🎵 ‘The Warehouse, The Warehouse. Where everyone gets a bargain!’ 🎵

I think you would be hard-pressed to find a New Zealander that hasn’t had this jingle stuck in their head at one time or another…

Company profile

The ‘Red Sheds’ are somewhat of a nationwide icon.

Founder Sir Stephen Tindall opened the first store in 1982. His mission was to make the desirable affordable for Kiwis everywhere.

This wasn’t so easy back then, when the domestic market harboured high import tariffs and a protected economy.

The Warehouse had found great success by delivering an extensive catalogue of goods to New Zealanders at bargain prices, all under one roof.

Over the next 30 years, the New Zealand economy opened itself up to the global markets. The Warehouse followed suit. Utilising parallel importing, a broader range of in-demand products were sourced globally, and earnings were used to expand and diversify.

A series of developments, including major mergers and acquisitions played a pivotal role in the creation of The Warehouse Group [NZX.WHS] that we know today.

The following timeline highlights the most notable events:

- 1991: First Warehouse Stationery store opens.

- 1992: Launching of The Warehouse card.

- 2001: The Warehouse Financial Services launched.

- 2013: The Warehouse Group acquires Noel Leeming Group, Torpedo 7, No. 1 Fitness, Shotgun Supplements, Shop HQ, and Insight Traders.

- 2014: The Warehouse Group purchases R&R Sport and Schooltex.

- 2015: Acquisition of Diners Club NZ and launch of Warehouse Money, a new generation of financial-services products.

- 2019: The Warehouse Group launches its sixth brand, TheMarket, an e-commerce marketplace that offers Kiwis a whole lot more choice when shopping online.

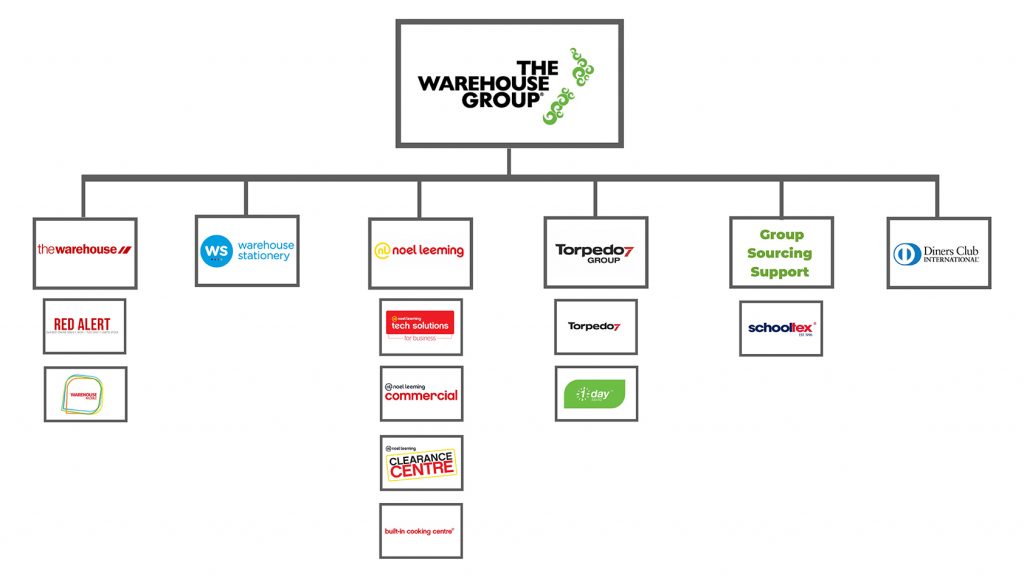

Here is a snapshot of the major subsidiary businesses working under The Warehouse Group umbrella:

