Call it idealism. Call it stubbornness. But some people remain nostalgic about the Gold Standard. They believe that a resurrection is possible. And every time there is a global recession, they renew their call for the world to return to gold.

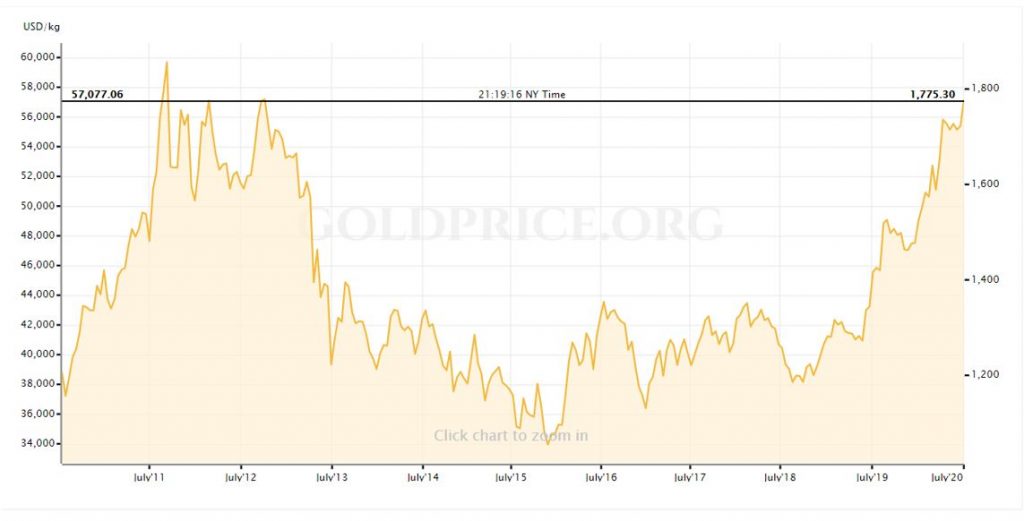

They encourage the hoarding of the precious metal. They believe it will serve as a hedge against inflation and Armageddon. As a result, the price of gold acts as a Fear Index. It rises each time there’s global anxiety, but it falls and flattens out once the immediate crisis passes.

Take a look at how gold has performed over the last 10 years.

The desire for the precious metal appears to be seasonal. It is tied to internal psychology rather than any external reality.

For this reason, most economists and historians believe that the Gold Standard is unlikely to be adopted again.

Here are some key points…

Already a Member? Sign In Here

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.