My last rental property was on a pleasant North Shore street. Views to the shipping channel and Rangitoto. 3 bedrooms, 2 lounges, and an internal double garage. A dream pad for a family, paying good rent.

Source: Author photo

Until that dream got shattered.

The complaints from the tenant started coming towards the middle of their lease. Not about the house. But about the neighbours.

I’d inspected the property a couple of times. Arranged a few maintenance jobs. The girl next door did seem to have a lot of boyfriends…and the police were regular visitors too. Eventually they attended armed. You get the picture.

My tenants were scared and wanted out of their lease. It was a stressful time for everybody concerned. But we made an agreement and got through.

Looking back at the rental income for that year of around $35,000 — a reasonable gross yield of 5% — I realised the net yield was zero. Factor in Rates. Repairs. The need for some new roofing.

Which serves as a reminder that many of these investment situations depend on capital gain. Auckland home prices constantly going up. Without that, this is just stress and work no smart investor needs.

Had I ran that $700,000 into dividend-paying stocks, I might well have earned that 5% yield net (not gross). With similar capital gains and less headaches over the same period.

At median price-to-income multiples around 9, Auckland property prices (and indeed, much of New Zealand’s) are seriously unaffordable. But you knew that.

Is the COVID-19 risk event about to make houses affordable again?

I get plenty of comments and queries:

- ‘Is now a good time to buy or sell a house?’

- ‘Would it be better to buy stocks and shares in this value market?’

- ‘Is the time coming to invest in property again?’

So, unless the investor is a Wholesale client, we’re not able to answer personally. But I will seek to answer them generically here.

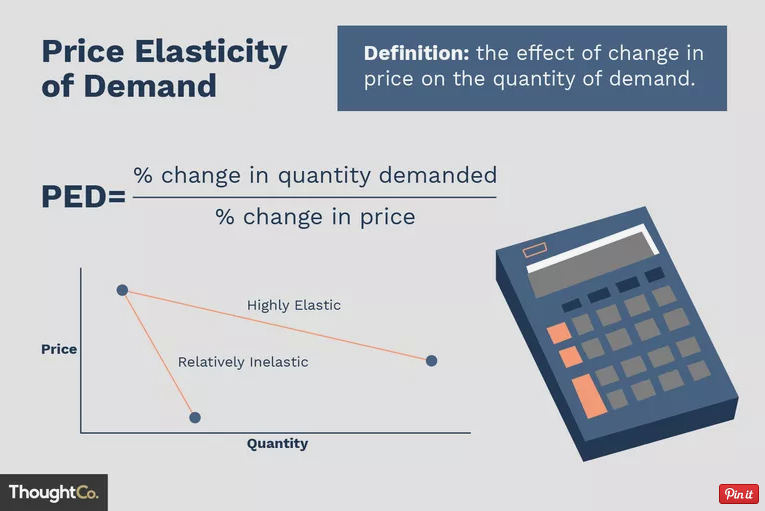

Every market comes down to supply versus demand. And inside each market, prices sit on a scale of elasticity.

Here’s a 2-second primer on price elasticity:

Elasticity refers to how much demand is affected by price. If price increases have little impact on demand, we can say a market is inelastic.

For the past decade, the Auckland property market has looked quite inelastic to me. Prices have doubled. There remains a shortage of homes. Higher prices have not harmed the quantity of sales.

Inelastic prices tend to apply to necessities. No matter the price, we can’t do without them. Shelter — housing is one of those needs.

Often, governments will step in to correct market failure. Especially where inelastic pricing of goods causes social detriment. The past two decades of governments in this country have failed to do that with housing.

In fact, they’ve fuelled the problem, with very high rates of net migration. If only first-home buyers could bring a class-action lawsuit. For what amounts to years of negligently floating Kiwi homes on the global money market.

New Zealand — yes, even Auckland — is a very desirable place to live

I spent the last few years living on an island in Europe. Population density: 915 per km2.

New Zealand: about 18.

I’m left with a keen sense of the terrors of living on a constricted anthill.

Very small family homes — unless you have a huge budget. Complete absence of a road shoulder or car parks by the roadside. There is nowhere to stop. You operate your car as a helicopter — planning your next car parking ‘landing’. And parking pay discs required everywhere. Even at the beach.