Source: Warehouse Stationery

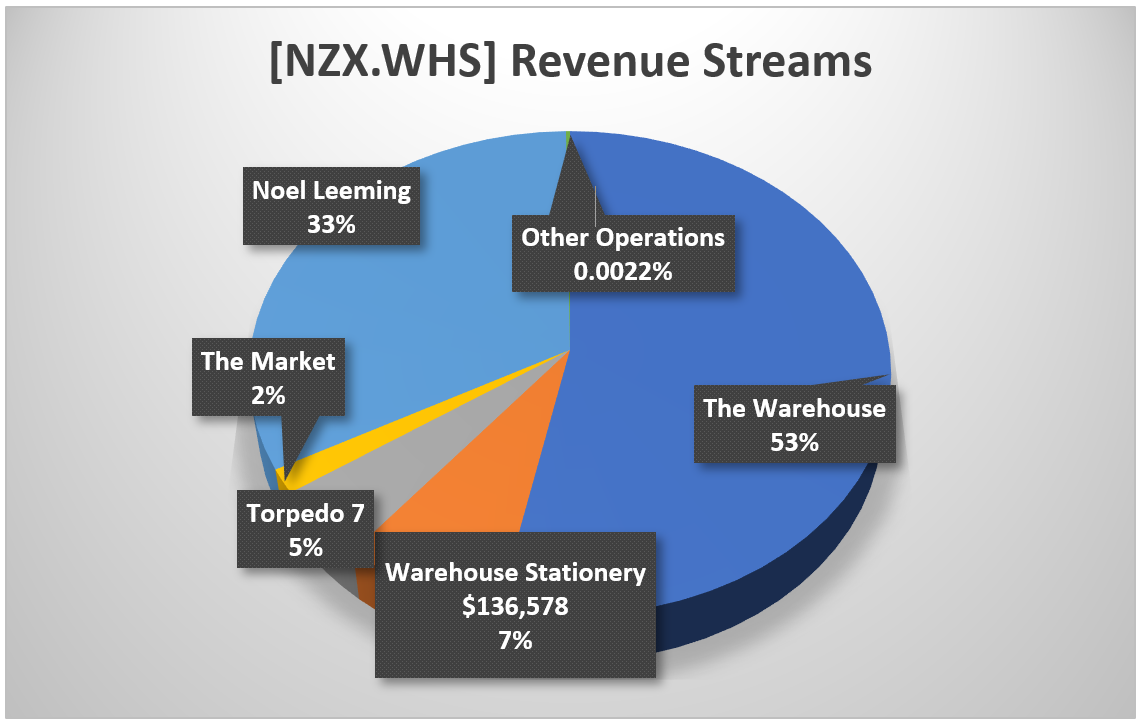

Furthermore, the chart below illustrates the percentage of unaudited revenue that was attributed to each of the main subsidiary businesses over the last 26 weeks, ending 31st January 2021.

Source: The Warehouse Group Financial Statements

Management & insider holdings

Good management should never be overlooked when it comes to analysing a potential buy. At the end of the day, it is the managers who execute plans and provide strategies to increase shareholder wealth.

For [NZX.WHS], the management seems to be a great fit for the company. The average management tenure of 4.1 years indicates experience in their roles, and it shows.

Nick Grayston, current CEO, has made great advances recently in restructuring the company’s operations.

Although at the cost of a number of stores closing down and hundreds of jobs being axed, the move resulted in record profits across all divisions during the first half of this financial year.

The move may have seemed drastic on paper, but it proves that the management can make effective decisions, even during Covid-19 related market uncertainties.

A high ratio of insider and institutional holdings can generally be taken as a positive sign.

It can suggest that the company has a positive outlook on future performance.

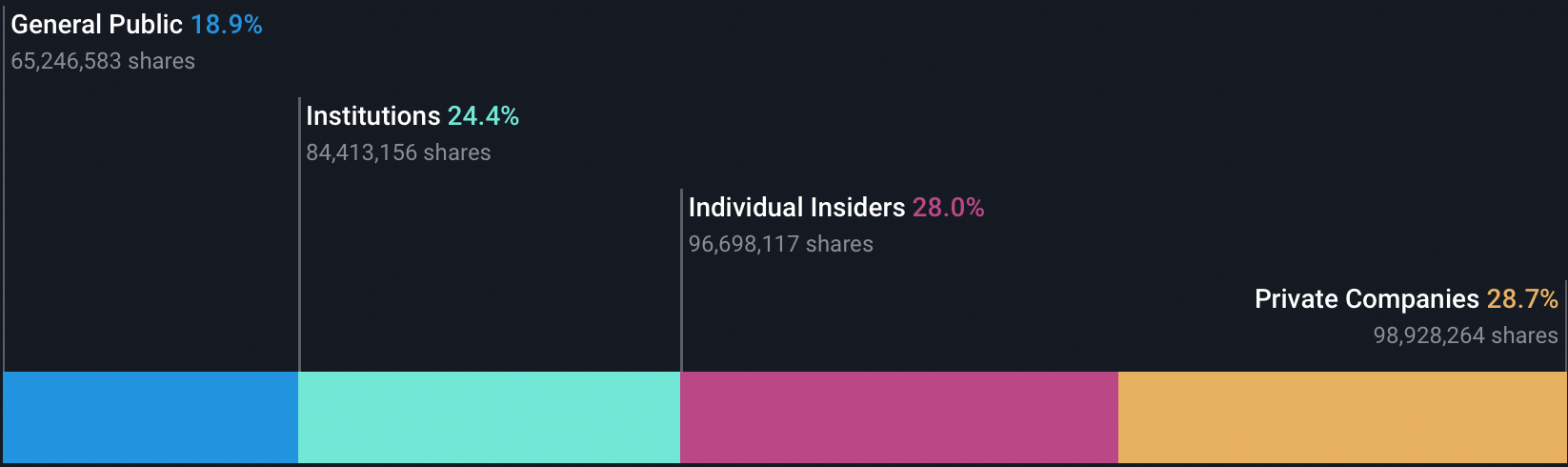

Have a look at the [NZX.WHS] share ownership breakdown across the board.

