About every 25 years, a new industry changes the world.

Unicorn companies lead the way. Billionaires get minted. And early investors enjoy spectacular returns, sometimes 20,000% or more.

You only have to look back over the past 170 years to see the major industries that have catapulted new developments to the world. And produced significant new wealth for their stakeholders:

2025 | 💰 ? |

2000 | Internet |

1975 | Computers |

1950 | Plastics |

1925 | Broadcasting |

1900 | Auto industry |

1875 | Telephone |

1850 | Telegraph |

It was at these key junctions that scientific and industrial developments started to gain traction and create wealth.

The world’s biggest bookstore

Now, around 2000, one entrepreneur quit his Wall Street job on a conviction. A conviction that came to him on a cross-country road trip from New York to Seattle — that the internet would transform sales of certain goods in a world-changing way.

That man, of course, was Jeff Bezos, and the company he founded was Amazon.

Bezos was named ‘richest man in modern history’ after his net worth increased to $150 billion in July 2018.

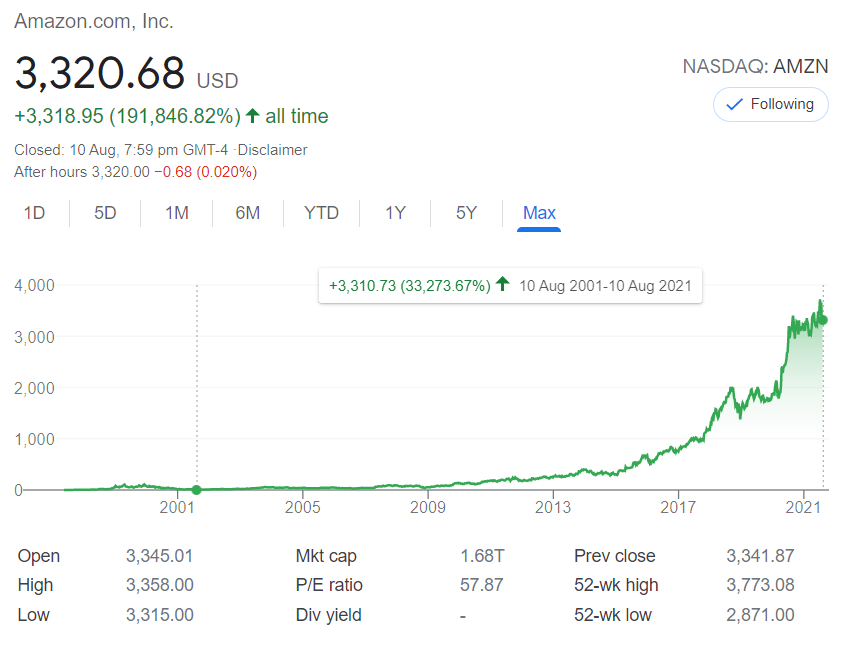

Had you purchased Amazon [NASDAQ:AMZN] stock in 2001 at around $10 as the company was getting going — and held it to now — you may have enjoyed a return of over 33,000%!

Source: Google Finance

Just $10,000 invested into Jeff’s company at the time could be worth over $3.3 million.

The next 2025 trend?

Investing in lead businesses in the next new industry cycle can make founders and investors plenty of money.

The question for Wealth Morning readers is this: What is the next 2025 trend? And which companies will be poised to capture outsized gains?

Notice that one industry leads to the next.

- Plastics enabled mass-manufacture of desktop computers.

- Computers enabled the internet.

- The internet is enabling many new industries and transforming our way of life.

A discussion with the seasoned investors in the Wealth Morning office — active traders and observers of the market — revealed the following…

Biotechnology. Transhumanism. A Fourth Industrial Revolution based on robots.

We are already seeing massive growth in the biotech industry, as biological processes are used to find new medical solutions.

Transhumanism — where technology is applied to take human beings beyond their current mental and physical limits — is at very early stages. Pacemakers are a basic example.

Google Glass — promising a connected world in front of your eyes — thus far seems to have failed to take off at the consumer level. But the company is making inroads in factory and industrial settings through ‘Google Glass Enterprise’.

