Take a look back on the last 20 years in the markets. I’m considering global developed stock markets. And property markets.

Excepting the year or two of liquidity shock around the Global Financial Crisis, it’s been a steep incline upward to unparalleled highs in values and prices.

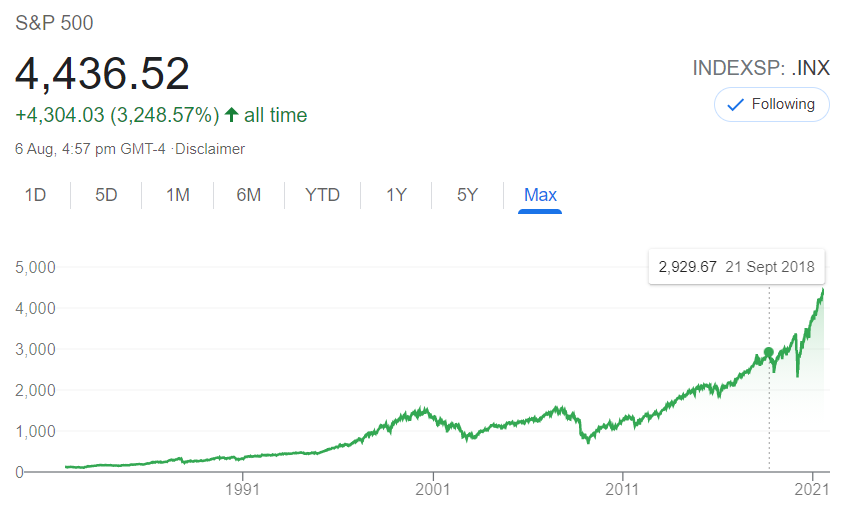

Take a look at the S&P 500 since 1981:

Source: Google Finance

Global housing markets have followed a similar steepening trend:

The year 2000, fortuitously, is the year I began investing in shares and property in a more intentional way. I had finished university only a few years before, had started out in business, and was making some money.

What we have seen since the year 2000 is something quite remarkable. Asset prices have taken off. Far beyond the rate of income growth.

Later, investing in 2020 was a simple equation.

When many stocks and some properties stalled or crumbled in value due to coronavirus lockdown fears, it was clear — there was money on the ground.

Today, the lie of the land is much more complex. Buy an asset at a high valuation and you are betting that the steepening growth line will continue unabated.

But here’s the big question: What if it doesn’t? What if the line starts going flat? How can you prepare for this?

In a moment, I’ll share with you my strategy to invest in such markets.

But, first, to understand how we arrived here, you need to look back on the phenomena that have driven these curves…

Already a Member? Sign In Here

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.