When my dentist retired before the coronavirus lockdown, I was nervous about finding another practitioner. You see, John ran his business on fair and honest principles. He never tried to sell you procedures you didn’t need. And he always provided practical solutions.

Fortunately, a recommendation led me to the right place — another local clinic run by two immigrant ladies.

So I had a filling topped up back in January, before an overseas trip. I took out my wallet to pay for the 45-minute procedure.

‘There is no charge,’ she said. ‘It is the holidays, and I’m not sure exactly how long this will last you.’

And I realised I had found another practitioner that cared about satisfaction first.

Now, the joy of living in New Zealand and the North Shore of Auckland is that many people and businesses honour this principle.

A friend of mine who recently immigrated from the UK picked up on it. ‘The starting point with people here is that it is assumed you are honest,’ he said to me. ‘Sadly, in many other parts of the world, the starting point is that people are dishonest.’

99% of the time, things work out. People are good. Businesses look after you and your assets — in return for your money and repeat business.

Within that 99%, some 20% offer exceptional care and service — like my dentist.

It is the 1% you need to watch out for and protect your wealth from

So, another friend of mine unfortunately ended up marrying someone in that 1%. The marriage was short-lived. After a time, she disappeared overseas with their child. She had no known address. And then she asked for money.

Fortunately, long before this marriage, my friend had the good sense to have his beneficial wealth held in a family trust. A separate legal entity. Impossible to claim against.

Of course, trusts protect beneficial assets against all sorts of different claims against a person. And while they are sometimes eyed with suspicion, it is a time-honoured principle that anyone can entrust their assets to the protection and management of reliable trustees.

To understand, you need to look into the rich history of trusts

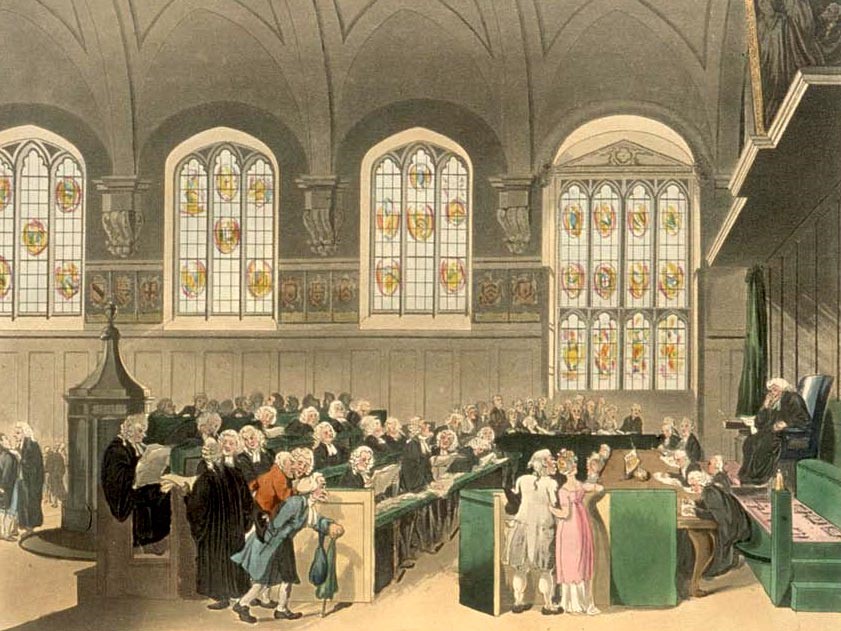

The Court of Chancery, where early trust law developed. Source: Wikipedia

Trust law developed in the 12th century, during the time of the crusades and pilgrimages to the Holy Land. So, when a landowner left England, he might convey ownership to a neighbour. The neighbour would manage the estate, look after it for his wife and children, and pay and receive feudal dues. Of course, this was on the understanding that all this would be conveyed back on the landowner’s return.

Unfortunately, some would refuse to hand over the property. It happened quite often. Perhaps more than our 1%!

Worse still, for the landowner, English common law did not recognise his claim on the land since the property had already passed! Legally, the land now belonged to the trustee, who did not have to return it…

Devastated landowners would petition the King, who referred the matter to his Lord Chancellor. This process helped develop the principle of equity. And the correct view that it would be ‘unconscionable’ for the legal owner to go back on his word and deny the claims of the landowner.

In this way, the landowner became ‘the beneficiary’, and the neighbour became ‘the trustee’. And the situation developed into the fair and equitable law of ‘trusts’ that we have today. You see this throughout Commonwealth countries and the United States.

How do trusts work today?

When setting up a trust, you convey property into the ownership of trustees. These trustees manage the property for you and any other beneficiaries. You can be a trustee yourself — but it is important that there is at least one additional, independent trustee overseeing the property.

Sometimes, when you’re investing or setting up a brokerage account that will come to manage significant holdings, you may be better to do that in the name of a trust.

Then, if the 1% come after you, well, your key growth assets could be protected.

Of course, no solution is bulletproof. But when you’ve likely worked so hard for what you have, it does deserve the best protection our law can provide.

Wealth Trusts

To assist our clients who need to consider the protection of a trust, we have recently acquired and integrated a partner service. It is the most economic service we could find in the market, enabling trust formation, management, and review from a low monthly fee.

A free initial consultation is currently available to Wealth Morning readers. Simply click here to apply.

Quite probably, your trust will not be needed to protect your assets from the 1%. But it may also serve other useful purposes in the form of estate planning, income distribution, and tax management.

Navigating life and building wealth comes down to a lot of things — from an honest dentist to a robust trust.

Keep a lookout.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.