It takes a good crisis to work out what you should really do next.

Five years ago, our business in New Zealand was coming to an end as the industry changed out of sight. We migrated to Europe with two small children. And I began looking for a new opportunity.

I wanted to get back to what I’d been doing since the age of 17. Investing in stocks and shares.

When you try and break into an industry as a migrant, there are many obstacles. But what many people don’t realise is you also have an advantage.

You come in with fresh, new insights and hard work. You are not constrained by anything. And that enthusiasm will blaze in your eyes and impart to anyone you meet.

Of course, getting an opening is difficult. You can learn more in months than you normally would in years. One opportunity for me was the Brexit drawdown in 2016, when many shares on the London Stock Exchange (and the pound) fell to cut-price levels.

For many, Covid is that crisis moment. When a business ends or a livelihood is damaged. That might be time to make a change and look for new opportunities with the hunger of a migrant.

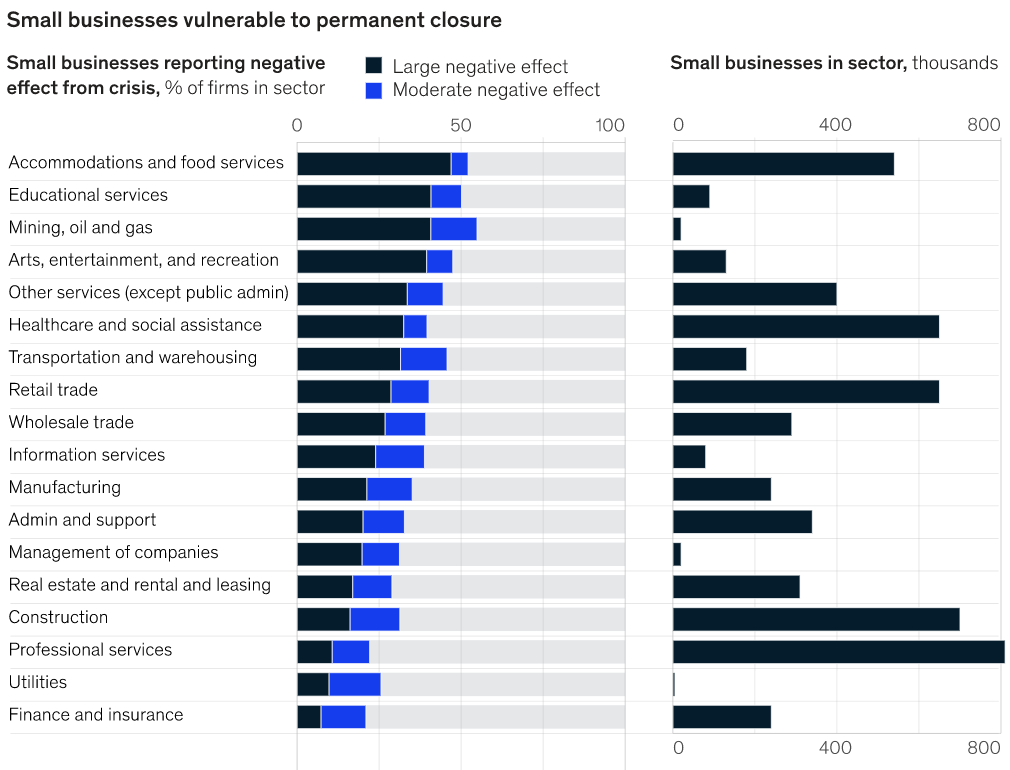

In some industries, more than a quarter of businesses may close permanently

Let’s take a look at the situation in the US, a country badly affected by Covid.

McKinsey published these findings last year:

Source: McKinsey and Company. June 2020

Source: McKinsey and Company. June 2020

Agricultural, forestry, fishing, and a few smaller sectors such as civic organisations were excluded due to insufficient data. But it’s pretty clear: Hospitality businesses are most affected.

Of course, without lockdowns, most will also bounce back. But here in New Zealand, there is also the border issue, threatening businesses dependent on tourists.

Reinventing and pivoting

Even before Covid, industries were changing much faster than before. Those most likely to succeed are those able to adapt and pivot. Young people today are often told the world is their oyster. But are given no guidance on where to dive in.

Something we do as investors is look for the big picture trends:

- Where is the market going?

- Which industries are vulnerable?

- Where are things about to leap?

But for a person seeking to reinvent or pivot in their vocation or business, the equally important factor this: Getting into something that excites you from the moment you get out of bed.

Knowing what that is will mean trying things. Seeing what sticks and feels right. And ultimately finding something that gives you that irrepressible ‘new migrant flame’.

Financing change

It’s possible to make a start in most industries. With sweat or capital. Some capital can sure smooth the way.

Building up a capital base comes down to generating surplus every month. And putting that into some smart investing.

What is smart investing? It’s different for everyone. But it comes down to pricing risk. To make money, you’ll need to take some risks.

Over the years one thing we’ve learnt is how to price the risk of a potential return. More and more, I come down to an overarching thought. People often take a lot of risk on small-cap businesses or speculative property investments. The end result is maybe a 10%-15% p.a. return when averaged out over several years. Sure, some do far better, and some lose out altogether.

I recently came across an angel investing fund. It was investing money in small, speculative technology businesses. Most of the businesses will fail over the longer-run. But there will be a few stars that may deliver spectacular returns.

The end result — perhaps 15% overall.

Many angel investments are probably best funded by those with direct industry experience. Who can provide more than just money.

If you’re not that industry insider, why stretch to that much risk? When you could potentially achieve the same return with larger more robust businesses. Companies in the market with extensive assets, huge customer bases, and often a steady dividend stream.

Of course, a confident, rising market over a few years can also help drive good returns. And history tends to tell us that markets do rise more often than they fall. But the future is unpredictable.

Smart investment decisions can drive meaningful return. Sometimes you find a good business with margin of safety that has been overlooked. Particularly in sectors recovering from Covid or pivoting themselves toward better opportunity.

Here at Wealth Morning, we have an upcoming event on investing for a Covid-recovering world

We do not see a smooth time ahead. But we do see opportunity for those with agile strategy.

To learn more about this opportunity and to reserve your seat, please see our event page:

👉 Property & Shares: Getting Ahead in Overvalued Markets

Regards,

Simon Angelo

Editor, Wealth Morning

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.