‘A stitch in time saves nine.’

You don’t need me to tell you this. Infrastructure in New Zealand could use some work.

Northern Auckland is one of the fastest growing areas in the country. Yet the key connection to Auckland city, across the Waitemata Harbour, often becomes a long car park. Tuned to talkback radio.

So there was going to be a walking-and-cycling bridge added at a cost of around $785 million.

After spending $51 million on ‘feasibility’, we now find that, structurally, it may not be a good idea.

Proposed additional structure for walking and cycling. Source: McConnell Dowell

What is needed is another connection to manage the 170,000+ daily vehicular crossings. While also enabling other transport choices.

Improving the daily productivity of around a quarter of a million people could surely lift economic growth.

Over the past 25 years, the rate of return on such public infrastructure investments has been shown to range from 15% to 45%.

As with any investing, the long-run return comes down to quality. A new bridge attachment unable to take vehicles in a rainy city was never going to cut it, was it?

Now there are new plans to ‘enable housing supply’ across Auckland. Will massively increasing density across an active volcanic field without the requisite infrastructure end well?

Fortunately, investors have some options. They can vote for parties that have a more reasoned approach. And they can benefit from investing in private infrastructure.

One listed infrastructure business that has produced excellent returns over the years is Infratil [NZX:IFT] [ASX:IFT].

While the risk profile may have increased somewhat, there has been a good run of growth and income:

Source: Google Finance

The 170% growth in the share price over the past five years indicates annualised growth of 34%.

Then there are dividends, currently projected at just under 3% p.a.

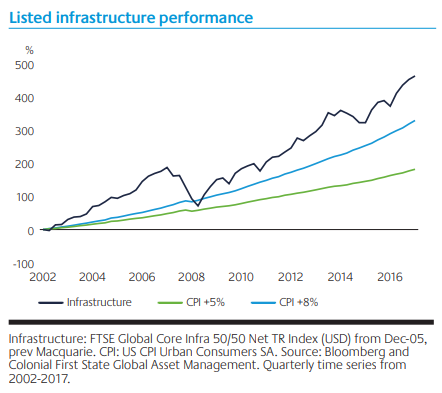

A key benefit of investing in infrastructure businesses these days is their ability to provide a hedge against inflation.

One study by Colonial First State found that 70% of assets owned by listed infrastructure companies have the ability to pass through the impacts of inflation to customers.

For this reason, they found that global listed infrastructure has delivered returns above inflation over the long-term. When investors allow for a time frame of three years or more.

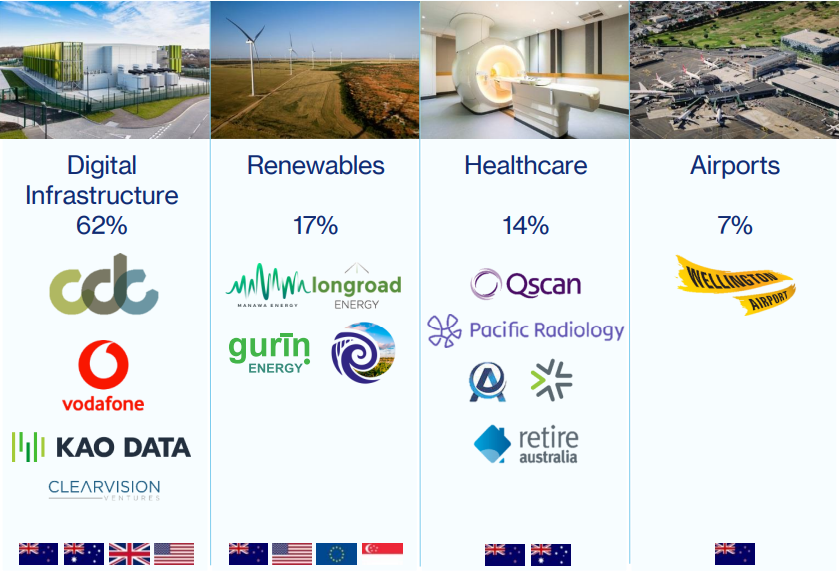

Infratil is an infrastructure-focused fund targeting four key areas:

- Renewable energy.

- Digital infrastructure.

- Healthcare.

- Airports.

As of March 2022, the portfolio looked like this:

Source: Infratil Annual Results Presentation

Recently announced full year results (to 31 March, 2022) showed pleasing progress:

- Net parent surplus of $1.17 billion.

- Proportionate EBITDAF of $513.9 million.

- Available capital of $1.67 billion.

- Shareholder return of 18.4%.

- Final dividend of 12 cps.

The Company has noted it has a pipeline of future opportunities. And the business remains committed to a ‘ten-year total shareholder return target of 11-15%’.

This could be an inflation-beating opportunity. But Infratil does present as quite expensive. The book value of the assets per share looks to be around $5.

It follows, today, at a share price around $8, investors may need to pay a 60% premium to own them.

It is also my view that the risk profile has moved up a few notches with the heavier focus on digital infrastructure. The tangible book value here is also more difficult to quantify.

We would have to rely on what has been a very good track record. Though past performance is not the future, especially in a volatile environment.

What is clear is that Infratil has done a very good job at investing in key infrastructure assets.

The government here could do well to follow their example of active investment focused on continuous development and return.

Meanwhile there are listed infrastructure businesses that may present better value. These are on the global markets. And we’ll be covering those in more detail soon for our Premium News subscribers.

Good infrastructure investment today can generate returns tomorrow. Solving problems now makes for much easier work going forward.

A stitch in time indeed saves nine — and can stop a hole in the integral fabric of a shirt, or city, becoming much larger than it needs to.

Regards,

Simon Angelo

Editor, Wealth Morning

Important disclosures

Simon Angelo owns shares in Infratil [NZX:IFT] via portfolio manager Vistafolio.

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.