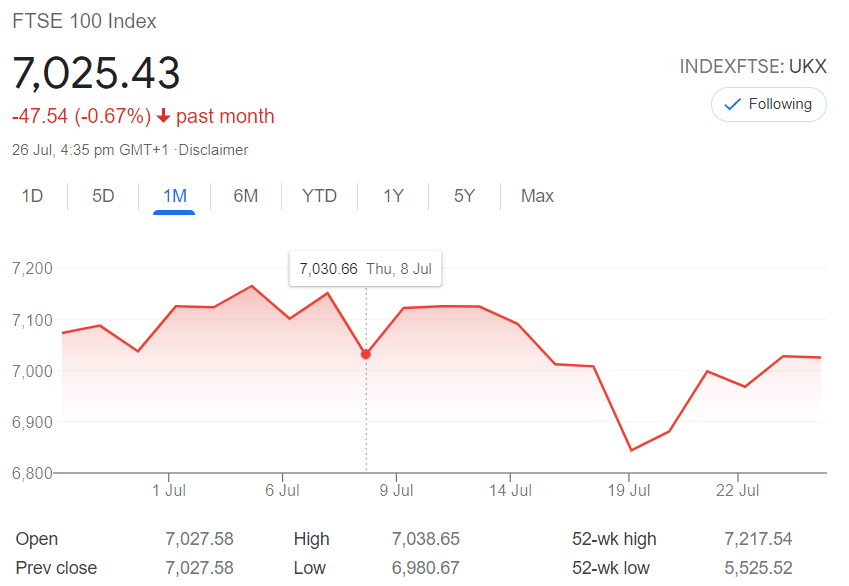

Last Monday (July 19), we saw quite a wobble.

The FTSE (UK Top 100 stock index) cratered to a low we’d not seen for a while — around 6,840.

Barely a week before, it’d climbed above 7,120.

Source: Google Finance

A 4% correction is meaningful. On a high beta stock, for example, this can mean drawdown of 10% or more.

Perhaps this was the beginning of the Bear, we wondered.

Nonetheless, in the portfolios we manage, we deployed plenty of cash. This has proven prescient. As I write today, the FTSE is back above 7,000.

And within our strategy: If you do not believe the fears are entirely rational and lasting — buy the dip.

People were asking about the sudden change in the market. I heard one gentleman raise the essence of these fears. Inflation. China. America. Money-printing. Virus variants such as Delta still raging.

While any large drawdown is frightening, investors need to keep their eye on the long-term.

I know, psychologically, this is not easy to handle. Last Monday night, there were some large investors that would have experienced a fall of $50,000 or more.

Of course, a few days later, that was pretty well-recovered.

But this is the truth of market investing. The more money you have in a portfolio, the more swings you will see. And the more speculative (high beta) stocks you invest in, the larger those swings may be.

As for buying such dips, you need to be able to scientifically identify and then examine the fears driving the market down.

We are certainly watching closely.

Here are the 3 biggest trends that we see emerging on the horizon right now…

Already a Member? Sign In Here

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.