A transportation revolution

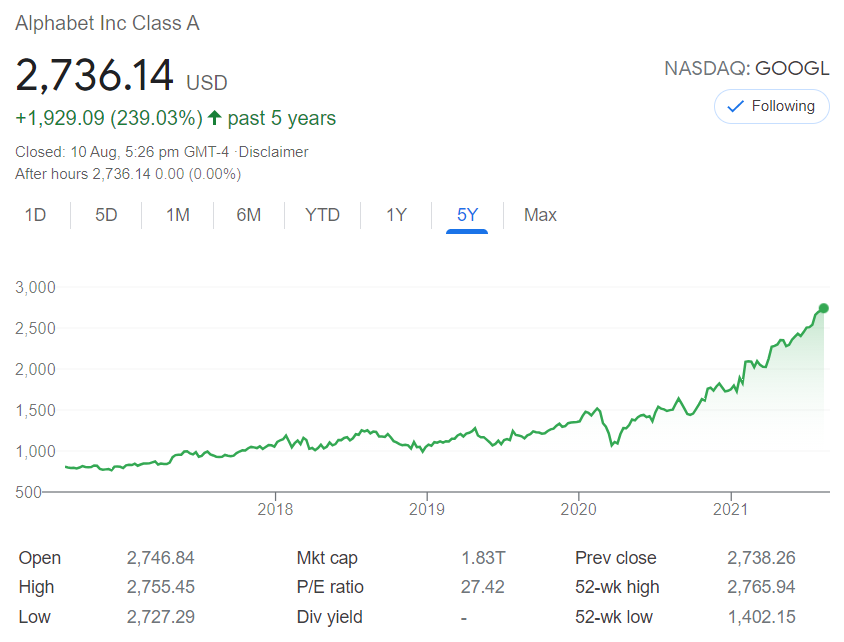

Google – Alphabet Inc [NASDAQ:GOOGL] has already enjoyed a long, upward run in its stock price.

It currently trades at a not unreasonable P/E of around 27 (for a growth story stock):

Source: Google Finance

Could there be more to come with Google’s ascent into new industries?

My own view on the next golden age comes from recent events in the Middle East and Australia. And gridlocked roads nearby.

As Iranian missiles flew toward American bases in Iraq, the oil price showed signs of jumping. But it didn’t quite take off. The missiles didn’t hit anyone. And there were expectations of the crisis de-escalating.

But next time, it could be different. Especially if Iran develops a nuclear bomb. And can call a higher price.

North America is now self-sufficient in oil, but the world still depends on the fuel as a primary source of energy.

Ending oil dependence by using technology

It is the burning of these fossil fuels, contributing to global warming, that was previously blamed on catastrophic bush fires that raged in Australia.

As industries seeks to end oil dependence and billions try to move more efficiently in the developing world, the 2025 trend for me comes down to a transport revolution.

History goes in cycles. With new enabling technology, it’s now time for a full revisit on our 19th century auto industry.

It’s about combining the internet, 5G telecommunications, computational power, and advancing battery technology to make everyman’s/everywoman’s transport electric and autonomous.

Much of the tech is already there. It is now a case of rolling that out.

Self-drive and ride-sharing

Telsa’s [NASDAQ:TSLA] is already developing leading technology in electrification and self-drive.

Vehicle autonomy could solve one of the key modern issues with cars: Parking. Vast areas of land get turned into tarmac car parks. High-rise buildings have floors of parks. What if we could do away with that need?

When your car can pick you up at an appointed time, or go about other deliveries when not needed, that’s game-changing.

Planners in the US are already factoring this in. They are designing parking garages in Los Angeles that are high enough to easily convert to apartments or shops — once people’s cars have the ability to drop and move on autonomously.

Chandler, a city in Arizona, recently became one of the first American cities to change its zoning code to facilitate autonomous vehicles. Developers can build less parking and save money if they provide ‘curbside passenger loading zones with benches and trees for shade.’

The future of technology is closer than we think

Fully autonomous vehicles save on the one thing at premium in cities: Space. Self-driving cars do not need parking space to enable people to open doors and get out.

They can follow one another inches apart. And once they’ve dropped you at work, they can go home to charge up, pick up your groceries, or potentially earn you passive income as a ride-sharing service.

Right now, in our Vistafolio Wealth Management Service, we are helping Eligible and Wholesale investors to get a slice of companies exploring these key developments. Electrification. Self-drive. Ride-sharing. A new transport paradigm.

Could now be the time to get on board?

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.