Source: Simply Wall St

Institutions, individual insiders, and private companies account for more than 80% of the current shares outstanding.

While a buy/sell recommendation could not be attributed to this fact, it certainly pays to know that, at this stage, company prospects can be regarded as positive.

Stephen Tindall, [NZX.WHS] founder, owns the highest stake, with around a 24% share.

In the last month, Julia Raue, an independent non-executive director of the Group, purchased 15,000 shares at $3.77 each. This is comforting as it shows she is confident shelling out $56,000 on the company at a price slightly higher than what it is now.

Based on this ownership breakdown, potential investors can rationally expect that the management incentive to increase shareholder wealth is there.

Dividends

Investors love to see dividends. They work to increase total ROI whilst mitigating the effects of potential capital losses.

[NZX.WHS] has had a solid track record of sharing its earnings with its shareholders.

This is a prominent selling point for the stock as it may provide its investors with a source of passive income.

The Group have averaged a dividend yield of 6.51% between 2012 and 2020.

In 2020, amidst the Covid-19 panic, [NZX.WHS] elected to cancel both its interim dividend and final dividend for the year. This was purely the result of unknown market conditions at the time, and it may have been the right call anyway.

This year, a special dividend of 0.05c was paid in February, and its first-half dividend of 0.13c will be paid on the 22nd of April.

In March 2021, a new dividend policy was approved to distribute at least 70% of the Group’s full-year adjusted net profits to shareholders. The policy is subject to trading performance, liquidity and market conditions.

A welcome decision as long as [NZX.WHS] can sustain the performance that they have displayed in the current fiscal year.

Potential for acquisitions

Last month, the CEO personally announced that the company is well-placed to introduce new retailers to the roster.

This news is welcome considering the success that The Warehouse Group have had with acquisitions in the past.

[NZX.WHS] are currently enjoying total liquidity levels in excess of $500 million, a huge improvement from the $236 million of liquidity they held at the same time last year.

Its’s encouraging to see that The Warehouse Group are open to continue developing and diversifying their operations.

Covid-19

Covid-19 has been a real experience and wake-up call for a lot of companies. The many that suffered were overshadowed by the few that planned and adapted to the market conditions.

The first wave hit during the main restructuring process for The Warehouse Group. The threat of lockdowns is still looming, and with it, the risk for decreased earnings.

Luckily for [NZX.WHS], the pandemic hit at the most opportune time. Development in their online offering played a huge role in keeping the Group afloat. The increase in online consumer spending was also serviceable as the Group adapted to provide contactless delivery at Alert Level 4 and below.

The decrease in operational costs due to the prior restructuring couldn’t have come sooner in the wake of the pandemic.

[NZX.WHS] received some backlash for cutting so many jobs after receiving the wage subsidy. The company remedied some of the negative press and showcased their debt-paying abilities by repaying the entire subsidy back at the end of the same year. All $68 million of it.

The Group’s flexibility and willingness to adapt under uncertain market conditions is to be commended. There are not many companies in the retail sector that have managed to rake in record profits following an event such as Covid-19.

Financials and growth prospects

To reiterate, [NZX.WHS] saw record operating profits in all of its divisions during 1H21.

The group ended this period with net cash of $183 million. A stark transition from the net debt of $68 million it accrued by the same time last year.

Adjusted NPAT is up by 140.2% in 1H21 compared to the previous corresponding period.

Group sales are also up nearly 7.5%.

As astonishing as these metrics are, they cannot be indicative of the company’s future performance and growth.

In contrast to the first half, the second half has been reasonably flat YoY.

The question to be asked is whether [NZX.WHS]’s recent growth is sustainable or is it short-lived?

Industry analyst reports have mostly agreed on the idea that the current level of growth that we have seen in the last year is not exactly sustainable for the future.

