It’s one of the greatest passages in literature.

It’s timeless. Meaningful. Profound.

It goes like this:

‘I must not fear. Fear is the mind-killer. Fear is the little-death that brings total obliteration. I will face my fear. I will permit it to pass over me and through me. And when it has gone past, I will turn the inner eye to see its path. Where the fear has gone there will be nothing. Only I will remain.’

Source: Behance

These memorable words come from a scene in Frank Herbert’s Dune.

The hero, Paul Atreides, is experiencing a moment of great pain and anguish. He’s being physically tortured. He’s on the verge of breaking down.

That’s when he recites the Litany Against Fear.

It gives him clarity. It gives him courage. And he pushes through his suffering.

In the end, he not only survives his harrowing experience, but he actually thrives.

He becomes the leader he was meant to be.

Biggest fears for 2022

Of course, we all feel fear.

Even the strongest of us.

Even the smartest of us.

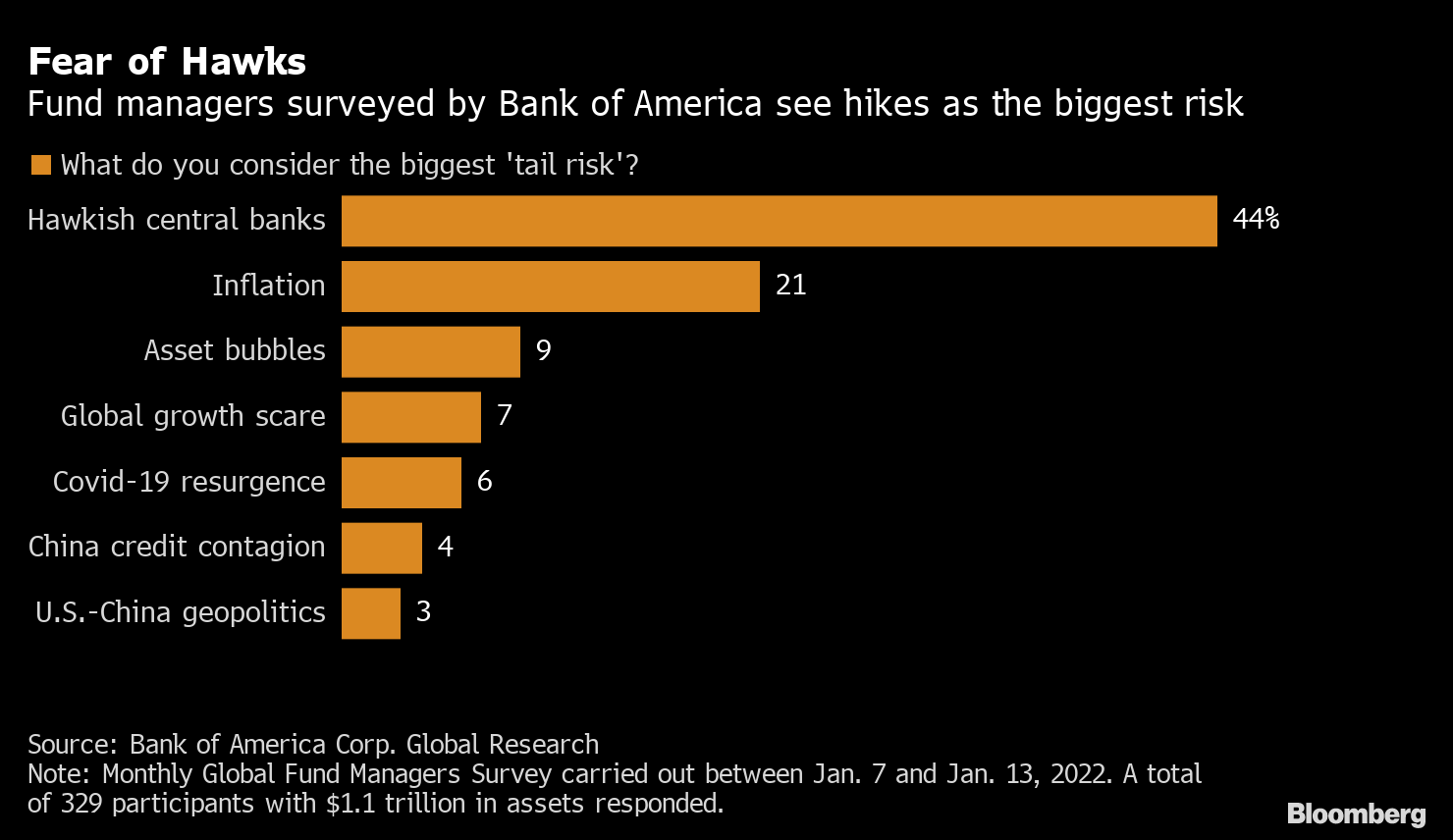

In January 2022, the Bank of America [NYSE:BAC] ran a survey with over 300 fund managers.

