Fletcher Building Limited [NZX:FBU] is New Zealand’s largest construction company. It was started in 1909 by James Fletcher.

They have held solid in the market for most of the decade, with a share price above $5.

Around 2017, Fletcher Building went into a steady decline, suffering multiple significant drops in share price.

As we will see, Covid has been the most significant factor in the company’s recent history.

Will Fletcher Building recover? Is it still worth investing in? Or has this giant been knocked down further?

Exploring recent events

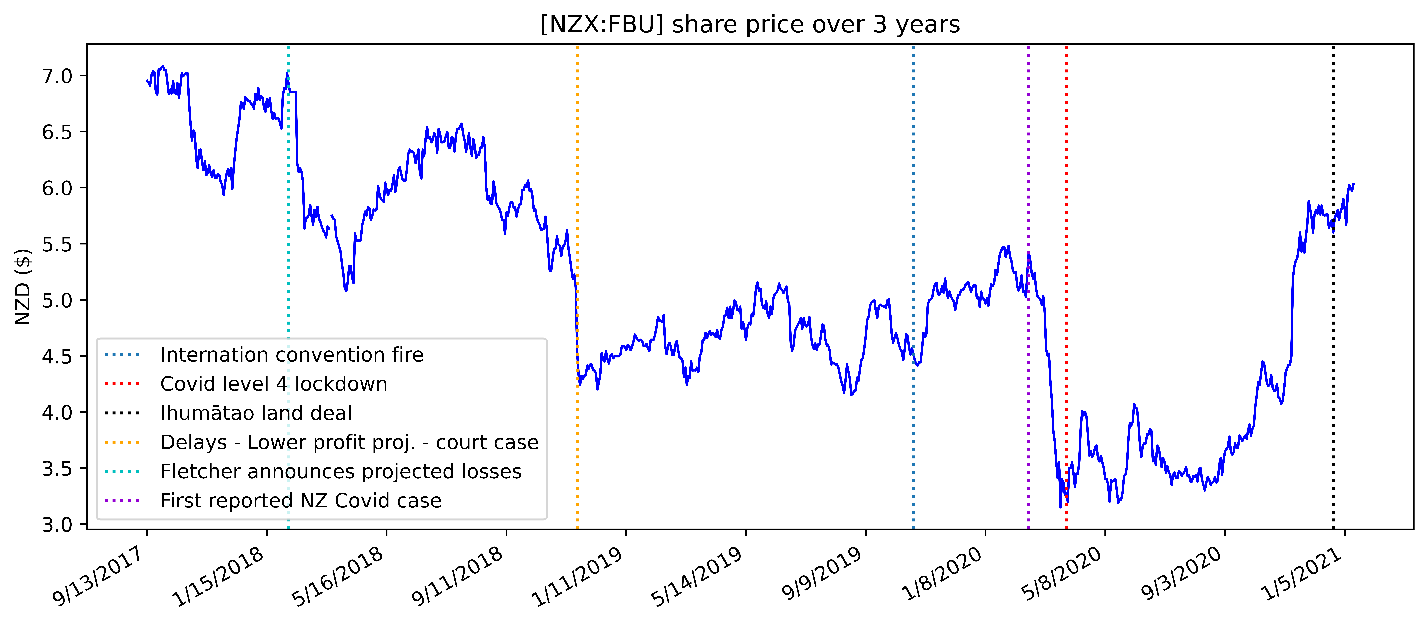

Figure 1 — Significant events near large drops in share price shown in vertical lines

Initial announcement of projected losses

The large 2018 share price crash happened right after Fletcher Construction announced earnings downgrades.

Directly after, they experienced a significant drop in share price over the next few months. This would be due to lowered investor confidence.

Lower projected profit and delays

FY19 was not smooth sailing for Fletcher Building. The share price in February fell to a new low.

The SkyCity Auckland Convention Centre’s construction was a $477 million contract initially projected to finish in February 2019. However, this was delayed to an uncertain date after 2019, with the cost due to liquidated damages predicted to be around $40 million.

The delay would have lowered investor confidence in Fletcher Building and helps to explain the share price fall.

SkyCity Convention Centre fire

On 22 October 2019, the $700 million construction site caught fire.

The fire could have been a significant event for the share price due to liquidated damages and the site’s cost.

However, the fire damage was assisted by insurers. All parties involved were still committed to completing the convention centre.

Following this, there appears no clear, connected and sustained impact on the share price.

First Covid case reported and moving to level 4 lockdown

Covid hit the construction industry hard and fast.

The first Covid case was reported in New Zealand. What followed was an immediate and severe drop in share price. It hit as low as $3.15 — the lowest in more than a decade.

Interestingly enough, the level 4 nationwide lockdown did little to harm the Fletcher Building share price any further. After the initial Covid case, it appeared that all the damage had already been done.

Investor confidence would have been on an all-time low. Indeed, the construction giant predicted a net loss of $196 million due to Covid in 2020.