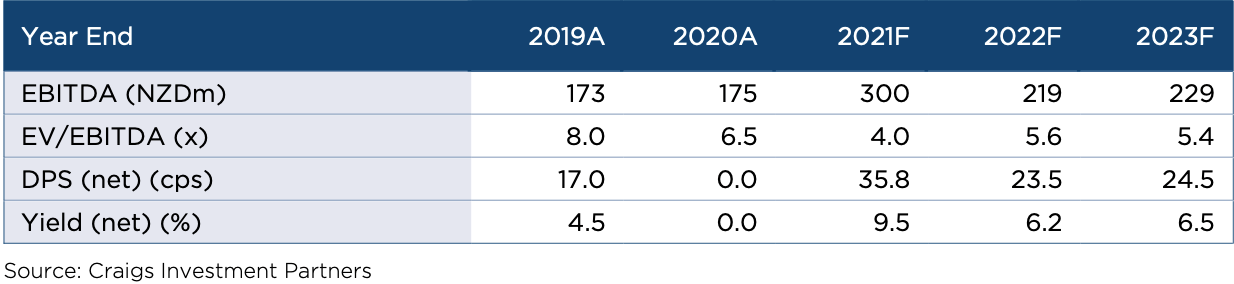

EBITDA has been predicted to drop in 2022 before regaining some lift in 2023.

One reason is attributed to the expectation that heightened consumer spending levels will diminish as the Covid-19 environment evolves.

Another huge factor that is limiting the sustainable growth potential of [NZX.WHS] is its payout ratio.

As the new policy has stated, they will be distributing at least 70% of profits to shareholders.

That only leaves a mere 30% of profits to be reinvested in the company.

The gripe I have with this relates to the fact that only 19% of shares outstanding are being held by individual investors like you and I.

It’s nice to see that we are getting a decent cut of the profits through dividends, but it seems like there could be more merit in reinvesting a larger percentage into the company.

Consistent earnings growth YoY would distil a lot more confidence for the potential investor. ‘Consistent’ is the word, and it just doesn’t seem to be the expected result based on multiple analyst estimations.

Risks

The greatest threat that I see in [NZX.WHS] future are retail competitors and new market entrants.

Supporting Kiwi companies should be endorsed as much as possible. The thing is, when offshore companies can deliver a larger range of goods, at competitive prices, and directly to your door, it can be hard to choose sides.

It is clear that e-commerce is becoming more and more of a staple in people’s lives. Unfortunately for The Group, they not only have to compete with brick-and-mortar entities such as Kmart and Farmers. They also have to compete with the likes of Amazon [NASDAQ:AMZN].

It is getting cheaper and cheaper to ship goods from online order to New Zealand.

Decreasing sales could have a significant effect on the profitability of [NZX.WHS].

Especially when net margins have almost exclusively been under 4% in the past.

This drives home how important increasing and sustaining sales volume is critical to this company’s success. A point that needs to be considered when making an investment decision.

Conclusion

The Warehouse Group appears to still be a solid company. The earnings growth that it has seen in the last year has been impressive, but can it be regarded as a sign of things to come?

Like many other analysts, I don’t believe that the stock price will be making any drastic moves in the near future.

If we can expect [NZX.WHS] to continue selling high volumes of product, then I believe their financial future can be regarded as bright.

It is up to the investor to decide whether the risk of increasing competition is too much to pursue the investment.

The dividend aspect is the most intriguing factor for me.

If I was to invest in [NZX.WHS], it would not be for the hope of short-term or even long-term capital gains.

It would be to add a moderately priced stock to my portfolio (P/E around 17 — similar to Briscoes Group [NZX:BGP]) in order to receive that attractive dividend two times a year.

Of course, investors should also consider that dividends are not guaranteed. Throughout 2020, The Warehouse did not post any dividends at all.

While The Warehouse provides a well-known brand and revenue that has thus far demonstrated resilience, investors should be under no illusion that the current share price provides a bargain.

The Price to Book ratio is currently over 3, meaning a premium is also paid for assets.

It would seem dividends are back on track for 2021 and management seems buoyed on the prospects of growth.

Investors should continue to monitor the risk profile of the business. Particularly in regards to potential competition and any slowing of revenue. That may suggest recent growth is from pent-up demand during Covid, rather than representing any sustained trajectory.

Regards,

Samael Knaap

Analyst, Wealth Morning

Sam is an intern analyst at Wealth Morning. He is currently completing his major in finance, while juggling his roles as President of the Massey University Investment Club and student fund manager. He won the Investment Club stock challenge, where he achieved a return of 44% over a 3-month period. Furthermore, he has received the INFINZ scholarship award for being the top 3rd year finance student in 2020. His role involves contributing research and writing financial reports for Wealth Morning’s readers.