They were asked what they feared most as investors for the year ahead.

Here’s what the survey revealed:

Source: Bloomberg

Their biggest fear was central banks pushing up interest rates too drastically. And their next biggest fear was surging inflation.

This makes sense, doesn’t it?

These two problems are undeniably linked.

Runaway inflation is a fast-moving menace — and when central banks hike up rates, they are using a blunt tool in an attempt to smash inflation down.

But this hammer is imprecise. Inelegant. And it’s likely to cause a lot of collateral damage along the way.

This is exactly what’s happening.

In New Zealand, we’re already seeing how the prospect of rising mortgages is putting the housing market into deep freeze. Homeowners with sizeable loans are certainly feeling the pinch now. Especially those with high debt-to-income ratios.

Meanwhile, globally, we’re seeing how giants like Facebook [NASDAQ:META] and Netflix [NASDAQ:NFLX] have lost a big chunk of their stock value this year. The FAANGs, once thought to be invincible, now suddenly look very vulnerable. It seems that Big Tech has lost its shine.

There’s no hiding it. Pessimism is the prevailing mood of the day. At the fuel pump. At the supermarket. At the workplace. Our collective anxiety can be all-consuming.

Indeed, fear is the mind-killer. And at a time like, it’s so easy to be paralysed with indecision. Stay frozen. Adopt a wait-and-see attitude.

But those who are courageous know one thing: even the darkest night must give way to the dawn.

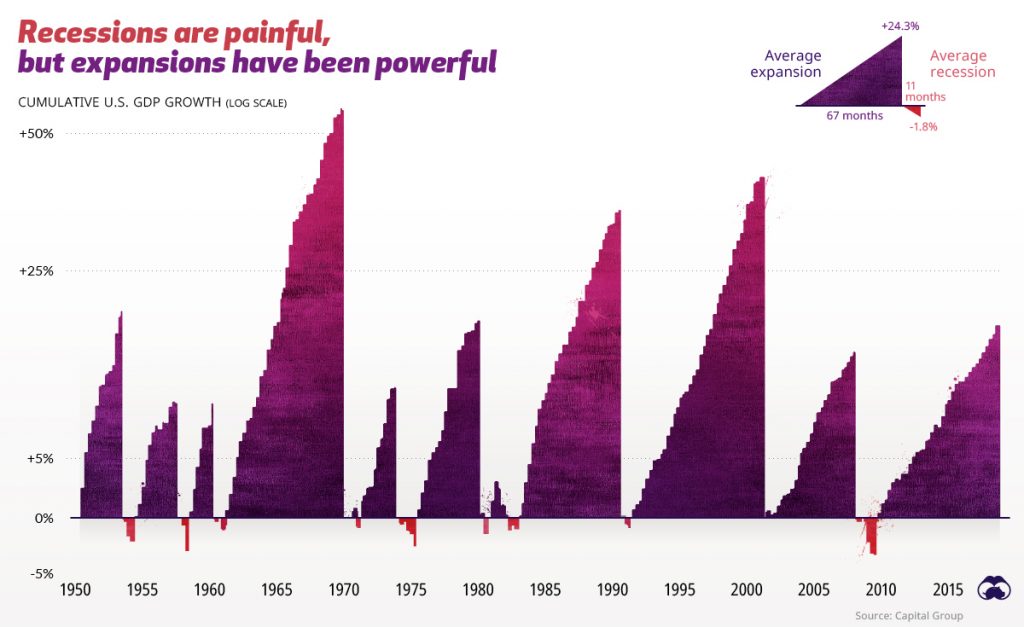

Source: Visual Capitalist

Boom. Bust.

Expansion. Recession.

Lather, rinse, repeat.

This is how the cycle works — and looking beyond fear and maximising the opportunities of the moment are what disciplined investors aim to achieve.

In the words of Warren Buffett:

‘Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.’

We want to hear from you

So, what is the biggest financial challenge that you’re struggling with right now?

What’s bothering you?

What do you need to fix?

Indeed, your story is important to us. You’re the man on the street. You’re the woman on the street. You’ve built a career. You’ve raised kids. You’ve experienced economic booms and busts.

You’re a survivor. A master of your destiny. An expert on ‘real life’.

You’re the person who understands what actual street-level challenges are all about. You see things and know things that our political leaders on both the left and the right often fail to appreciate.

This is why we want to know how you’re coping in your journey so far. This will help guide us as we research future content for our financial articles.

So, what are your hopes? What are your dreams? What does the road ahead look like for you?

We really want to hear from you. This is why we’ve prepared a very short survey — and it will only take you a leisurely 30 seconds for you to do it.

👉 Click here to do our 30-Second Survey now.

Thank you so much for taking the time to share your personal story with us.

We’re grateful!

Regards,

John Ling

Analyst, Wealth Morning

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.