Quantum Wealth Summary

- Information technology has been the top-performing sector for the past decade.

- But prophets of doom are now questioning America’s future prosperity, especially when it comes to tech innovation. Some traders are even trying to profit from a bearish outlook.

- So, which is a better strategy? Optimism or pessimism? Which yields a better long-term result?

- We take a deep dive into this situation — and we investigate whether it’s worthwhile to bet against American tech.

Want to get rich quick?

Or…at the very least…get rich quicker?

Well, according to statistics gathered by Fidelity, here’s how the top five sectors in the American S&P 500 index have performed over the past 10 years:

- Information Technology: +417%

- Health Care: +262%

- Consumer Discretionary: +230%

- Financials: +195%

- Industrials: +156%

Source: Bankrate

Of course, you don’t have to be an expert to see the obvious trend: the tech sector has been a huge outperformer this past decade.

If you had hitched your wagon to tech, obviously, you would have done very well for yourself. On average, you could have turned a hypothetical sum of $100,000 into $500,000. Or… maybe $1 million into $5 million. Ka-ching!

Of course, that’s just for starters.

Here’s what would have happened if you had picked individual winners:

- Netflix [NASDAQ:NFLX] — a return of over 1,600% since May 2012.

- Bitcoin — a return of over 8,000% since November 2015.

- Tesla [NASDAQ:TSLA] — a return of over 10,000% since May 2012.

Mind-blowing? Indeed.

Hypothetically speaking, there may well be lucky gamblers out there who have managed to turn humble investments of $10,000 into $1 million. Just by punting on the right horse, at the right time.

By comparison, the median price of an Auckland house rose *just* 164% between December 2011 and December 2021.

Respectable? Absolutely.

But adrenaline junkies who fly by the seat of their pants wouldn’t have bothered with property. Too ho-hum. They were chasing much bigger fish in Silicon Valley.

Just think about this:

- The bull run was so feverish that tech companies were racing to get listed on American stock exchanges.

- 2021 was a record year for the tech sector. Initial public offerings (IPOs) reached an all-time high of 1,035 IPOs.

- This surpassed the previous record in 2020, where 480 companies went public.

- The sentiment was buoyed by low interest rates. Easy access to debt. And, yes, FOMO — fear of missing out.

We saw greed. We saw excitement. We saw excess.

The mood was intoxicating.

But then…2022 rolled around.

And — oh boy — this is what happened:

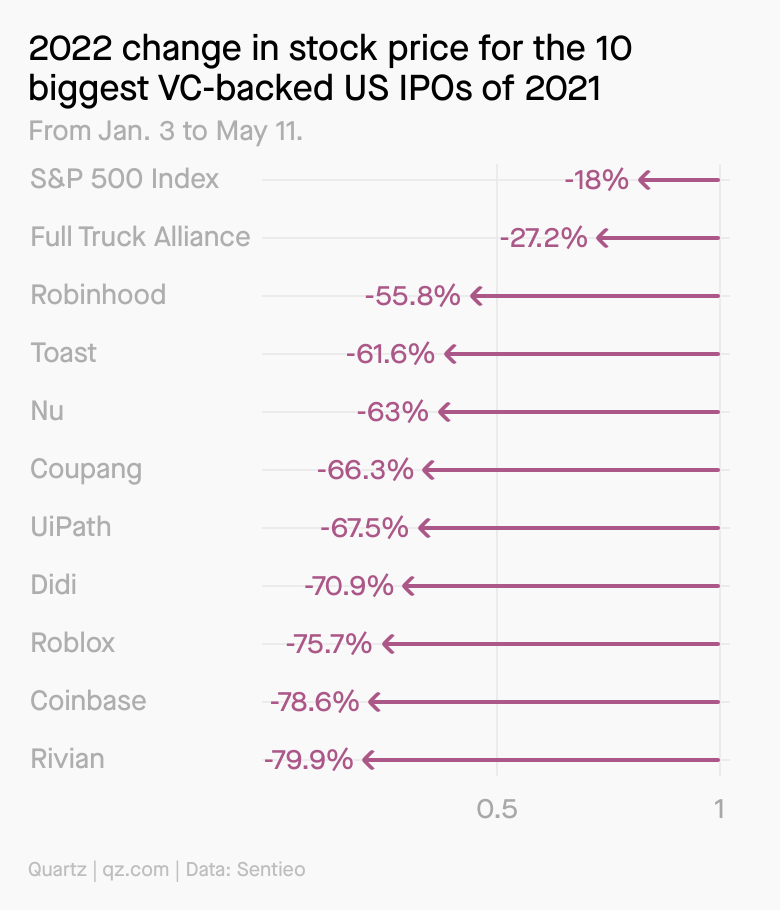

Source: Quartz

Ouch! What a heart-stopping plunge.

It’s not just the newer tech companies that have been slammed. Even older, established brands like Netflix and Bitcoin have taken a wallop, declining sharply from their peaks.

This sudden reversal of fortune is enough to agitate, if not horrify.

What was once green is now a bloodbath. A sea of red.

So…has the tech bubble finally popped? Is the day of reckoning finally here?

Well, that’s the trillion-dollar question.

Obviously, for a long time now, prophets of doom and permabears have been warning that the astronomical returns enjoyed by the tech sector were too good to last.

Stock valuations were pushed into nosebleed territory.

There was simply too much arrogance. Too much ego. Too much hubris.

Now, apparently, the chickens have come home to roost — and it’s all coming undone.

Here’s what what Dan Ives of Wedbush Securities has to say about the situation:

‘It’s a perfect storm for investors with nowhere to hide as Fed hikes, inflation, geopolitical issues and worries about a recession are abound. Tech stocks are getting crushed on this flight to safety, and it’s a bear-market mentality with the pain threshold being tested for tech investors.’

Indeed, the pain is real. As the appetite for risk shrinks, the flow of venture capital appears to be drying up. And tech companies are moving ahead with layoffs as they try to slash bloated budgets.

Here’s what we’re seeing now:

- The Nasdaq index is down over 27% so far this year. This has proven to be a nightmare for people with portfolios that are heavily reliant on long positions in tech. Everything they have is in the red. There has been much weeping and gnashing of teeth.

- But…here’s the surprising thing. People with short positions in tech are way up in the green. On average, they are enjoying gains of between 30% to 80% this year. There’s been much cheering and rejoicing.

Interestingly enough, it appears that the bears are winning big because the bulls are losing big.

But how exactly are these contrarian investors achieving such fat profits? Is this a credible strategy to follow? What are the benefits and risks of going short and betting against American tech?

Let’s do a deep dive and unravel this mystery. We want to take a critical look at how this works…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.