There is no doubt that the New Zealand market is a great place to invest your capital.

A history of strong returns, coupled with minimal barriers to entry, provides an environment in which investors can find profit across many business sectors.

With stable market uptrends and growth that trumps many global markets, one may ask, ‘What is the point in investing abroad if I seem to have it all here?’

The truth is, by investing internationally, you can open yourself up to a whole new world of opportunities and potential. You can access sectors and industries that are not available in a smaller economy like New Zealand.

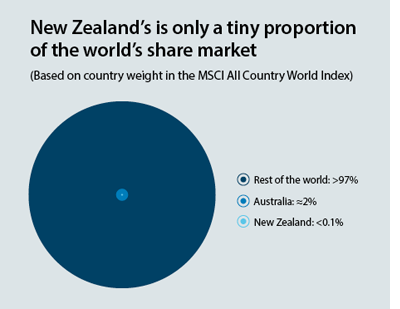

Take a moment to ponder that New Zealand makes up less than 1% of the global market!

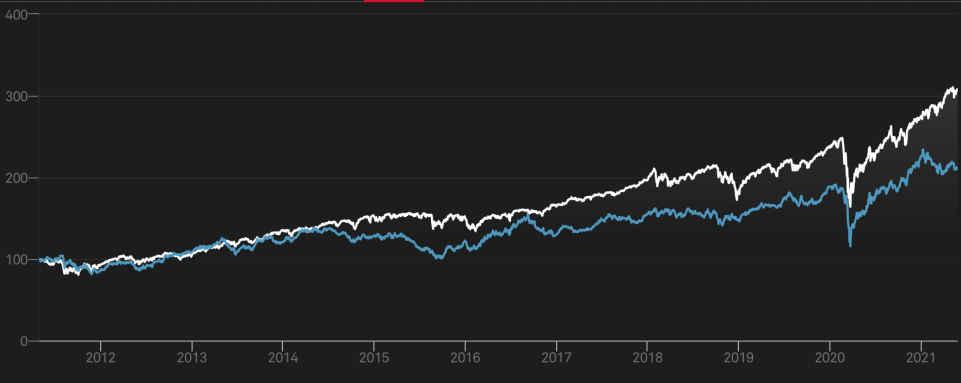

It is also hard to ignore the fact that the American S&P 500 has provided a somewhat higher return over the last 10 years when compared to the NZX 50. Very intriguing…

Source: ANZ

Source: S&P

Why investing in the New Zealand market is a good idea

Investing in the New Zealand market yields benefits that go above and beyond the scope of personal financial gain. Yes, of course you can make money investing in New Zealand stocks, but you are also investing in the future of the country.

As great as it is already, I for one would love to see a future New Zealand with greater infrastructure, more competitive salaries, and reduced poverty among the population.

I am not saying that investing in New Zealand companies is a magic cure that will solve all of our problems, but it could help support economic growth here by injecting more money into local companies, particularly when they run capital raises.

Other advantages of the domestic market include its ease of entry, lack of currency risk, and a diverse range of local investment vehicles — stocks, ETFs, bonds, real estate.

Why investing globally is a better idea

There are a few drawbacks to consider if you do not wish to include foreign assets into your portfolio.

- Firstly, you would not be geographically diversified. By having all of your eggs in the New Zealand basket, your portfolio could be at risk of greater losses if the domestic economy was to take a turn for the worst. By holding a geographically diverse portfolio, the potential for severe loss can diminish.

- Secondly, New Zealand is a relatively small country with an equally small economy. There simply aren’t as many companies to invest in as compared to a larger economy like the US.To put this into perspective, there are 186 companies listed on the NZX main board, while around 6000 companies trade on the NYSE and Nasdaq every day.

- Lastly, there are countless industries in the world to invest in, many of them ripe with opportunity. While New Zealand certainly has strong ties in agricultural and primary industries, we are lacking in many other areas.

This provides the incentive that many potential investors need as they wish to seek returns in their preferred industries. Particularly in industries and sectors where they may see upside or growth.

ANZ Bank has compiled an interesting graphic detailing examples of domestic industry exposure and compares it to some of the hot global industries that are not available in the New Zealand markets.

Source: ANZ

Opening up to these industries could provide a much more diverse range of investment opportunities and exposure.

After assessing your risk profile and financial goals, you could own a piece of any company that catches your eye. One that you believe could grow further and/or deliver good income in the form of dividends.

Whether it’s investing in individual market movers like Amazon [NASDAQ:AMZN] and Tesla [NASDAQ:TSLA], or investing into entire industries with the countless ETFs available, there is truly something for everyone.

For example, you could gain exposure to biotechnology, medicinal cannabis, or near future/early stage tech with selected ETFs that seek to include the leading businesses in each sector.

How you can invest both locally and globally

The good news is that you are not confined to investing only in the New Zealand market.

You can achieve the best of both worlds by creating a portfolio that includes securities from both New Zealand and the international markets.

In doing so, you could increase your breadth of opportunity and take advantage of geographic diversification.

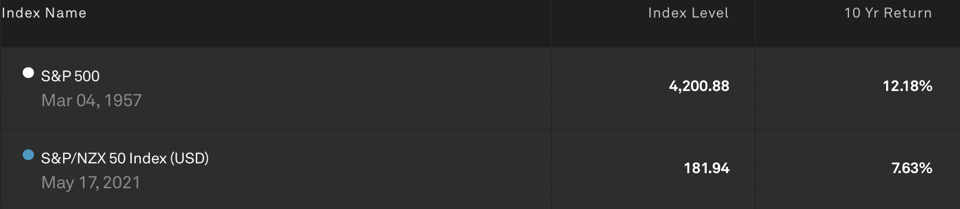

Source: NZ Super Fund

Chances are, you may already be invested in foreign assets without even knowing it!

Many KiwiSaver funds, especially growth funds, are already investing your contributions into foreign assets.

The NZ Super Fund also heavily relies on foreign equities to achieve the strong growth that they have managed to achieve so far.

The purpose of this fund is to help fund pensions for New Zealand’s retirees. A staggering 75% of the fund is invested overseas. This goes to show the importance that professional investors place on foreign investment.

In order to invest in foreign equities, you can place an order on your investing platform or consult your authorised financial broker. It is relatively simple to invest globally with the right tools.

Our Vistafolio Wealth Management Service, for example, actively manages and seeks out foreign investment opportunities as they arise in the market for our Eligible and Wholesale Investor clients.

Conclusion

We have addressed the benefits and potential limitations of investing in the domestic market.

We also understand the benefits that overseas investments can have on your portfolio, such as geographical diversification and a greater range of investment options.

Before adding foreign investments into your portfolio, one should be aware of the research requirements, higher transaction costs, currency volatility, and management fees that are present with this scope of investing.

Remember to always research the market you are interested in before committing any capital. This practice will help you to understand the potential quirks and processes that differ from the domestic market.

Regards,

Samael Knaap

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Sam is an intern analyst at Wealth Morning. He is currently completing his major in finance, while juggling his roles as President of the Massey University Investment Club and student fund manager. He won the Investment Club stock challenge, where he achieved a return of 44% over a 3-month period. Furthermore, he has received the INFINZ scholarship award for being the top 3rd year finance student in 2020. His role involves contributing research and writing financial reports for Wealth Morning’s readers.