Fear was once an emotion we could do something with.

Someone giving you a hard time? Take up your sword — later, your pistol — and challenge them to a duel.

In fact, duelling was a legal means of resolving disputes for hundreds of years. Particularly those that could not be regulated by law: matters of honour and insult.

The idea of the ‘judicial duel’ was well-established. Based upon religious belief: that God would protect the party in the right by allowing him to win!

Of course, duelling often led to serious injury and death. This had other implications.

Duelling to fencing

When I was living in Europe, I did fencing classes for a while.

This has a family connection for me.

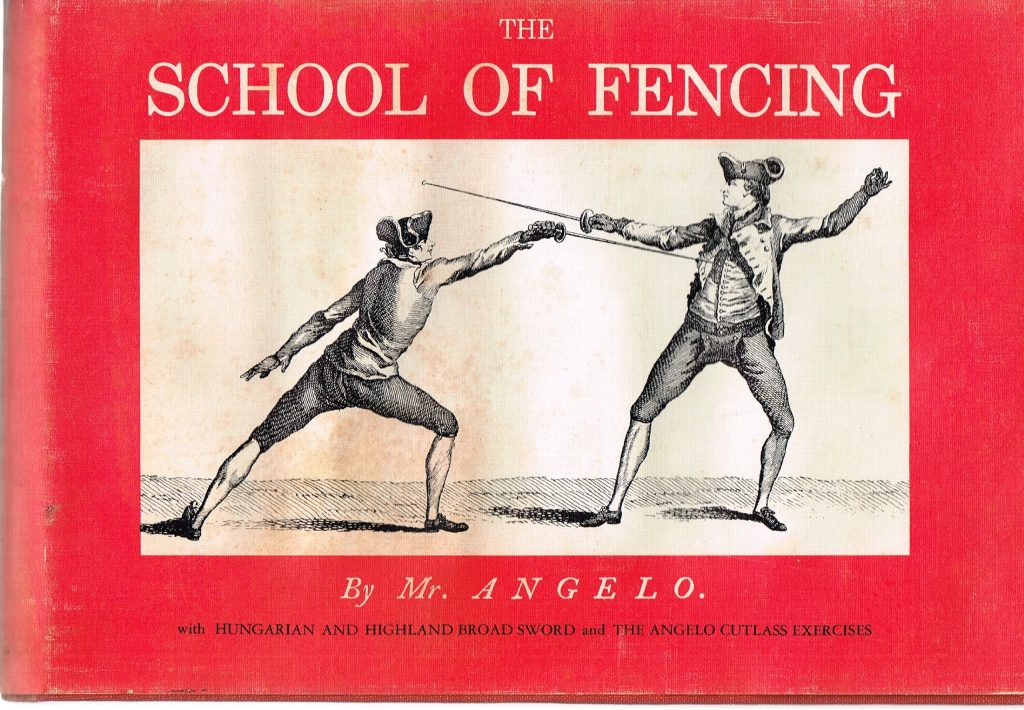

My ancestor, Domenico Angelo, an Italian migrant to London in the 19th century, was a pioneer in the sport.

Domenico Angelo’s fencing book. Source: Author collection

As the market for duelling moved toward a safer sport, fencing — a pursuit with few injuries — became a good alternative. Domenico built a successful business teaching the new game. And was still teaching it at Eton College when he died well into his 80s.

His sons ended up in the military. And two of them came out to Australia and New Zealand.

With this background, you may wonder if a little fencing and duelling still run in my veins?

In actual fact, fencing had none of the fear-conquering dangers I was looking for. By the time you don the protective garb, it is a very safe sport. There is little chance of being run through by a rapier.

A fearful age

If there’s one thing I notice today — and I am a victim of this too — people are more and more fearful.

We run portfolios for wholesale investors. A common call my colleague John receives is from people worrying over when the next market crash may come. The crash that could wipe out a significant chunk of their value.

Well, we’re pretty defensive in our strategy — so likely not. But it is a fear that crops up. A fear, as people approach and enter retirement, that becomes serious.

Of course, we do see people who embrace and thrive on such risks. They seek out more speculative opportunities. One is in his 80s.

But, for the most part, people are fearful and worried about ‘The Next Crash’.

Many are also worried over Covid-19. This seems to have stoked the fearful culture.

Fair enough — it’s a bloody nasty virus.

But perspective is important. Here in New Zealand, we’ve lost 27 people to the virus itself. But likely hundreds more due to issues caused by lockdowns that smash livelihoods and darken mental health.

I often hear people fretting over the market and losing 30% of their life savings. A proposition that would likely be temporary if it did eventuate — given the tendency of modern markets to swing back. And seemingly fast with government ‘money printing’.

Then those same individuals jump in a tiny car and drive down the North Island.

Frankly, if you want the upside of the market and specific opportunities, you have to embrace some risk and conquer fear. But, equally, a good investor will find stocks to ride the risks they see ahead.

Are there crash-proof stocks?

Certainly. But they’re very hard to pick.

During the GFC (Global Financial Crisis), when many shares crumbled 50% or more, McDonald’s [NYSE:MCD] hardly moved at all. Yet faced with Covid lockdowns in March 2020, it joined much of the market with a 30% descent.

Compare that to British pharma company AstraZeneca [LSE:AZN]. It did initially shed around 15% during the first phase of lockdowns. But it then promptly climbed 42% by May 2020.

This time, pharmaceuticals and ‘stay at home’ tech stocks did well. Retail, hospitality, aviation, and travel plummeted. Some are still in recovery mode — which in itself presents opportunity.

Perhaps the best ‘insurance’ against major drawdown during times of market crisis is buying at value in the first place. Many portfolios weren’t too badly affected by Covid 2020 since they’d held solid stocks for some time. Bought at reasonable earnings and book-value ratios. And paying solid dividends — though many were cut through the pandemic.

Following Black Monday (1987), the GFC, and Covid 2020 market crashes, some investors feel scared. They’re fearful to continue to invest in the markets. Yet it was those who had the courage to immediately deploy funds in the aftermath of such crashes that have captured tremendous returns.

It’s easy to be scared. But that soon passes once you pick up the sword.

Regards,

Simon Angelo

Editor, Wealth Morning

Important disclosures

Simon Angelo owns shares in McDonald’s [NYSE:MCD] and AstraZeneca [LSE:AZN] via portfolio manager Vistafolio.

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.