Quantum Wealth Summary

- A key reason my clients and I invest is to achieve financial freedom.

- In this dispatch, we look at what this means and paths to it.

- We review stocks and positions that could help prepare you for financial independence.

- We consider the risks and pitfalls you may encounter along the way.

Here in New Zealand, the median household income is around $75,000. The vast majority of this comes from salary and wages.

In Australia and the US, household income is around 60% higher.

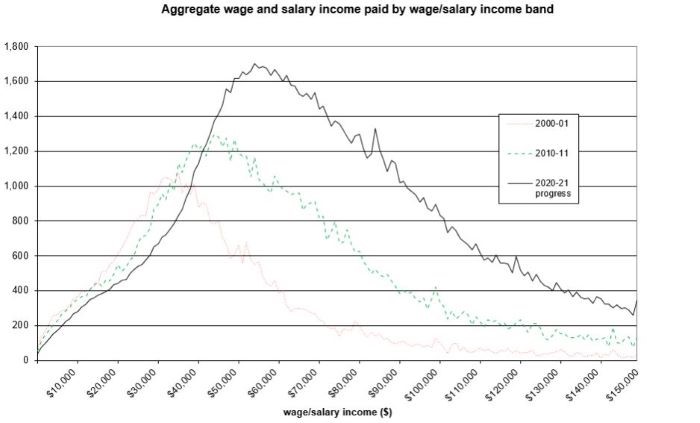

If we look at the distribution of wage and salary income in New Zealand, this appears quite close to a bell curve. The sort of normal distribution that occurs routinely across populations:

Source: IRD

Most people earn somewhere between $30,000 and $110,000. Though there is a significant tail of people who earn beyond that.

Australia — and particularly the US — see longer tails of much higher earners.

While salaries can run much higher, earnings from financial assets likely play a greater role there.

By definition, if you seek a lifestyle that enables you to afford somewhat above the average, you need to generate income over $80,000 per year. Then you need to keep this income apace with inflation.

For investors seeking this level of financial independence and beyond, the key questions are:

- What level of capital is needed to generate enough income, growth, or years of drawings?

- What level of risk are you comfortable with?

- How can you effectively balance risk with return?

- What sort of positions in the financial markets could help you achieve income and growth goals while protecting your capital?

- What other considerations such as leaving an inheritance or providing for family need to be factored in?

In essence, financial independence requires a ‘flywheel’. A source of kinetic energy that keeps running regardless. Financially speaking, a flow of money that is perpetual.

In the work I do, this means assembling a robust portfolio.

Let’s take a look at how this can be done…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.