This contributed to the low share price that followed into the next few months.

Ihumātao land deal

After many years in the courthouse, a deal was announced between the New Zealand government and Fletcher Building in December 2020.

The deal gave payout of $30 million in exchange for the land previously obtained by Fletcher Building in 2016. The sale was break-even. Following the announcement, there is a positive trend happening in Figure 1 that could be connected to this event.

Financial status

Currently, Fletcher Building has an undefined P/E ratio due to them not being profitable.

They made a net earnings loss of $196 million in the year ending 30 June 2020 (FY20), compared to their profit of $164 million in the year ended 30 June 2019 (FY19).

Fletcher Building has a market capitalisation of around $4.8 billion. This company has a relatively strong foothold in the industry.

They may continue to absorb losses and become profitable again in the future.

Market Competitors

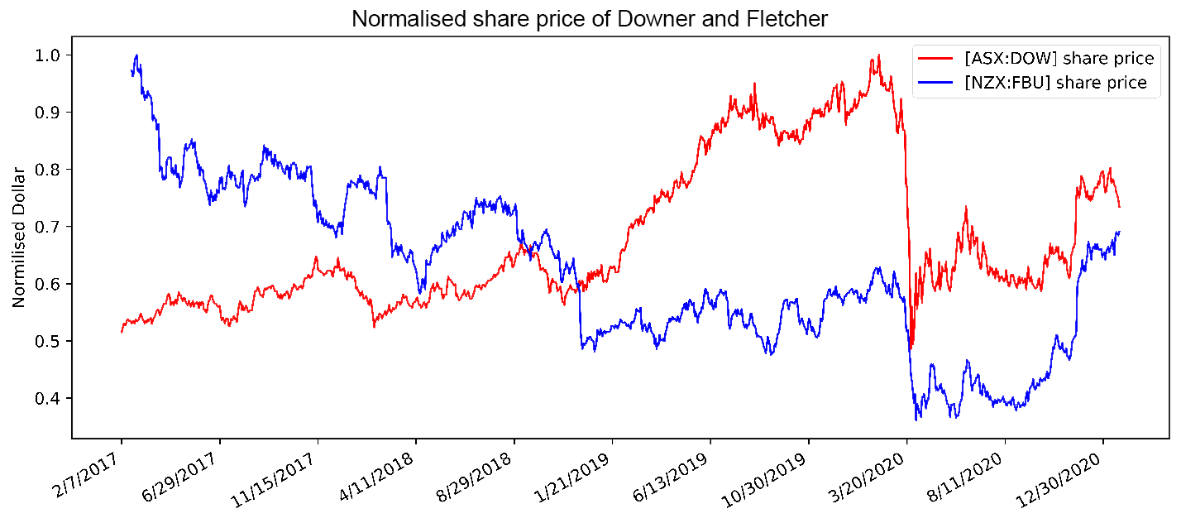

Figure 2 — [ASX:DOW] and [NZX:FBU] time-series normalised by their respective maxima

One of the largest construction companies competing with Fletcher Building in the construction industry is Hawkins, bought by Downer Group [ASX:DOW] in 2017.

Has Downer Group [ASX:DOW] experienced the same struggles during Covid? Or is Fletcher Building just losing its grip on the industry?

In Figure 2, both companies had enormous drops in their share price when Covid hit. The large dip lasted a similar amount of time for both companies before they started to recover. Downer Group also reached its lowest share price in a decade.

The large spanning drop shows us that the construction industry is struggling with Covid. It is the biggest impacting force.

Future endeavours for large-scale construction

Fletcher Building hopes to increase its homebuilding capacity in 2021.

In Christchurch, where the market is tight, it has a contract for 900 properties with a strong demand for finished houses.