So you’ll always have people in a crowded world wanting to come to a place like New Zealand. Ideally, you’d have a government with a population strategy. Selecting a smaller number of the best to fill skills and build new homes. Not swamp the existing market.

For the past two decades, the Auckland market has faced a perfect storm:

- Inelastic demand — people compete and borrow to pay rising home prices.

- Easy low interest rates — almost 50% of Auckland mortgages show a debt-to-income ratio over 5x household income. This is pressured by any measure. The UK applied a legal maximum of 4.5x since 2014.

- Constantly growing demand — net migration of more than 40,000 people per year since 2014, predominantly settling in Auckland.

- Geographical limits — a dual-harbour constrained isthmus with a shortage of density housing and transport links.

- Intergenerational assistance — estimates suggest parents could be the 6th largest lender, combining loans and gifts to help children into housing.

Supply and demand

But the pandemic is changing the forces of inelastic demand in housing:

- Migration has been cut to nearly nothing.

- Unemployment and salary cuts reduce the ability to borrow.

- Investor appetites have been socked with a raft of tenant protection measures — on top of the existing bright-line test, loss ring-fencing and growing compliance cost.

Moreover, it seems supply is suddenly increasing, at least in the rental market. A survey conducted by Adam Bennett, who runs the New Zealand Investors and Economic chat group, found 40-60 new rental properties were being listed on Trade Me since the country came out of Level 4. Most of these were CBD apartments.

A property manager commented they had 650 listings in the Auckland CBD at the same time last year. This May, they were approaching 1,400.

It appears that, with the demise of international student numbers and Airbnb rentals, a flood of units are now up for rent. When landlords cannot rent their property nor service their debt, they might need to sell.

Now, it’s very early days. But we may see these sort ‘change-of-use’ dynamics spread across other markets.

We’re hearing from mortgage-broker contacts that some standalone house deals are changing hands at reductions of up to 15% off asking prices — but often still close to CVs. This broker mentioned properties around the 700-800k mark.

Perhaps what we’ll see is not so much a price crash but increased price elasticity. More sensitivity to price. And a two-step market. Homes below 900k could face less of a discount than those at the mid-to-higher end, where the market gets hung out to dry.

So, is this a good time to buy a home?

The property market is slow-moving. We need more time to see the economic impacts. Probably it’s a good time to upgrade. The gap between a cheaper and more expensive home will likely narrow more than it ever has.

And there may be situation-specific bargains. Such as in the Auckland CBD or in tourist hotspots with deserted holiday accommodation. But, likely, the best of those bargains may lie hidden and not where you think.

My bet on price bleeds could include lifestyle blocks, vineyard properties, upscale suburbs that are not coastline fringed — think Epsom or Albany, lower-end apartments, and areas previously popular with migrants.

What about opportunities for property investors?

Over the long-run – providing migration restores, Auckland should still experience rapid population growth and some capital gain.

If you’re up for all the troubles of being a residential landlord over the next 5 years, you could still do okay.

But beware: there are more headwinds in this equation than before. And if money-printed price inflation gets away on us — though that seems a long way off right now — interest rates could jump and spell deeper trouble.

Commercial property seems a more sensible choice. But pickings for investors with smaller cheque books are limited indeed.

My own view is you’re better in a range of good listed property stocks. And this pandemic has positioned the share price of many of those at rare value. Often well below the book value of the underlying assets. Some still on track to pay dividends of 5% or more.

We cover these recommended stocks in our Premium Research.

It’s sure going to be an interesting year on the property front.

Worst-case, the affordability crisis gives way to collapsing demand in many areas. And the crows of debt come home to roost. Sooner than we think.

Some real economic leadership wouldn’t go amiss. We could use this crisis to deal with housing inequality. And position for real economic growth tomorrow.

But we now have a government debt bomb on top of a mortgage powder keg.

Things look about to get as bad as they did in my living memory. Which takes us back to Rob Muldoon’s ‘80s. When the whole country was on the brink. You were right on that, Sir Roger Douglas.

Courage,

Simon Angelo

Editor, WealthMorning.com

Disclaimer: This article is general in nature and not intended as any financial or investment advice. Consult an Authorised Financial Adviser to discuss your specific situation.

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.