No doubt, you would have heard about cryptocurrency spiralling down in value over the past two weeks.

Bitcoin fell sharply, nearly touching US$10,000 per coin.

What was the cause of this?

Is this the end of crypto?

A sudden fall in cryptocurrency prices

No one appears to have a certified reason for this sharp decline.

Several explanations have been suggested:

- Gold is losing its value.

- Tech stocks like Apple and Facebook have tumbled.

- So there’s a connection between crypto pricing and the volatility of other assets.

As I’ve mentioned before, Bitcoin is often referred to as digital gold.

Over the past few years, Bitcoin and physical gold have consistently been moving in sync with one another. They stay around the same resistance level in terms of value.

However, when gold fell recently, a herd mentality took hold in the markets. This may have created a temporary weakness in crypto prices.

In addition, tech stocks have fallen sharply this past week as well. This correction was healthy and expected. Tech stocks have risen too fast, too quickly, in the aftermath of COVID. A reset was needed.

Since cryptos exist in the same digital space as tech companies, there’s a direct link between the two.

Certainly, there was a massive surge in the value of cryptocurrency during the pandemic. From March to August, Bitcoin soared from US$5,000 to just under US$12,000.

That’s a gain of over 100% in only a matter of months.

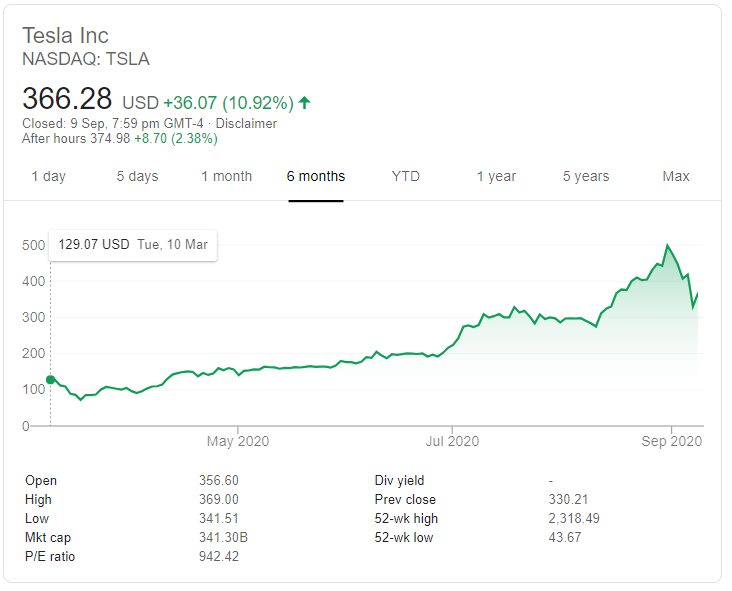

It was the same for tech companies like Tesla.

Source: Google Finance

In March, Tesla was valued at US$129.07 per share.

At the end of August, it reached a high of US$498.32 per share — before experiencing a sudden drop.

This seems to suggest that tech and crypto are connected — and when one asset experiences a correction, the other will experience it as well.

What’s the road ahead for cryptocurrency?

Personally, I don’t think the sudden drop is something to worry about.

Warren Buffett, one of the world’s greatest investors, says: ‘Be fearful when others are greedy, and be greedy when others are fearful.’

Buffett has returned an average of 20% growth in his net worth per year on average for the past 55 years.

He’s certainly doing something right.

At the moment, what we’re seeing is a herd mentality on the stock and crypto exchanges.

When people start selling, others will tend to jump on the bandwagon and start selling as well. This accounts for the sharp correction we’ve seen.

But should you be a contrarian investor instead? Should you be going against the herd? Buying when others are selling?

There’s a strong case to be made for cryptocurrency. Its presence and influence are growing by the day. More and more, you see crypto being used as a medium of exchange. It’s being used to pay for goods and services all around the world.

Cryptocurrency has also proven itself to be a good long-term asset. When the world was facing an economic meltdown as a result of COVID-19, savvy investors used cryptos as a store of value and a hedge against risk.

Also, let’s not forget this key advantage: cryptocurrency is largely unregulated. It has no government control. So this means that crypto could provide an alternative to traditional banks and financial markets.

I believe that the death of cryptocurrency has been exaggerated.

This is just a small bump in the road.

The digital revolution is still coming.

I can’t wait to see what happens next.

Regards,

Alistair Bilkey

Analyst, Wealth Morning

PS: Looking for tech opportunities that the mainstream isn’t talking about? Our Lifetime Wealth Premium Research gives you the inside scoop. Join us today, and you’ll the first to know once we roll out a potential crypto recommendation.

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.