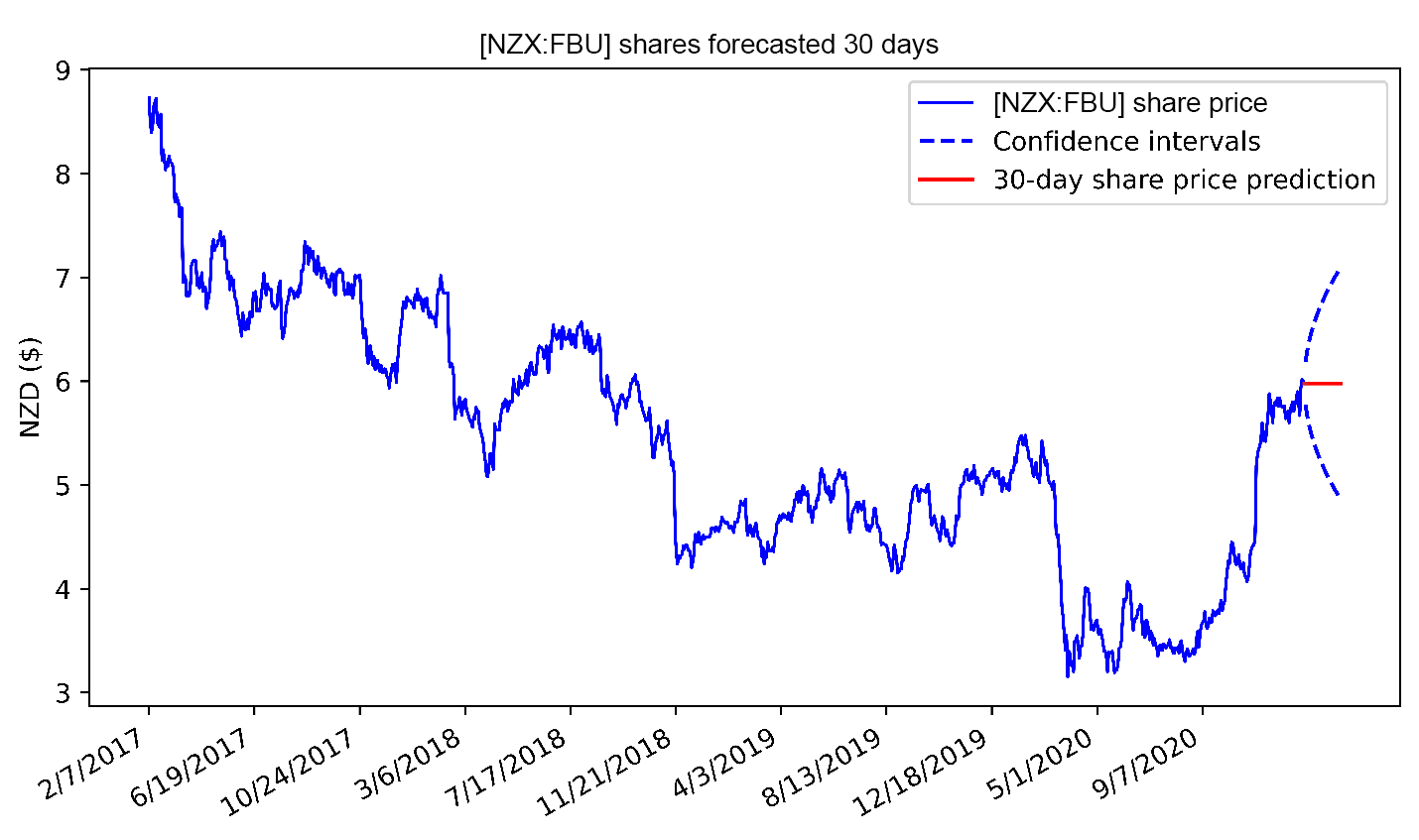

Figure 3 — The forecast predicts the average share price to be at a plateau over the next month

Future performance

The new variant of Covid from the UK and South Africa will pose an enormous risk to New Zealand.

19 cases of the UK variant have been detected in Kiwi MIQ facilities since 13 December 2020.

The strain is 40%-70% more infectious than the original strain in March 2020. Modelling experts predict we will need a level 4 lockdown much longer than the last to combat this new strain if it were to get into our community.

We have seen the devastating impact the Covid lockdown has had on Fletcher Building and the rest of the industry. It has been the largest impacting factor in the decade on in the share price.

Another lockdown could have a bigger impact. It is unlikely Fletcher Building will be able to operate on their projects, such as the Christchurch housing, while the lockdown is in effect.

Financially, they could pull through, but at what cost?

- Fletcher Building has already laid off 1000 staff in New Zealand and 500 in Australia following the impact of the first round of Covid.

- A more prolonged lockdown could force Fletcher to scale down its operation.

- This would make the company significantly smaller and not the construction giant it once was.

And what about the Covid vaccine? The Ministry of Health expects the first group of people to receive the vaccine by Q2 2021. These will likely be health workers, their contacts, and people at risk. It will take much longer for the general population to be vaccinated.

Covid has proven to be the most adverse factor for Fletcher Building. Until it is behind us, the risks facing the business may be heightened.

If you’re considering investing over the long haul, there may be opportunity for Fletcher Building to ‘rebuild’ post post-Covid and regain its pre-Covid stance.

However, the business has some additional challenges which investors should be aware of:

- There is substantial competition in the market, especially in the building materials area. The housing market — where it is significantly exposed — is very cyclical. Though there is currently upside here. Yet the overall track record suggests it has been challenging to sustain much competitive advantage and for the company to earn above its cost of capital.

- Significant risks around the cyclical and competitive nature of building remain, notwithstanding ongoing fallout from Covid. While Fletcher does offer upside within a country turning toward a homebuilding focus, we would like to see the business refine strategy. In particular, to use its scale to achieve a better return on capital.

For now, the share price may be somewhat heady given the risk outlook. And especially given a return to dividends looks to be some time away.

Regards,

John Bailie

Analyst, Wealth Morning

(Disclaimer: this material is provided for example purposes only. It should not be construed as investment advice. The opinions expressed are the personal views and experience of the author, and no recommendation is made.)