When you get into your mid-to-late 40s, you begin to glimpse a time when the leaves will fall. Work will slow or end. Children may or may not be independent. It is not such a distant vista.

And it is this time when I most hear people asking about investing for retirement. There are some who have already started from a young age, and they are ahead in the race. But there are others who are just getting started, and looking for a way to jump ahead over the next decade.

The main problem any investor faces in most asset markets today is they are sitting high. Short of March 2020, when stock prices crumbled over fear of Covid-19 lockdowns, it is a challenge to find anything at value.

Blame the baby boomers. Those who have gone before and cleaned up. They own the lion’s share of property, businesses, and stocks — at least in the developed world. But they have saved and worked for it too.

Perhaps things today are harder. It used to be you could run your money in a term deposit and make 7% or 8% a year. Those days are long gone.

Beyond a medium-term period of high recovery inflation — at least according the US Fed — we are likely staring into the same old deflationary conundrum of the 2010s:

- Ageing populations.

- Ever cheaper goods and services due to globalisation and technology.

- Very high asset prices by any metric as waves of grey cash seek yield.

And today, more than ever before, TINA reigns.

Who or what is TINA?

TINA — or ‘There Is No Alternative’ — was a phrase originally coined by Victorian philosopher Herbert Spencer.

Spencer was a realist. What we may colloquially call a ‘hard bastard.’ He also coined the term ‘survival of the fittest’, following an interpretation of the works of Darwin.

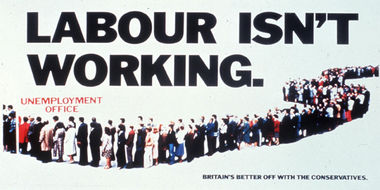

Many British people will link the term TINA to Margaret Thatcher, who was fond of using it. Indeed, the sentiment helped the Conservatives rise to power under Thatcher from 1979 to 1990.

Source: Wikipedia

There was simply no good other alternative.

In the investment world, TINA is also powerful.

There is no perfect investment. Stocks go up and down. At times, and in the wrong market cycle, you can lose your shirt. Then, as a bull run gathers steam, you can do very well indeed.

Property comes with inherent hassles and sometimes liquidity problems.

Fixed interest and bonds may struggle not to rot your wealth in the backdrop of much inflation.

TINA 2.0 — There Is No Alternative (to equities)

Why are markets continuing to rise so sharply following the Covid-19 disaster and all the worries that has brought?

If you have money to deploy and wish to gain potential growth and income, the TINA effect is powerful. And it also provides further tailwind to stock markets in a low interest-rate environment.

There now exists a perfect storm of loose monetary policy and quantitative easing (‘money printing’) feeding the markets. And, at least here in NZ, the swing of a larger regulatory hammer on investment in residential housing, along with rising interest rates, is starting to threaten that market.

I’m a value investor. I look for value in whatever market and cycle.

Today, I see few alternatives for modest capital, except into shares in well-researched companies. But that involves some risk, which requires understanding.

Sometimes there is no alternative to what’s in front of you. At least when you’re trying to climb ahead.

A smart person knows when they’ve met TINA.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.