He’s flamboyant, uncompromising, and impossible to ignore.

Say what you want about Elon Musk, but the man simply doesn’t do anything halfway. His approach is brute force. Damn the torpedoes. Full speed ahead.

Source: The Infotech Report

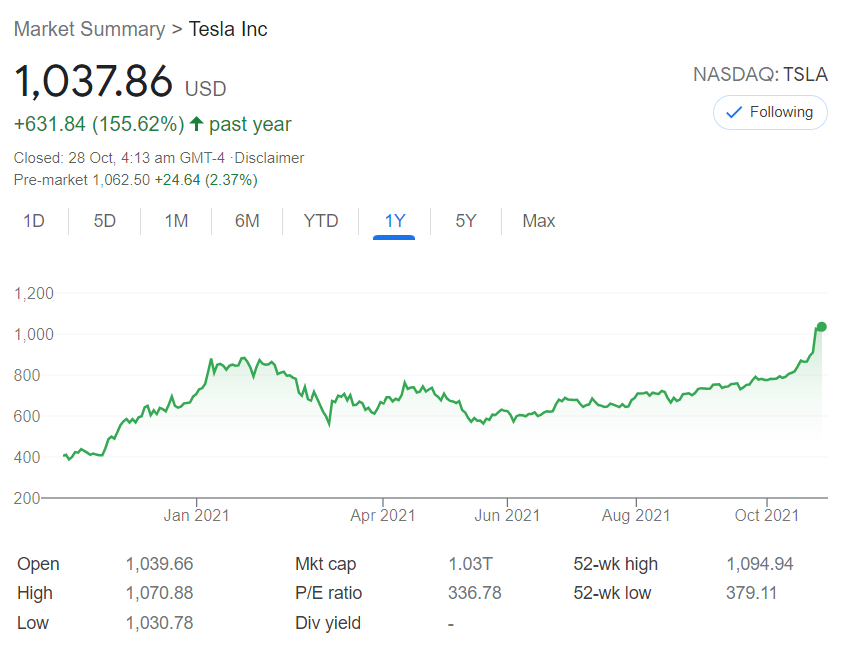

Right now, Tesla [NASDAQ:TSLA] is the largest automaker in the world by stock market capitalisation, valued at US$1 trillion. That puts it way ahead of global rivals like Toyota [TSE:7203], Audi [XTRA:NSU], and Daimler [XTRA:DAIM].

Tesla’s success is due, in large part, to Musk’s extravagant showmanship.

No one sells electric dreams quite like he does — even if the reality has to play catch-up with the rhetoric.

Extreme confidence

Tesla’s stock has risen over 155% this past year, undimmed by the Covid pandemic, boosted by feverish investor interest.

Source: Google Finance

On paper, the company’s Price to Earnings sits at an astronomical level.

It’s overvalued and overbought. Pushing the limits of human sanity itself.

Here’s how to visualise the fundamentals:

- A P/E ratio of 1 means that, at the current share price, you’re theoretically paying for 1 year of a company’s forward earnings.

- Right now, the average P/E for companies on the S&P 500 Index is 28.95. This means that investors are typically paying for 28.95 years in forward earnings in order to buy into the average S&P 500 stock.

- But, hey, watch out. With a P/E of 336.78, Tesla certainly tips the scales. Investors are showing a willingness to pay a stunning premium of 336.78 years in forward earnings.

Talk about extreme confidence!

This hype machine, quite literally, operates on overdrive. Musk has promised us everything from a miraculous million-mile battery to a cheap US$25,000 electric car. His charisma is so magnetic that the media is willing to give him a free pass.

But look past the glitz and glamour. You will see that Tesla’s most immediate problem could be its inability to scale up and deliver.

Consider this:

- In 2019, Toyota sold just under 11 million cars.

- In that same time frame, Tesla sold just under 300,000 cars.

This industrial discrepancy is astounding — especially when you consider that Tesla has a market valuation much larger than that of Toyota.

Musk is an insurgent entrepreneur with a reputation for playing it fast and loose with facts. But in a rare moment of sobriety, even he had to acknowledge the limits of his own hype:

‘The extreme difficulty of scaling production of new technology is not well understood. It’s 1,000 percent to 10,000 percent harder than making a few prototypes. The machine that makes the machine is vastly harder than the machine itself.’

Entering the S&P 500 Index

Tesla is still very much a work in progress with dicey fundamentals.

Despite this, mainstream acceptance of the company is already happening.

On December 21, 2020, Tesla was added to the S&P 500 Index. This was big news and a vindication for Musk himself. It came after Tesla was previously passed over for inclusion in the index back in September 2020.

So, on a practical level, what does this mean for you?

Well, if you are already investing in a generic index fund — like those run by Vanguard, BlackRock, or Fidelity — you are automatically getting a slice of Tesla.

No ifs. No buts. You’re getting a sprinkling of Musk’s fairy dust, whether you want it or not.

So…it’s not hard to imagine what the long-term impact of this will be. Tesla’s towering valuation may swell even more, as passive funds surge into its coffers. It’s an enormous sugar hit that can’t be ignored.

Only time will tell whether Elon Musk will be able to use that extra wealth to finally deliver on his promises. The world awaits with bated breath.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.