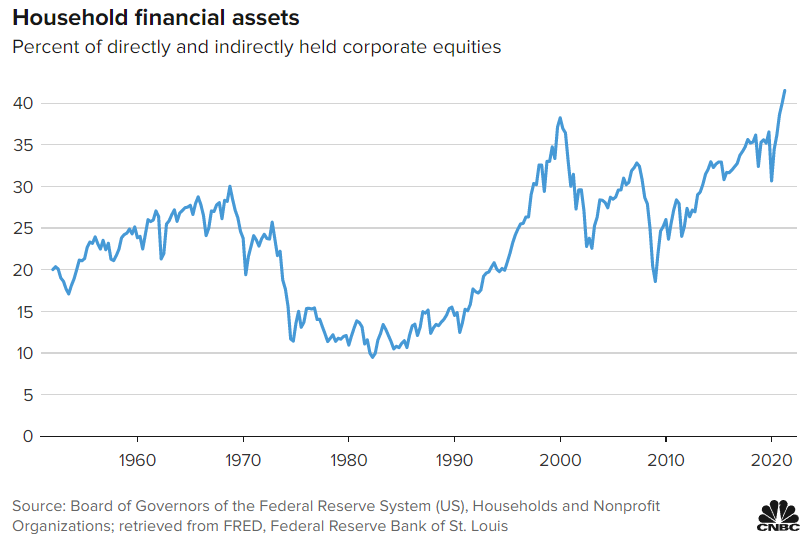

US households recently posted the highest levels of wealth ever at over $141 trillion.

According to the Federal Reserve, a full 41.5% of this wealth was in equities.

Source: CNBC

As they say, ‘money goes where money grows’.

What this means for markets going forward is that rises and falls may be taller and deeper.

Wealth in stocks is magnified. More than ever, you want to understand the stocks you own and buy. Their outlook. And income.

The bottom line

In 2016, a bet on Brexit or Trump would have paid great odds.

I would wager a bet on quality companies during this — or the next market drawdown — could also pay off nicely.

It is these sorts of companies we’re reporting on in our Quantum Wealth Report. I encourage you to take a look.

It pays to stay curious.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.